Embed presentation

Download to read offline

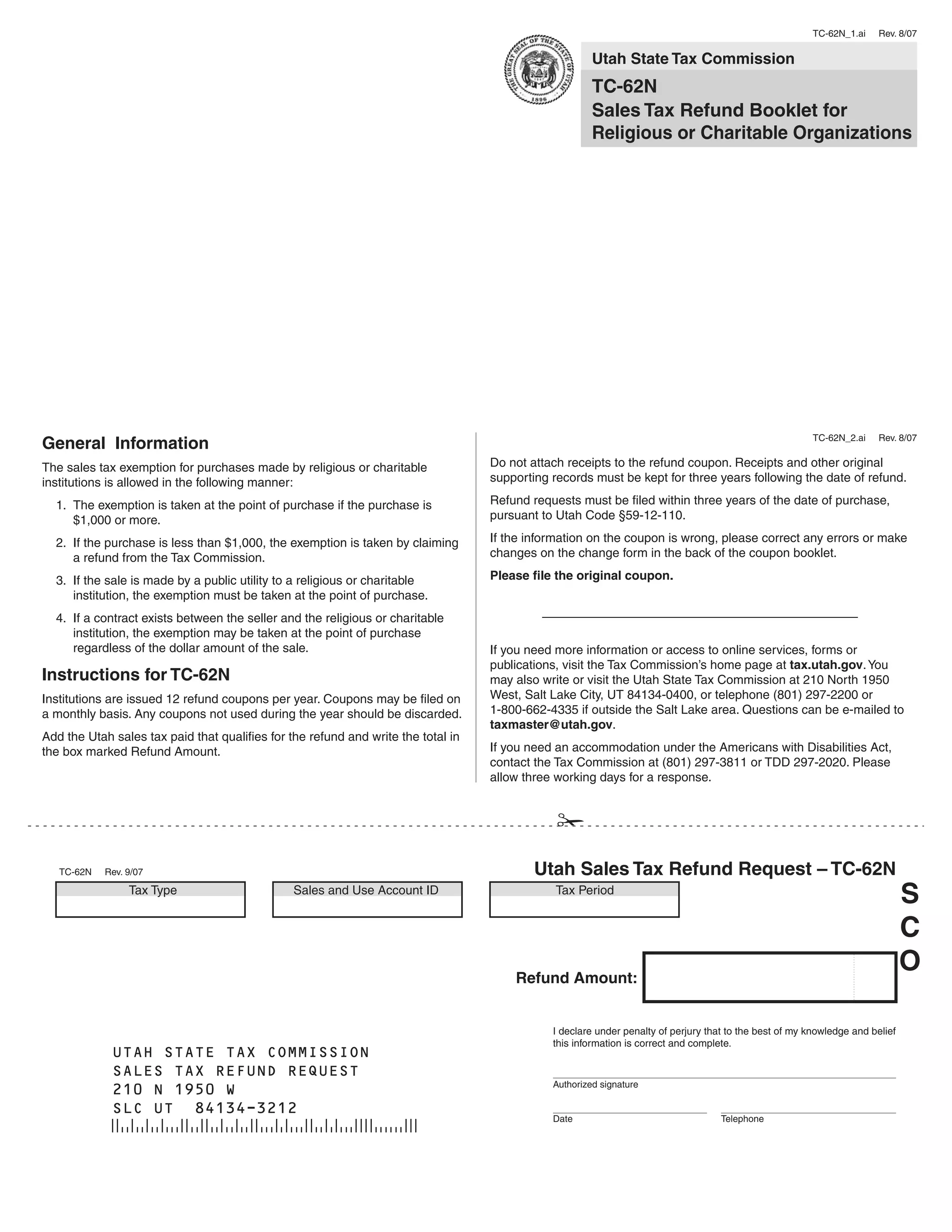

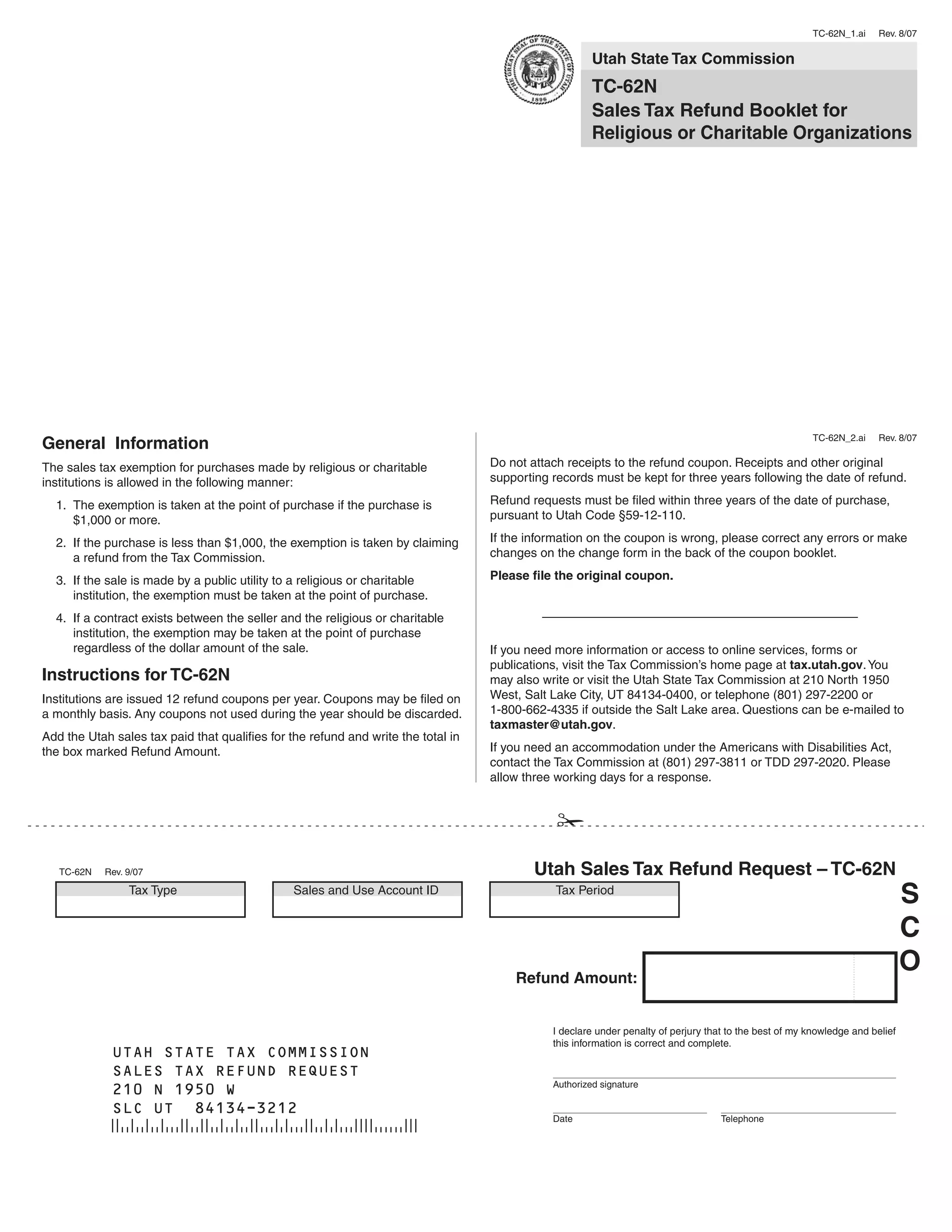

The document provides instructions for religious and charitable organizations in Utah to claim a sales tax refund from the Utah State Tax Commission for tax paid on qualifying purchases under $1,000. It explains that organizations can take the sales tax exemption directly at purchase for items over $1,000 or get a refund from the Commission for items under $1,000. It includes a refund coupon for organizations to fill out and mail to the Commission to request a refund, along with instructions to keep receipts for 3 years and file within 3 years of purchase.