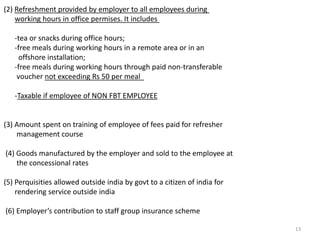

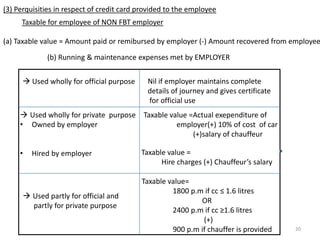

1. The document discusses various types of salaries, allowances, and perquisites that are taxable or exempt from income tax for government and non-government employees.

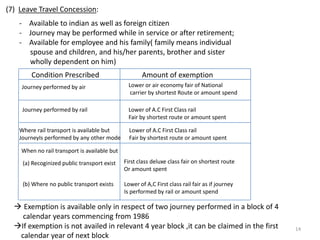

2. It covers leave encashment, gratuity, pension received by government employees, voluntary retirement schemes, retrenchment compensation, and various allowances such as HRA, transport allowance, children education allowance etc.

3. It also discusses deductions available under section 16 and specifies which perquisites are taxable or exempt for employees. Maximum exemptions for various allowances are also provided.

![SALARIES1LEAVE SALARYLeave EncashmentDuring continuityOf employementAt the time ofRetirement or Leavig the jobGovernmentEmployeeNon-govtemployeeCGE/SGENGE/LA/PSUExemptLeast ofExempt U/S10(10AA)TaxableCash equivalent of Leave salary(b) [10m(Basic P.M +DA for Retirement) + fixed % Comm in T.O] / 10 x leave to the credit<_ 30 days P.AAmount Specified by govt =300000Actual leave encashmentॐ1](https://image.slidesharecdn.com/taxation-110827110735-phpapp02/85/Taxation-1-320.jpg)

![NOTE:pension received from united nations organisation->Exempted(2) Family pension received by family members of an employee after his death-> not taxable as salary but taxable as GFOS U/S 56(4) VRS Compensation[Sec 10(10)]-> Max exemption 5,00,000-> Exemption allowed only once. Conditions/Guideline to be satisfied as per rule 2 B.A of IT RulesApplicable if employee has completed 10 years of service or age of 40 years exepct for employee of public sector coApplicable to all employeesVRS should caused due to VRS should not be filled up nor the retiring employee br employed in another concern of same managementAmount under VRS should be- Less than or = to 3 months’s salary for every completed year of service OR ( Salary less or = at the time of retirement) x Balance months of service left before the date of retirement Where, salary = salary last drawn P.M = Basic + DA for retirement + fixed% comm on TONOTE: ->Relief can be claimed U/S 89ॐ4](https://image.slidesharecdn.com/taxation-110827110735-phpapp02/85/Taxation-4-320.jpg)

![(5) RETRENCHMENT COMPENSATION [Sec 10(10B)]Exempt -> least ofAmt calculated as per Industrial Disputes act 1972 =15 days avg pay for each completed year of service or part there of in excess of 6 monthsAmt notified by Govt = 5,00,000Actual Retrenchment compensation received-> NOTE: No limit if compensation paid under govt approved schemeDifferent forms of Allowances(1)City compensatory allowanceTaxable(2)House rent allowanse[sec 10(13A)]Exempt least ofIf Resedential house is in Bombay , Delhi , Calcutta , Madras=50% of BASIC + DA for ret +fixed % comm on TO(a)If at any other place =40% of (BASIC+DA for ret +fixed %commonTO) Actual HRA received for period of occupationExcess of rent paid over 10% of salary on due basis =Rent paid (-) 10% of (BASIC + DA for ret +fixed %comm on TO)NOTE: No exemption if employee lives in his own house or in a house where he does not pay any rentॐ5](https://image.slidesharecdn.com/taxation-110827110735-phpapp02/85/Taxation-5-320.jpg)

![(3) Allowance where exemption depends upon actual exependiture by the employee (Sec10(14))Amount of allowance->In case of followingexemption=lower oforActual exp by employeeTravelling allowance or transfer allowanceConveyance allowanceDaily allowanceHelper allowanceResearch allowance-granted for encouraging academic or professional researchUniform allowance-granted to meet exependiture on purchase or maintenance of uniform(4)Allowance where exemption does not depends on actual exependiture of employee [sec 10(14)]Amount of allowance orAmount specified in rule2 BBIn case of following allowanceExemption = lower ofSpecial compensatory (Hill area) allowance Exemption 800 P.MBoarder area allowance/remote area/disturbed area allowance Exemption 200P.M to 1300 P.Mॐ6](https://image.slidesharecdn.com/taxation-110827110735-phpapp02/85/Taxation-6-320.jpg)

![(13) Highly active field area allowanceFor member of armed forces Max exemption=4200 P.M(14) Island duty allowance For members of armed forces In Andaman Nicobar & Lakshdeep Max exemption =3250 P.M(5)Allowance to govt employees outside india[Sec 10(7)] Totally exempt for an indian citizen(6) Tiffin allowance Taxable(7) Fixed medical allowance Taxable(8) Servant allowanceTaxable(9) Allowance to high court and supreme court judgesExempt(10) Allowance received from united nations organization(UNO)Exemptॐ9](https://image.slidesharecdn.com/taxation-110827110735-phpapp02/85/Taxation-9-320.jpg)

Payment of annual premium by employer on personal accident policy effected by him on his employee(11) Free educational facility provided in an institute owned/maintained by employer to children of employeeMax exemption 1000 per month(12) Gift in kind uptoRs 5000 per year Exempt but gift in cash and cheque Taxable(13) Computer/laptop given(not transferred) to an employee for official/personal purpose (which is owned or hired by employer) Not taxable(14) Transfer of movable asset(other than computer,electronicitem,car) by employer to an employee after using it for 10 years or more without considerationNot Taxable(15) Interest free loan for medical treatment specified in rule 3A Not taxable(16) Initial fees paid by employer for acquiring corporate membership of clubNot taxable(17) Use of health club etc. provided uniformally to all employees by the employer->Not Taxable(18) Perodicals and journals provided for dis charge of workNot taxable(19) Conveyance facility provided to high court and supreme courtNot taxable(20) Conveyance facility provided to an employee to cover the journey between office and residence Not taxable(21) The value of any benefit provided free of cost or at concessional rate by a company to its employees by the way of allotment of shares debentures or warrents under employee stock plan Not taxableॐ15](https://image.slidesharecdn.com/taxation-110827110735-phpapp02/85/Taxation-21-320.jpg)