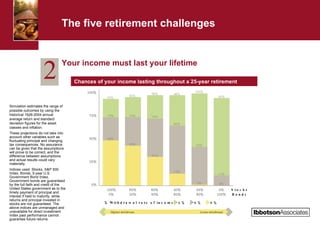

The document discusses the evolving landscape of retirement, highlighting the increased duration of retirement and the associated income challenges faced by retirees today. It emphasizes five key retirement challenges, including the need for a stable income, the decline of traditional income sources, rising healthcare costs, and the importance of individualized planning with financial advisors. Solutions such as diversified portfolios, fixed and insured income strategies, and insurance products are proposed to help manage these challenges.