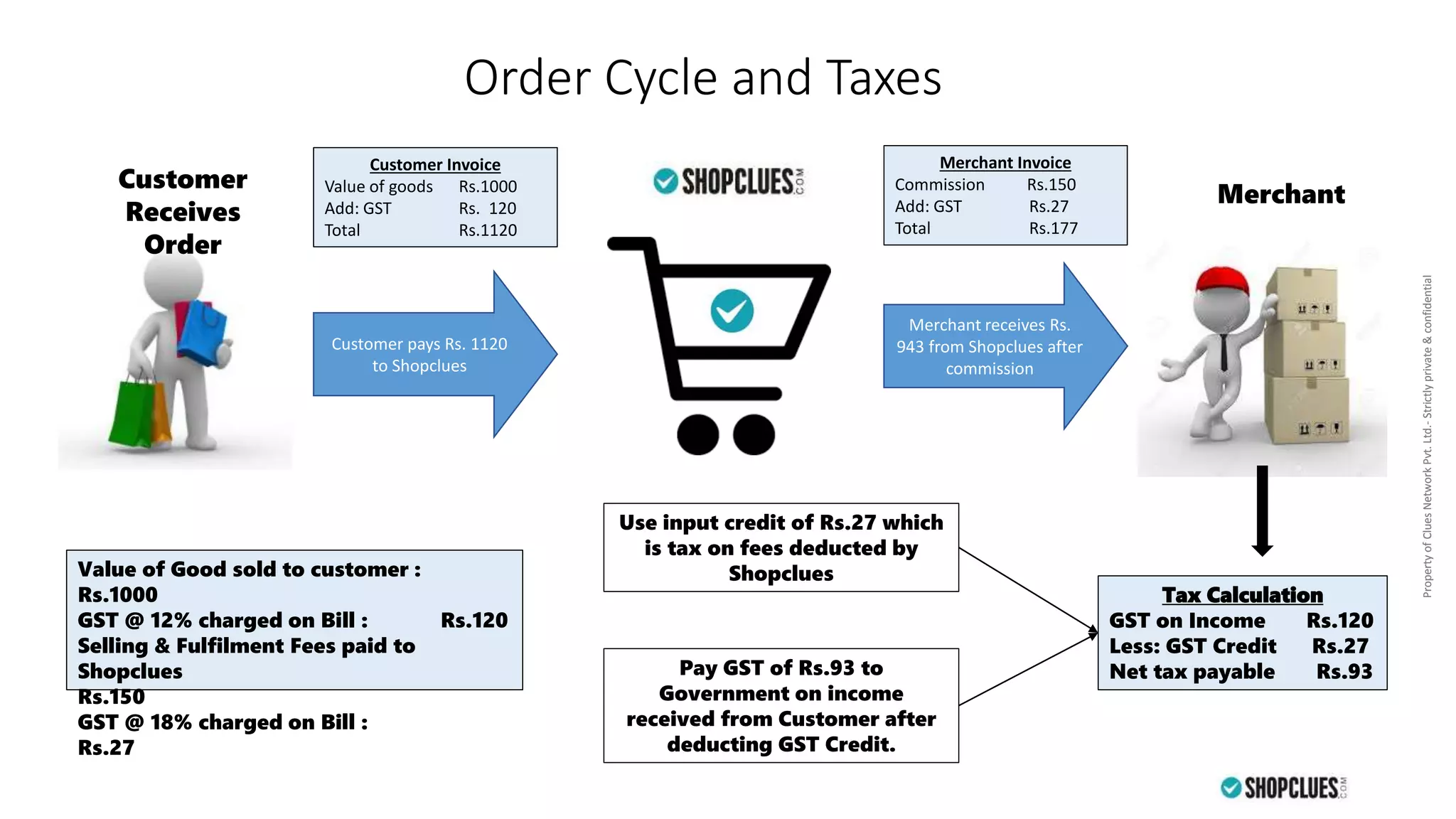

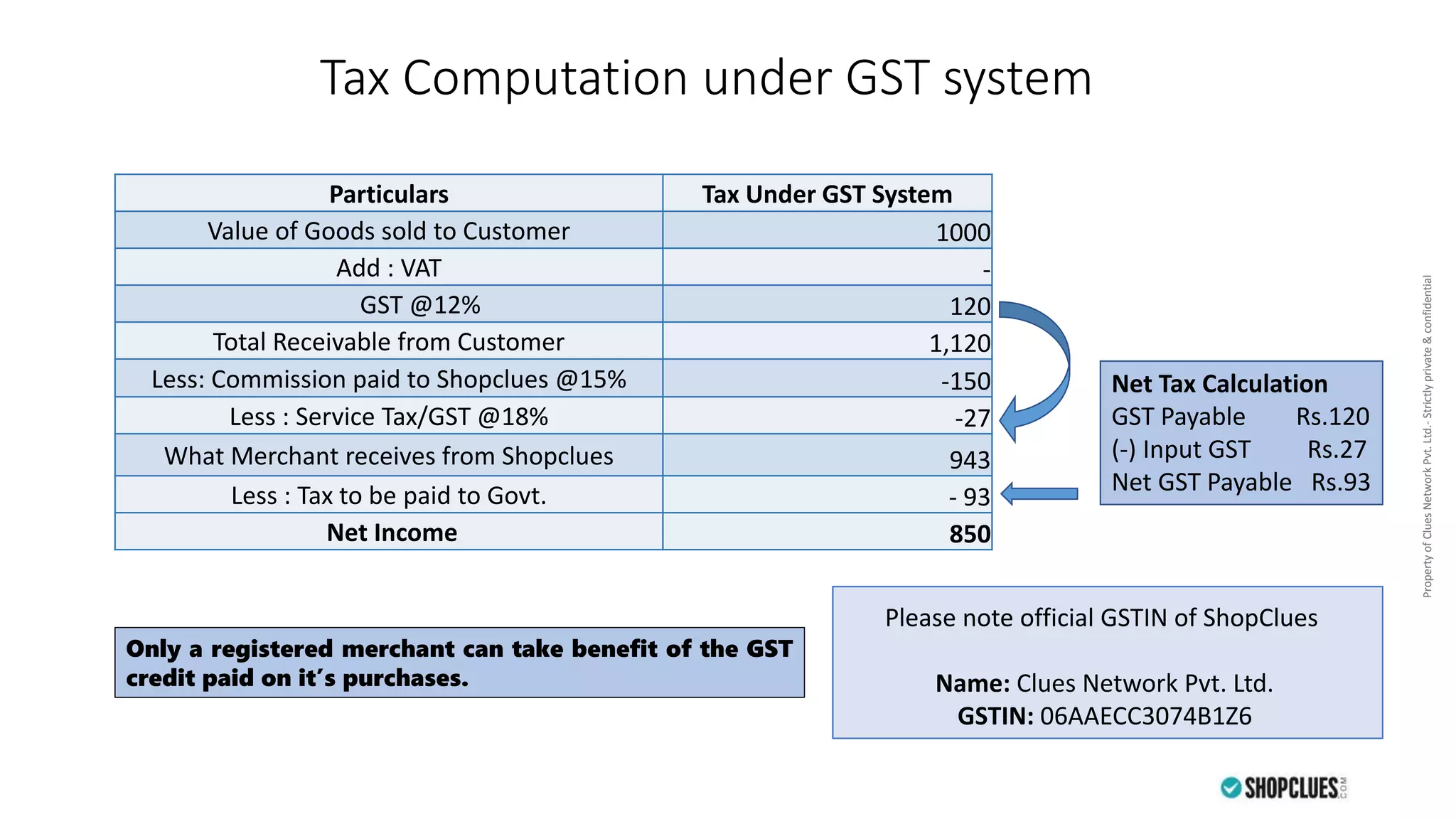

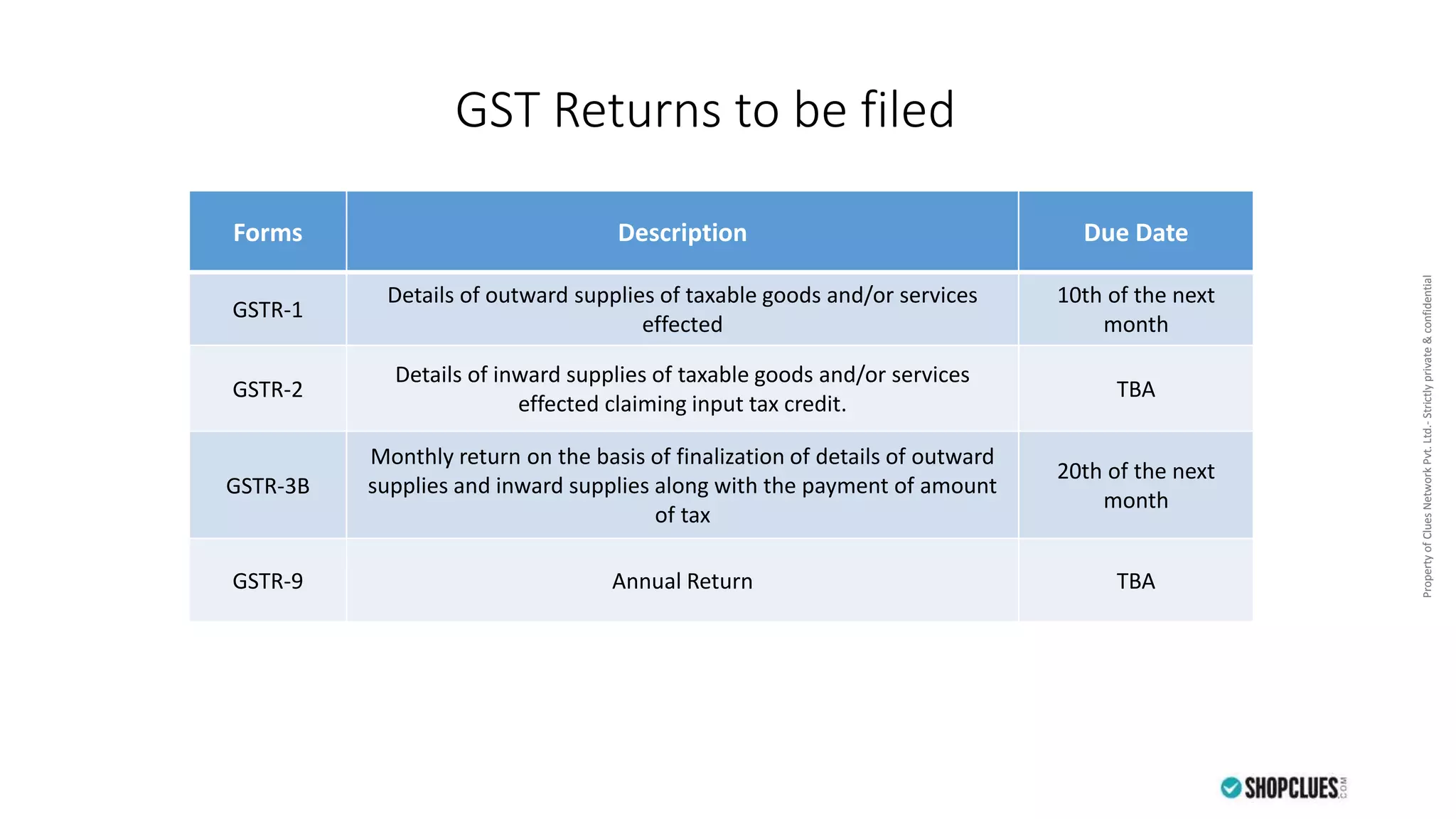

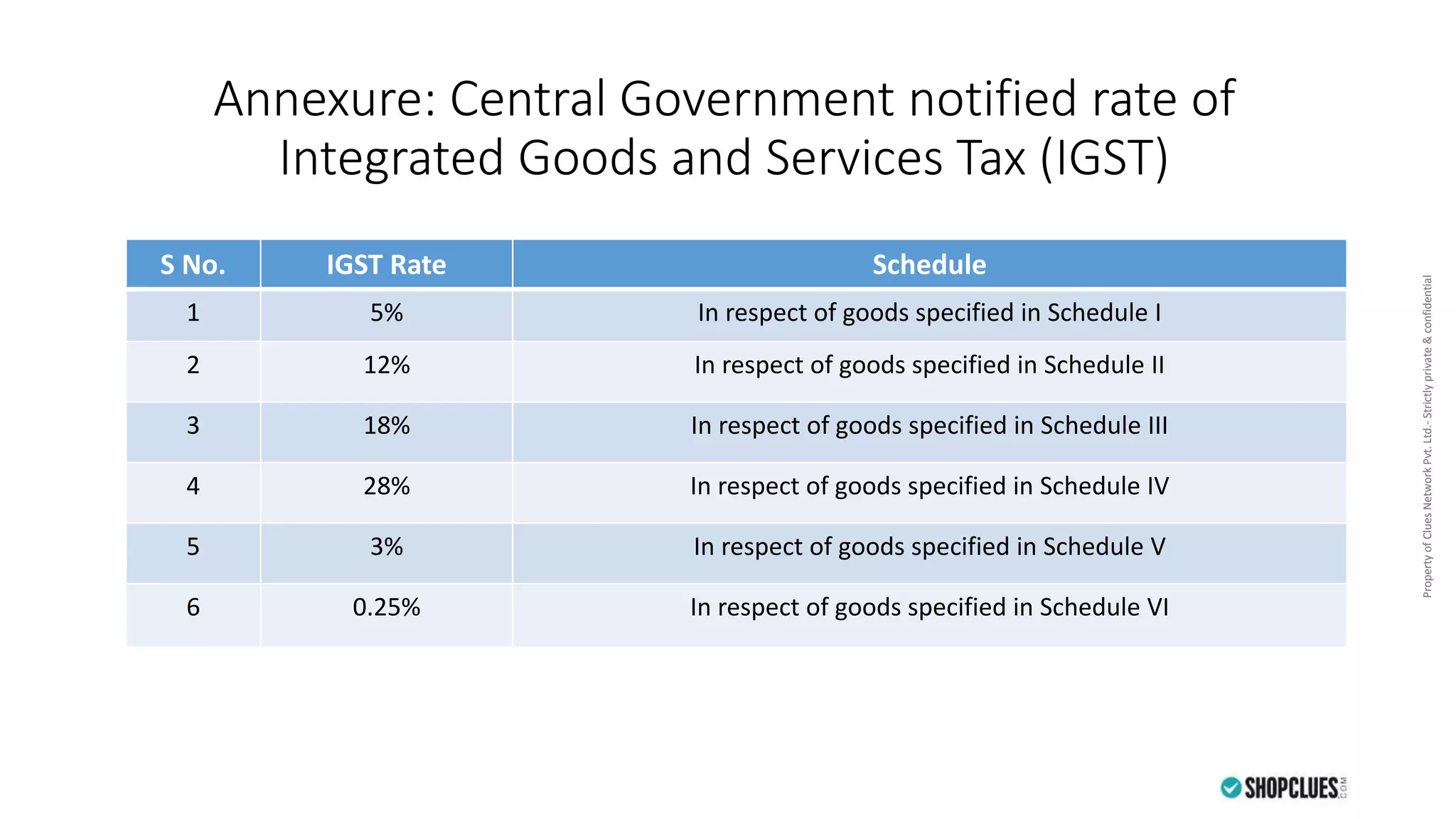

The document outlines the tax computation process under India's GST system for a merchant selling goods through an e-commerce platform. It shows that the merchant pays 12% GST on goods sold but can claim a tax credit of 18% GST paid on commission fees to offset against taxes owed, resulting in a net tax payable of Rs. 93 to the government. It also lists the various GST return forms and due dates that merchants must file, and provides an annexure specifying the Central Government's rates of Integrated GST ranging from 0.25% to 28% for different categories of goods.