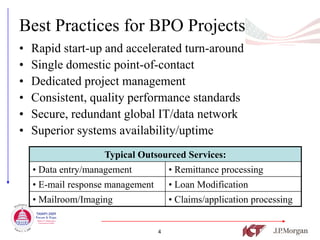

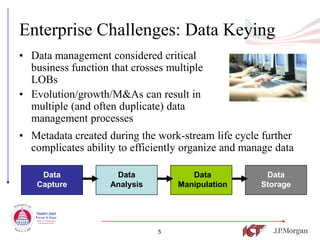

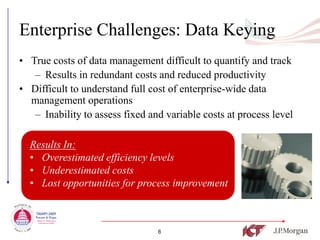

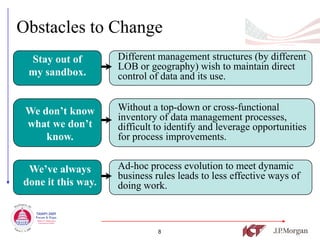

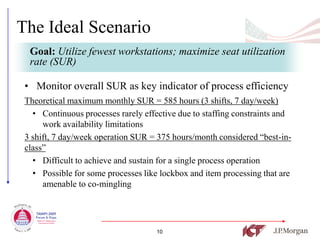

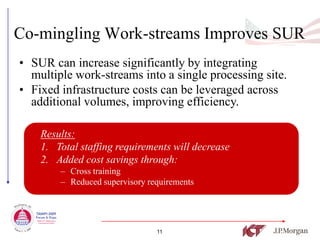

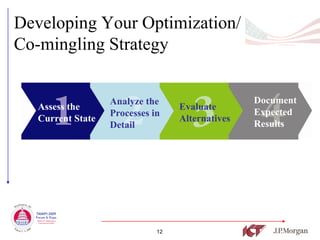

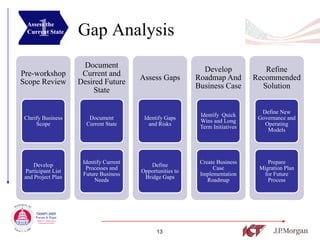

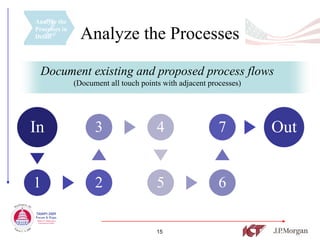

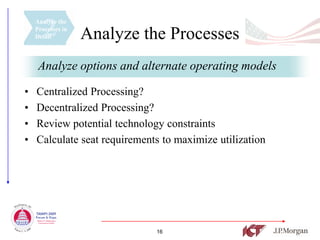

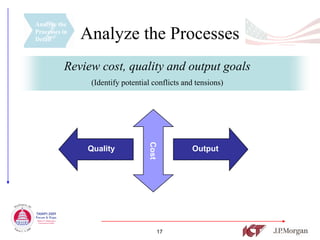

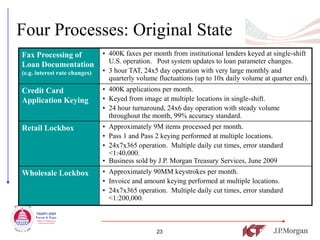

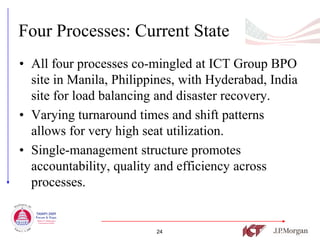

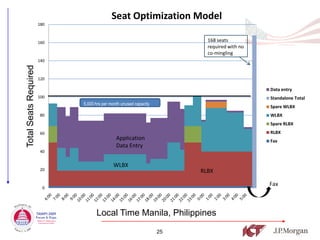

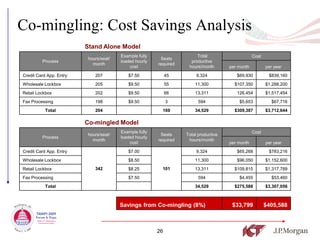

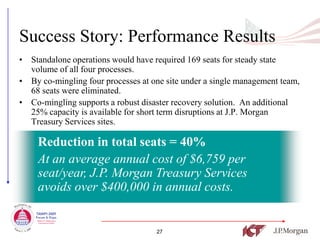

The document discusses a model for optimizing process efficiency in multi-stream data keying environments, highlighting challenges, root causes, and strategies such as co-mingling to improve efficiency. It provides a case study from J.P. Morgan Treasury Services showcasing the successful consolidation of data keying processes, resulting in significant cost savings and improved operational performance. The insights are geared towards organizations seeking to streamline their data management processes and enhance productivity.