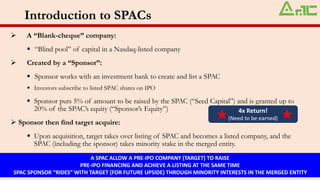

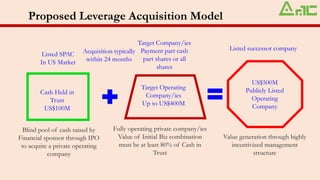

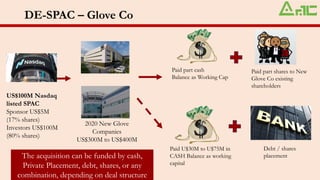

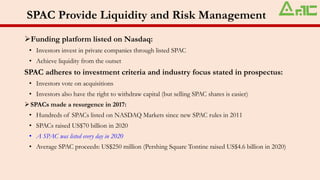

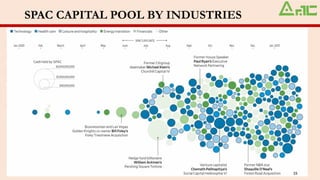

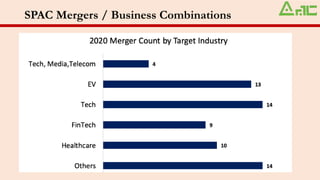

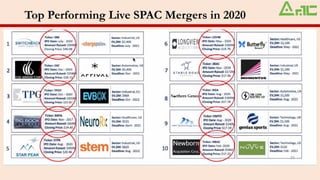

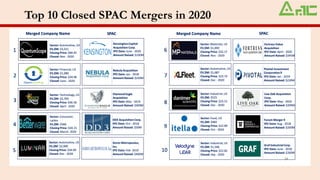

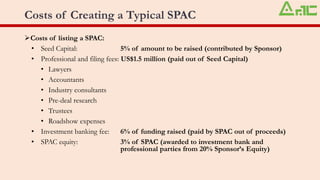

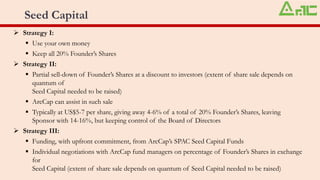

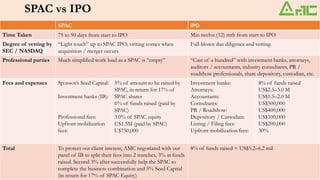

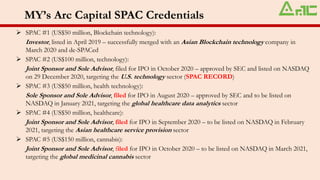

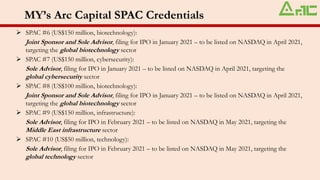

The document provides an overview of Special Purpose Acquisition Companies (SPACs), describing their structure, advantages over traditional IPOs, and the mechanics of acquiring target companies. It highlights the resurgence of SPACs since 2017, the reasons for their popularity, and preferences of SPAC investors across various industries. Additionally, it details the costs involved in creating a SPAC and outlines multiple SPACs that have been successfully launched and merged with target companies.