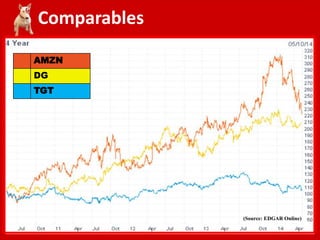

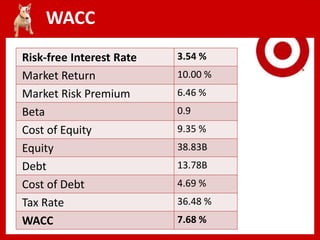

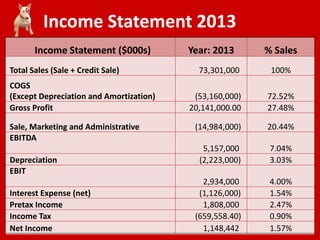

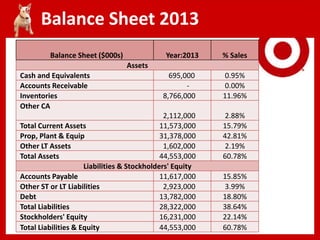

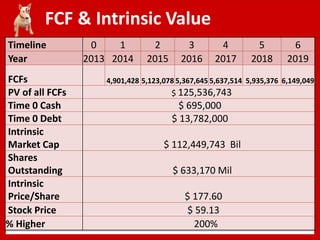

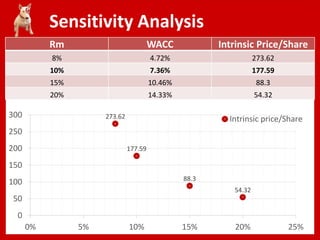

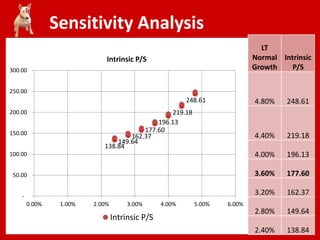

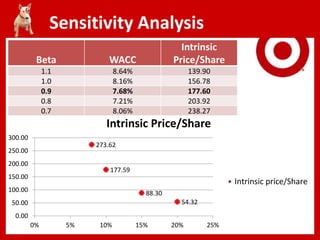

Target's financial valuation was analyzed using comparable companies, pro forma financial statements, sensitivity analysis, and discounted cash flow modeling. The analysis found Target's intrinsic value to be $177.60 per share, significantly higher than its current stock price of $59.13, indicating it is undervalued. Sensitivity analysis showed the valuation is most sensitive to changes in WACC and long term growth rate. The recommendation is that Target focuses on expanding its online market and global business to better realize its intrinsic value.