Tampa Bay 2018 Q1 Office Outlook

•

1 like•37 views

The numbers are out, and the Tampa Bay office market started the year strong. Ever tightening vacancy and climbing asking rates could make 2018 the year we see development in downtown and the suburbs alike!

Report

Share

Report

Share

Download to read offline

Recommended

JLL Grand Rapids Office Insight & Statistics - Q1 2018

After a few years of steady growth, rents seems to have plateaued, while vacancies have stabilized. Conditions are likely to remain steady until the new Class A supply begins to deliver. The west side remains a hot market for both leasing and development activity, and we expect to see some tenants leaving downtown to explore opportunities in cheaper, trendier submarkets.

JLL Grand Rapids Office Insight & Statistics - Q2 2018

The second quarter showed continued positive trends in the Grand Rapids office market. Total vacancy fell to 10.0 percent as nearly 190,000 square feet of space has been absorbed so far in 2018. Rent growth has slowed this year with current average asking rents coming in at $18.02.

JLL Grand Rapids Office Insight & Statistics - Q4 2019

The fourth quarter was a continuation of the stable conditions in the Grand Rapids office market. Both rent growth and vacancies remained relatively flat year-over-year, and most of the quarter’s leasing activity was made up of transactions under 10,000 square feet.

JLL Grand Rapids Office Insight & Statistics - Q2 2017

The west side of downtown has seen increased activity over the past few months, quickly becoming one of the city’s hottest areas. After seeing retail and multifamily move into the area, office leasing and development activity is seeing an uptick.

JLL Pittsburgh Office Insight & Statistics - Q4 2018

Urban leasing activity concentrates in new construction, making it difficult for the existing product to compete without proper upgrades.

JLL Grand Rapids Office Insight & Statistics - Q1 2020

Looking ahead we expect to see the decelerating conditions to continue. The market has already showed signs of a slowdown over the past year. Now, with increased global uncertainty due to COVID-19, we expect leasing activity to slow, as tenants become reluctant to commit, while sales activity is likely to halt as well. JLL will be closely monitoring rental rates and vacancy levels, as well as key tenants in the market during this period of economic volatility.

JLL Pittsburgh Office Insight & Statistics - Q2 2020

COVID-19 delays most projects in the second quarter, but activity begins to return in June.

JLL Pittsburgh Office Insight & Statistics - Q1 2018

New development is multiplying in the Fringe and Oakland / East End submarket. Demand from the technology industry continues to brew. However, leasing activity has not yet brought absorption back to positive.

Recommended

JLL Grand Rapids Office Insight & Statistics - Q1 2018

After a few years of steady growth, rents seems to have plateaued, while vacancies have stabilized. Conditions are likely to remain steady until the new Class A supply begins to deliver. The west side remains a hot market for both leasing and development activity, and we expect to see some tenants leaving downtown to explore opportunities in cheaper, trendier submarkets.

JLL Grand Rapids Office Insight & Statistics - Q2 2018

The second quarter showed continued positive trends in the Grand Rapids office market. Total vacancy fell to 10.0 percent as nearly 190,000 square feet of space has been absorbed so far in 2018. Rent growth has slowed this year with current average asking rents coming in at $18.02.

JLL Grand Rapids Office Insight & Statistics - Q4 2019

The fourth quarter was a continuation of the stable conditions in the Grand Rapids office market. Both rent growth and vacancies remained relatively flat year-over-year, and most of the quarter’s leasing activity was made up of transactions under 10,000 square feet.

JLL Grand Rapids Office Insight & Statistics - Q2 2017

The west side of downtown has seen increased activity over the past few months, quickly becoming one of the city’s hottest areas. After seeing retail and multifamily move into the area, office leasing and development activity is seeing an uptick.

JLL Pittsburgh Office Insight & Statistics - Q4 2018

Urban leasing activity concentrates in new construction, making it difficult for the existing product to compete without proper upgrades.

JLL Grand Rapids Office Insight & Statistics - Q1 2020

Looking ahead we expect to see the decelerating conditions to continue. The market has already showed signs of a slowdown over the past year. Now, with increased global uncertainty due to COVID-19, we expect leasing activity to slow, as tenants become reluctant to commit, while sales activity is likely to halt as well. JLL will be closely monitoring rental rates and vacancy levels, as well as key tenants in the market during this period of economic volatility.

JLL Pittsburgh Office Insight & Statistics - Q2 2020

COVID-19 delays most projects in the second quarter, but activity begins to return in June.

JLL Pittsburgh Office Insight & Statistics - Q1 2018

New development is multiplying in the Fringe and Oakland / East End submarket. Demand from the technology industry continues to brew. However, leasing activity has not yet brought absorption back to positive.

JLL Detroit Office Insight & Statistics - Q1 2018

2018 is poised to be another great year of growth for Detroit’s office market. With transformational developments underway like the Hudson’s site downtown, and others in the pipeline like the Monroe Block and the to-be-determined jail site development, the buzz downtown is palpable.

JLL Pittsburgh Office Insight & Statistics - Q2 2019

Vacancy increases across the market as new leasing activity slows down in existing product.

JLL Grand Rapids Office Insight & Statistics - Q1 2019

Looking ahead, we expect conditions to remain stable. Both vacancy and rent growth have leveled off over the past several quarters. Moving forward, construction figures will increase as Studio Park’s office component breaks ground and development along the East Paris Corridor increases.

JLL Cleveland Office Outlook: Q3 2017

Cleveland ushers in a new set of landlords as improving market conditions attract out-of-state investors

JLL Pittsburgh Office Insight & Statistics - Q3 2018

The Pittsburgh office market had quite the summer in 2018. More tenants flock to the urban core, 420 Boulevard of the Allies sold, and District Fifteen is fully leased before delivering.

JLL Cleveland Office Outlook: Q2 2018

An in-depth look at the Cleveland office market. Analysis includes leasing, sales, construction and employment.

JLL Pittsburgh Office Insight & Statistics - Q2 2018

The Pittsburgh office market is rebounding as leasing activity picks up across most submarkets.

JLL Pittsburgh Office Insight & Statistics - Q4 2019

2019 ended the decade on high notes, as Pittsburgh gets its first VC-funded tech unicorn and the former Civic Arena site gets an anchor tenant for the tower.

JLL Detroit Office Insight & Statistics – Q2 2016

The quagmire persists – high demand and not enough supply. CBD vacancy rates for the second quarter were 14.5 percent as office construction has come to a virtual halt.

JLL Cleveland Office Outlook: Q2 2018

An in-depth look at the Cleveland office market. Analysis includes leasing, sales, construction and employment.

JLL Detroit Office Insight & Statistics - Q2 2017

As fundamentals continue to improve in Detroit’s office market, we will see rent growth and continued development activity. Downtown, expect to see increased mixed-use projects along Woodward, while in the suburbs build-to-suit projects will remain prevalent.

National Dashboard Report | Office - Metro Areas with Population < 1M

This is the National Dashboard of Canada office markets with a population under one million for the second quarter of 2018.

JLL Detroit Office Insight & Statistics - Q4 2018

The fourth quarter of 2018 was highlighted by yet another high-profile groundbreaking, as Bedrock began work on the Monroe Blocks development, a mixed-use project totaling over 1.4 million square feet that will bring approximately 847,000 square feet to the CBD office inventory. Market-wide, total vacancy fell by 60 basis points to 20.2 percent as 149,007 square feet was absorbed, while average asking rents rose by 1.0 percent up to $19.85 per square foot.

St. Louis Office Outlook Q3 2016

Vacancy across the region is down 180 basis points from the third quarter of last year. Much of the gains have come in Class B properties, which have absorbed three times more square footage in 2016 than Class A properties. Find out more in our Q3 Office Outlook.

Industrial Insight and Statistics: Dallas-Fort Worth (2019-Q2)

Industrial Insight and Statistics: Dallas-Fort Worth (2019-Q2)

JLL Pittsburgh Office Insight & Statistics - Q4 2017

The vacancy rate has risen in 2017, but several new industries are emerging in Pittsburgh that could potentially fill space quickly.

JLL Detroit Office Insight & Statistics - Q1 2019

Over 202,000 square feet of space was absorbed in the first quarter, with notable transactions taking place in the city and the suburbs. Chicago-based Coyote Logistics made headlines with the announcement of a 58,000-square-foot lease at Bedrock’s Assembly Building at 1700 West Fort Street, bringing 500 new jobs to the burgeoning Corktown neighborhood. Google announced plans to expand their 29,000-square-foot office at Little Caesars arena.

JLL Detroit Office Insight & Statistics - Q3 2017

As conditions continue to improve in Detroit, we will see sustained rent growth and dropping vacancies. Looking ahead - we can prepare to see cranes amongst the downtown skyline, as Bedrock readies to break ground on the Hudson’s development on Woodward in December.

JLL Pittsburgh Office Insight & Statistics - Q1 2019

The new year begins with positive absorption, along with two new construction deliveries in the Fringe submarket.

JLL Louisville Office Outlook - Q2 2018

An in-depth look at the Louisville office market. Analysis includes sales, leasing, construction and employment.

More Related Content

What's hot

JLL Detroit Office Insight & Statistics - Q1 2018

2018 is poised to be another great year of growth for Detroit’s office market. With transformational developments underway like the Hudson’s site downtown, and others in the pipeline like the Monroe Block and the to-be-determined jail site development, the buzz downtown is palpable.

JLL Pittsburgh Office Insight & Statistics - Q2 2019

Vacancy increases across the market as new leasing activity slows down in existing product.

JLL Grand Rapids Office Insight & Statistics - Q1 2019

Looking ahead, we expect conditions to remain stable. Both vacancy and rent growth have leveled off over the past several quarters. Moving forward, construction figures will increase as Studio Park’s office component breaks ground and development along the East Paris Corridor increases.

JLL Cleveland Office Outlook: Q3 2017

Cleveland ushers in a new set of landlords as improving market conditions attract out-of-state investors

JLL Pittsburgh Office Insight & Statistics - Q3 2018

The Pittsburgh office market had quite the summer in 2018. More tenants flock to the urban core, 420 Boulevard of the Allies sold, and District Fifteen is fully leased before delivering.

JLL Cleveland Office Outlook: Q2 2018

An in-depth look at the Cleveland office market. Analysis includes leasing, sales, construction and employment.

JLL Pittsburgh Office Insight & Statistics - Q2 2018

The Pittsburgh office market is rebounding as leasing activity picks up across most submarkets.

JLL Pittsburgh Office Insight & Statistics - Q4 2019

2019 ended the decade on high notes, as Pittsburgh gets its first VC-funded tech unicorn and the former Civic Arena site gets an anchor tenant for the tower.

JLL Detroit Office Insight & Statistics – Q2 2016

The quagmire persists – high demand and not enough supply. CBD vacancy rates for the second quarter were 14.5 percent as office construction has come to a virtual halt.

JLL Cleveland Office Outlook: Q2 2018

An in-depth look at the Cleveland office market. Analysis includes leasing, sales, construction and employment.

JLL Detroit Office Insight & Statistics - Q2 2017

As fundamentals continue to improve in Detroit’s office market, we will see rent growth and continued development activity. Downtown, expect to see increased mixed-use projects along Woodward, while in the suburbs build-to-suit projects will remain prevalent.

National Dashboard Report | Office - Metro Areas with Population < 1M

This is the National Dashboard of Canada office markets with a population under one million for the second quarter of 2018.

JLL Detroit Office Insight & Statistics - Q4 2018

The fourth quarter of 2018 was highlighted by yet another high-profile groundbreaking, as Bedrock began work on the Monroe Blocks development, a mixed-use project totaling over 1.4 million square feet that will bring approximately 847,000 square feet to the CBD office inventory. Market-wide, total vacancy fell by 60 basis points to 20.2 percent as 149,007 square feet was absorbed, while average asking rents rose by 1.0 percent up to $19.85 per square foot.

St. Louis Office Outlook Q3 2016

Vacancy across the region is down 180 basis points from the third quarter of last year. Much of the gains have come in Class B properties, which have absorbed three times more square footage in 2016 than Class A properties. Find out more in our Q3 Office Outlook.

Industrial Insight and Statistics: Dallas-Fort Worth (2019-Q2)

Industrial Insight and Statistics: Dallas-Fort Worth (2019-Q2)

JLL Pittsburgh Office Insight & Statistics - Q4 2017

The vacancy rate has risen in 2017, but several new industries are emerging in Pittsburgh that could potentially fill space quickly.

JLL Detroit Office Insight & Statistics - Q1 2019

Over 202,000 square feet of space was absorbed in the first quarter, with notable transactions taking place in the city and the suburbs. Chicago-based Coyote Logistics made headlines with the announcement of a 58,000-square-foot lease at Bedrock’s Assembly Building at 1700 West Fort Street, bringing 500 new jobs to the burgeoning Corktown neighborhood. Google announced plans to expand their 29,000-square-foot office at Little Caesars arena.

JLL Detroit Office Insight & Statistics - Q3 2017

As conditions continue to improve in Detroit, we will see sustained rent growth and dropping vacancies. Looking ahead - we can prepare to see cranes amongst the downtown skyline, as Bedrock readies to break ground on the Hudson’s development on Woodward in December.

JLL Pittsburgh Office Insight & Statistics - Q1 2019

The new year begins with positive absorption, along with two new construction deliveries in the Fringe submarket.

What's hot (20)

JLL Pittsburgh Office Insight & Statistics - Q2 2019

JLL Pittsburgh Office Insight & Statistics - Q2 2019

JLL Grand Rapids Office Insight & Statistics - Q1 2019

JLL Grand Rapids Office Insight & Statistics - Q1 2019

JLL Pittsburgh Office Insight & Statistics - Q3 2018

JLL Pittsburgh Office Insight & Statistics - Q3 2018

JLL Pittsburgh Office Insight & Statistics - Q2 2018

JLL Pittsburgh Office Insight & Statistics - Q2 2018

JLL Pittsburgh Office Insight & Statistics - Q4 2019

JLL Pittsburgh Office Insight & Statistics - Q4 2019

National Dashboard Report | Office - Metro Areas with Population < 1M

National Dashboard Report | Office - Metro Areas with Population < 1M

Industrial Insight and Statistics: Dallas-Fort Worth (2019-Q2)

Industrial Insight and Statistics: Dallas-Fort Worth (2019-Q2)

JLL Pittsburgh Office Insight & Statistics - Q4 2017

JLL Pittsburgh Office Insight & Statistics - Q4 2017

JLL Pittsburgh Office Insight & Statistics - Q1 2019

JLL Pittsburgh Office Insight & Statistics - Q1 2019

Similar to Tampa Bay 2018 Q1 Office Outlook

JLL Louisville Office Outlook - Q2 2018

An in-depth look at the Louisville office market. Analysis includes sales, leasing, construction and employment.

JLL - Tampa Bay 2018 Q2 Industrial Outlook

Check out the latest data on the industrial market in Tampa.

Broward County Office Outlook - Q4 2018

Fort Lauderdale's office mrakt is on solid footing entering 2019!

JLL Grand Rapids Office Insight & Statistics - Q3 2018

Overall vacancy in the Grand Rapids metro is currently 10.2 percent, down 2.1 percent year-over-year. Asking rents downtown seem to have leveled off this year, consistently hovering around $20.00 per-square-foot each quarter and currently sitting at $20.45 per-square-foot. There are 174,000 square feet of office space under construction, most of which is in the Warner Building development, set to deliver in early 2019.

JLL Pittsburgh Office Insight & Statistics - Q1 2020

The year started off strong, but uncertainty presents itself as the COVID-19 outbreak impacts the economy.

Pittsburgh Office Insight & Stats Q4 2021

Leasing activity slowly recovers to pre-pandemic levels. While the market continues to feel the impact from COVID, Duolingo expands 38,000 s.f. at Liberty East at Pittsburgh’s highest recorded rental rate, suggesting that there is still an appetite for new construction within the urban core

JLL Columbus Office Outlook: Q2 2016

A number of large corporations in Columbus are consolidating their operations and moving into owner-occupied buildings.

JLL West Michigan Industrial Insight & Statistics - Q1 2020

While West Michigan market has seen historically low vacancy figures and impressive rent growth the past few years, we should expect things to slow in Q2 as the effects of the COVID-19 pandemic begin to take hold. Market fundamentals remain stable; however, given the current uncertainty, we expect leasing and sales activity to slow considerably in the near term as occupiers evaluate their current and future space needs.

JLL Cleveland Office Outlook: Q1 2018

An in-depth look at the Cleveland office market. Analysis includes leasing, sales, construction and employment.

JLL Cleveland Office Outlook: Q1 2018

An in-depth look at the Cleveland office market. Analysis includes leasing, sales, construction and employment.

JLL Pittsburgh Industrial Insight & Statistics - Q1 2020

Pittsburgh's industrial market was strong and steady going into the new decade. The COVID-19 outbreak caused a pause in development, but Pittsburgh is positioned to rebound.

JLL Cleveland Office Outlook: Q4 2017

An in-depth look at the Cleveland office market. Analysis includes leasing, sales, construction and employment.

Atlanta Office Sector Report (Q2 2016)

Leasing volume has been stuck in neutral for several quarters. Nevertheless, activity in the Midtown, Central Perimeter, North Fulton and Northwest remains steady with corporate relocations boosting demand as well.

JLL Cleveland Industrial Outlook: Q3 2018

An in-depth look at the Cleveland industrial market. Analysis includes leasing, sales, construction and employment.

Q3 2015 Industrial Brief

Market Experts at Lee & Associates compiled a national overview of the current Industrial Real estate market.

JLL Cleveland Office Outlook: Q1 2018

An in-depth look at the Cleveland office market. Analysis includes leasing, sales, construction and employment.

Pittsburgh Office Insight & Stats Q1 2022

Negative absorption shows signs of slowing as Pittsburgh office leasing activity remains steady, indicating further office market recovery.

JLL Pittsburgh Office Insight & Statistics - Q3 2019

Southpointe is making a comeback, while asking rates in Oakland reach record highs.

Similar to Tampa Bay 2018 Q1 Office Outlook (20)

JLL Grand Rapids Office Insight & Statistics - Q3 2018

JLL Grand Rapids Office Insight & Statistics - Q3 2018

JLL Pittsburgh Office Insight & Statistics - Q1 2020

JLL Pittsburgh Office Insight & Statistics - Q1 2020

JLL West Michigan Industrial Insight & Statistics - Q1 2020

JLL West Michigan Industrial Insight & Statistics - Q1 2020

JLL Pittsburgh Industrial Insight & Statistics - Q1 2020

JLL Pittsburgh Industrial Insight & Statistics - Q1 2020

JLL Pittsburgh Office Insight & Statistics - Q3 2019

JLL Pittsburgh Office Insight & Statistics - Q3 2019

More from Kyle Koller

Milwaukee Snapshot - March 2017

When we talk about maximizing efficiencies as it relates to our real estate footprint, the discussion often involves the use of collaborative space, offices versus cubicles, and mitigating square foot per employee and real estate cost per employee metrics. When it comes to the latter, our Milwaukee area firms have shown that it isn’t always just about leasing less space.

Milwaukee Chart of the Week October 24th, 2016

The third quarter of 2016 marked a milestone for the Milwaukee-Waukesha-West Allis Metropolitan area as total employment surpassed pre-housing bubble, and even pre-dot-com bubble, peaks. The unemployment rate, at 4.7%, also approaches the pre-Great Recession low of 4.3%.

Milwaukee Chart of the Week August 29th, 2016

All of the activity downtown has tenants securing their spot in the action. There is room for more - but large blocks of space are harder to come by in the CBD.

Milwaukee Chart of the Week August 15th, 2016

It's no coincidence that the two streets holding the majority of downtown Milwaukee's office inventory have also been targeted for recent development. The interlocking gears are moving and some more exciting stuff may be around the corner!

Milwaukee Chart of the Week March 7th, 2016

Milwaukee has made a strong effort over the past few years to highlight its downtown vibrancy. Recently, Milwaukee made Lonely Planet's 10 Best in the U.S. list for 2016.

More from Kyle Koller (6)

Recently uploaded

2BHK-3BHK NEW FLAT FOR SALE IN TUPUDANA,RANCHI.

Flat available for sale

Location- Tupudana, Ranchi

Savitri enclave

Area- 3BHK

Rate- 4000/sq.ft.

Super Build Up Area-1629 sq.ft.

Build-up area-1253 sq.ft.

Rate- 65lakh16k(approx)

Floor available- Flat available in all floor(G+12)

Balcony- 2

Washroom- 2

Parking - CAR PARKING

Amenities- Joggers track,temple, children's park,gym,banquet hall (5 Lakh)

Possession year (Handover year)- Dec 2025

Outside View from the apartment and flat balcony is very beautiful.

For more information contact AASHIYANA STAR PROPERTIES

7766900371

Simpolo Company Profile & Corporate Logo

Simpolo Tiles & Bathware

Tile ho,

toh Simpolo.

Since the first steps were taken in 1977, Simpolo Ceramics has carved its niche as a consistently growing organisation with unparalleled innovation and passion rooted in simplicity.

We endure gratification for every experience we offer, created to share something meaningful. It may not resonate with the majority, but that makes us a class apart. If only a handful were to understand the purpose of our existence, we would be proud to have found our believers. Rather, people with whom we can share our beliefs.

VISUALIZER

Design your space in your style with our very own Visualizer. Now, you can choose the tiles of your liking from our wide selection and see how they would look in a space. Select the tile from the multiple options and the visualiser will replace the surfaces in the image with the selected tiles. This way, instead of just your imagination, you can choose the tiles for your place by getting an actual picture of how they would look in a space. So, design your space the way you desire digitally and implement it in real life to get the best results!

You can also share this visualiser with others to help them design their space.

Committed to delighting customers with world-class ceramic products and services. Make Simpolo synonymous with the best quality and set new benchmarks of excellence for all stakeholders. Pursue best business practices with utmost integrity to make Simpolo an exciting organisation to work with, for vendors, channel partners, investors and employees alike.

Gain worldwide recognition in the field of ceramic building products through Research and Innovation and bring an enhanced lifestyle within reach for every household.

BricknBolt Understanding Load-Bearing Walls and Their Structural Support in H...

Load-bearing walls are the backbone of any home construction, providing crucial structural support that carries the weight of the house above. For companies like Brick and Bolt Mysore and Bricknbolt Faridabad, understanding and properly implementing these elements are key to constructing safe and durable buildings.

Omaxe Sports City Dwarka A Comprehensive Guide

Omaxe Sports City Dwarka stands out as a premier residential and recreational destination, offering a blend of luxury and sports-centric living. Located in the thriving area of Dwarka, this project by Omaxe Limited is designed to cater to modern lifestyle needs while promoting a healthy, active living environment.

How to Scan Tenants in NYC - You Should Know!

Scanning tenants in NYC requires a thorough and compliant approach to ensure you find reliable renters. For a positive rental experience, consider hiring a property management service. Belgium Management LLC specializes in NYC rental property management and tenant relationship management. We prioritize tenant satisfaction, making us a trusted name in New York property management. Our dedicated team ensures tenants feel valued and supported throughout their lease.

Urbanrise Paradise on Earth - Unveiling Unprecedented Luxury in Exquisite Vil...

Immerse yourself in the epitome of luxury living at Urbanrise Paradise on Earth. These opulent 4 BHK villas, nestled off the prestigious Kanakapura Road in Bangalore, redefine elegance and sophistication. With meticulous craftsmanship, breathtaking design, and unparalleled amenities, Urbanrise Paradise on Earth offers a sanctuary where every moment is infused with luxury and serenity. Experience a life of grandeur and indulgence at this exclusive residential enclave.

Presentation to Windust Meadows HOA Board of Directors June 4, 2024: Focus o...

Presentation to Windust Meadows HOA Board of Directors June 4, 2024: Focus on Public Safety as Job #1, Engagement, Wealth of HOA, Branding, Communication, Culture, Civic Responsibility

One FNG by Group 108 Sector 142 Noida Construction Update

One FNG by Group 108 is launching a new commercial project in Sector 142 Noida. Office space and high street retail shops on the FNG and Noida Expressway. For more information visit the website https://www.onefng.com/

Killer Referans Bahcesehir Catalog Listing Turkey

Referans Bahcesehir which is being constructed, in the center of the most regional destination as Bahçeşehir, shines out with its central location and unique landscape including social facilities such as a fitness center, sauna, sports facilities, children’s playground and recreational areas.

Not only drawing attention for immediate surroundings including commercial centers and private schools but also providing the easily accessible location with closeness to Tem Highway and connection roads, ongoing construction of 3rd Bridge Connection roads and Metro Projects

Bahcesehir is a rising value in the great city of Istanbul… Located at a new transportation junction in the northwest of the City… Located at such a spot that the access roads for the 3rd bridge and for the 3rd Airport will reach the region in 2016. The Marmaray and the Subway will extend all the way to Referans Bahcesehir respectively in 2018 and 2019.

465 flats and 34 stores are designed with an outstanding approach and arranged with a unique perspective offering the following options: 1 plus 1, 2 plus 1, 3 plus 1, 3.5 plus 1, 4 plus 1, and 4.5 plus 1. It is planned so as to safeguard you and your loved ones based upon a modern, technological safety approach. As you experience the joy and luxury here, you will be content and feet at ease.

It is worth seeing both inside and outside with heart-warming cafes, tasty restaurants and elegant stores… And it is ready to offer a vivacious social life with a warm and cozy space design.

A folding swimming pool and indoor swimming pools, playgrounds, Turkish bath, sauna… It has them all. Everything you need for your well-being and for having a pleasant time will be at your service. You simply need to align the rhythm of life with the rhythm of Referans Bahcesehir.

https://listingturkey.com/property/referans-bahcesehir/

Green Homes, Islamabad Presentation .pdf

Green Homes Islamabad offers beautifully designed 5, 8, and 10 Marla homes near the airport and motorway. Enjoy luxury, convenience, and high rental returns in a prime location.

Sense Levent Kagithane Catalog - Listing Turkey

Sense Levent offers a luxurious living experience in the heart of Istanbul’s vibrant Levent district.

This cutting-edge development seamlessly integrates modern design with natural elements, featuring live evergreen plants maintained by an advanced irrigation system, ensuring lush greenery year-round.

The building’s elegant ceramic balconies are both stylish and durable, enhancing the overall aesthetic and functionality. Residents can enjoy the 700m Sky Lounge, which provides breathtaking views of Istanbul and a perfect space to relax and unwind.

Sense Levent promotes a healthy and active lifestyle with a full gym, swimming pool, sauna, and steam room, all available in the building. The interiors are crafted with high-quality materials, ensuring a luxurious and inviting living space.

Designed with young professionals in mind, Sense Levent features 1+1 and 2+1 units with smart floor plans and balconies. The project promises high investment returns, with an expected annual return of 6.5-7%, significantly above Istanbul’s average ROI.

Located in the rapidly growing and highly desirable Levent area, the development benefits from ongoing urban regeneration projects. Its prime location offers proximity to shopping malls, municipal buildings, universities, and public transportation, adding immense value to your investment.

Early investors can take advantage of discounted units during the construction phase, with an expected capital appreciation of +45% USD upon completion. Property Turkey provides comprehensive rental management services, ensuring a seamless and profitable investment experience.

Additionally, robust legal support and significant tax advantages are available through Property Turkey’s licensed Real Estate Investment Fund. Levent is a dynamic urban hub, ideal for young professionals with its numerous corporate headquarters and shopping malls.

Sense Levent is more than just a residence; it’s a place where dreams and opportunities come to life. Contact us today to secure your place in this exclusive development and experience the best of Istanbul living. Sense Levent: Sense the Opportunity. Live the Dream.

https://listingturkey.com/property/sense-levent/

Biography and career about Lixin Azarmehr

Lixin Azarmehr, a Los Angeles-based real estate development trailblazer, co-founded JL Real Estate Development (JL RED) in 2015 and serves as its CEO. Her expertise has propelled the firm to specialize in luxury residential and mixed-use commercial projects, with a portfolio that features upscale retail spaces and sophisticated care facilities.

Brigade Insignia at Yelahanka Brochure.pdf

Brigade Insignia offers meticulously designed apartments with modern architecture and premium finishes. The project features spacious 3,3.5,4 and 5 BHK units, each thoughtfully planned to provide maximum comfort, natural light, and ventilation.

https://www.newprojectbangalore.com/brigade-insignia-yelahanka-bangalore.html

Optimizing Your MCA Lead Capture Process for Better Results

Need MCA leads? No sweat! MCAs are great for small biz funding. Learn how to snag top-notch leads: businesses needing cash, with repayment ability, decision-makers, and accurate contacts. Use content, social ads, lead platforms, partnerships, and capture processes for quality leads.

https://www.leadgeneration.media/blog/b/streamline-your-mca-sales-process-with-pre-qualified-leads

One20 North Vancouver Floor Plans by Three Shores Development.

One20 North Vancouver Floor Plans by Three Shores Development.

Riverview City Loni Kalbhor Pune Brochure

500 acres of brilliance await you here at Riverview City which offers modern living, effortless convenience, and a beautiful natural setting. It is a mega township by Magarpatta City in Loni Kalbhor, Pune. Enjoy easy access to work, schools, and fun while experiencing a perfect work-life balance.

Visit - magarpattacity.developerprojects.in

Rixos Tersane Istanbul Residences Brochure_May2024_ENG.pdf

Tersane Suites Residences is a luxurious real estate project located in the heart of Istanbul, next to the beautiful Golden Horn. This unique development offers hotel concept residences with Rixos management, making it the perfect choice for both homeowners and investors.

The Tersane Suites Residences offers a wide range of options, from studio apartments to spacious four-bedroom units, all designed to the highest standard. The suites are finished with high-quality materials and feature modern, open-plan living spaces, fully-equipped kitchens, and large balconies with stunning views of the city and sea.

One of the standout features of Tersane Suites Residences is the Rixos management, which provides a truly exclusive and upscale living experience. Residents will have access to a range of luxury amenities, including a fitness center, spa, and indoor and outdoor swimming pools. Plus, the on-site restaurants and cafes provide a taste of the local and international cuisine.

The Tersane Suites Residences also offers a great opportunity for investors, as it provides a rental guarantee program. This means that investors can enjoy a steady income stream, with the peace of mind that their property is being managed by a reputable and experienced team.

The location of Tersane Suites Residences is also unbeatable, with easy access to the city’s main transportation links and within close proximity to the historic center, making it the perfect base for exploring all that Istanbul has to offer.

The KA Housing - Catalogue - Listing Turkey

Welcome to KA Housing, a distinguished real estate development nestled in the heart of Eyüpsultan, one of Istanbul’s most promising districts.

Just 10 minutes from the bustling city center, Eyüpsultan offers a serene escape with the convenience of urban living. The direct metro line ensures seamless connectivity to all parts of Istanbul, making it an ideal location for residents who seek both tranquility and vibrancy.

KA Housing boasts unparalleled accessibility, with proximity to Istanbul Airport only 30 minutes away, facilitating easy international travel. Effortless city access is guaranteed by direct metro and transportation links to Istanbul’s cultural and commercial hubs. Quick access to key metro lines connects you to every corner of the city within minutes, making commuting and exploring the city hassle-free.

The development offers luxurious living spaces with a range of unit layouts from 1+1 to 4+1, designed with meticulous attention to detail. Each unit features balconies or terraces, providing stunning vistas of Istanbul and enhancing the living experience. High-quality materials and superior craftsmanship ensure durability and elegance, while sound-proof insulation and high ceilings (2.95 m) offer comfort and sophistication.

Residents of KA Housing enjoy exclusive on-site amenities, including a state-of-the-art gym, outdoor swimming pool, yoga area, and walking paths. Entertainment options abound with a private cinema, children’s playground, and a variety of dining options including a café and restaurant. Security and convenience are paramount with 24/7 security, a dedicated carpark garage, and an IP intercom system.

KA Housing represents a prime investment opportunity with limited availability in a high-demand area, ensuring enduring value and potential for lucrative returns. Homes in this development provide exceptional value without compromising on quality, offering affordable luxury for discerning buyers. The construction is of the highest quality, built to the latest seismic and disaster resistance standards, ensuring safety and resilience.

The community and surroundings of KA Housing are enriched by close proximity to prestigious universities such as Haliç University, Bilgi University, and Istanbul Ticaret University, making it an ideal location for students and academics. The development is adjacent to the Alibeyköy stream leading into the Halic waters, offering serene natural escapes amidst lush greenery. Residents can enjoy the cultural richness of the area, surrounded by historical and cultural landmarks that blend leisure, nature, and culture seamlessly.

https://listingturkey.com/property/the-ka-housing/

Recently uploaded (20)

BricknBolt Understanding Load-Bearing Walls and Their Structural Support in H...

BricknBolt Understanding Load-Bearing Walls and Their Structural Support in H...

Urbanrise Paradise on Earth - Unveiling Unprecedented Luxury in Exquisite Vil...

Urbanrise Paradise on Earth - Unveiling Unprecedented Luxury in Exquisite Vil...

Presentation to Windust Meadows HOA Board of Directors June 4, 2024: Focus o...

Presentation to Windust Meadows HOA Board of Directors June 4, 2024: Focus o...

One FNG by Group 108 Sector 142 Noida Construction Update

One FNG by Group 108 Sector 142 Noida Construction Update

Optimizing Your MCA Lead Capture Process for Better Results

Optimizing Your MCA Lead Capture Process for Better Results

One20 North Vancouver Floor Plans by Three Shores Development.

One20 North Vancouver Floor Plans by Three Shores Development.

Rixos Tersane Istanbul Residences Brochure_May2024_ENG.pdf

Rixos Tersane Istanbul Residences Brochure_May2024_ENG.pdf

Tampa Bay 2018 Q1 Office Outlook

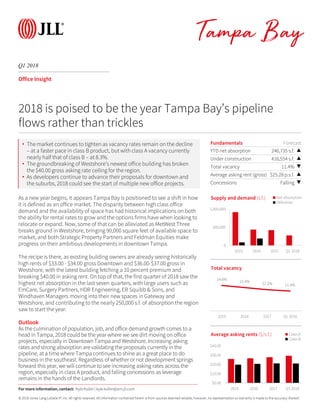

- 1. © 2018 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Q1 2018 Tampa Bay Office Insight As a new year begins, it appears Tampa Bay is positioned to see a shift in how it is defined as an office market. The disparity between high class office demand and the availability of space has had historical implications on both the ability for rental rates to grow and the options firms have when looking to relocate or expand. Now, some of that can be alleviated as MetWest Three breaks ground in Westshore, bringing 90,000 square feet of available space to market, and both Strategic Property Partners and Feldman Equities make progress on their ambitious developments in downtown Tampa. The recipe is there, as existing building owners are already seeing historically high rents of $33.00 - $34.00 gross Downtown and $36.00-$37.00 gross in Westshore, with the latest building fetching a 10 percent premium and breaking $40.00 in asking rent. On top of that, the first quarter of 2018 saw the highest net absorption in the last seven quarters, with large users such as EmCare, Surgery Partners, HDR Engineering, ER Squibb & Sons, and Windhaven Managers moving into their new spaces in Gateway and Westshore, and contributing to the nearly 250,000 s.f. of absorption the region saw to start the year. Outlook As the culmination of population, job, and office demand growth comes to a head in Tampa, 2018 could be the year where we see dirt moving on office projects, especially in Downtown Tampa and Westshore. Increasing asking rates and strong absorption are validating the proposals currently in the pipeline, at a time where Tampa continues to shine as a great place to do business in the southeast. Regardless of whether or not development springs forward this year, we will continue to see increasing asking rates across the region, especially in class A product, and falling concessions as leverage remains in the hands of the Landlords. Fundamentals Forecast YTD net absorption 246,735 s.f. ▲ Under construction 416,554 s.f. ▲ Total vacancy 11.4% ▼ Average asking rent (gross) $25.28 p.s.f. ▲ Concessions Falling ▼ 0 500,000 1,000,000 2015 2016 2017 Q1 2018 Supply and demand (s.f.) Net absorption Deliveries 2018 is poised to be the year Tampa Bay’s pipeline flows rather than trickles 14.6% 13.4% 12.2% 11.4% 2015 2016 2017 Q1 2018 Total vacancy $0.00 $10.00 $20.00 $30.00 $40.00 2015 2016 2017 Q1 2018 Average asking rents ($/s.f.) Class A Class B For more information, contact: Kyle Koller | kyle.koller@am.jll.com • The market continues to tighten as vacancy rates remain on the decline – at a faster pace in class B product, but with class A vacancy currently nearly half that of class B – at 8.3%. • The groundbreaking of Westshore’s newest office building has broken the $40.00 gross asking rate ceiling for the region. • As developers continue to advance their proposals for downtown and the suburbs, 2018 could see the start of multiple new office projects.

- 2. © 2018 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Q1 2018 Tampa Bay Office Statistics For more information, contact: Kyle Koller | kyle.koller@am.jll.com Class Inventory (s.f.) YTD total net absorption (s.f.) YTD total net absorption (% of stock) Direct vacancy (%) Total vacancy (%) Average asking rent ($ p.s.f.) YTD Completions (s.f.) Under Development (s.f.) Gateway/Bayside Totals 3,653,043 187,199 5.1% 12.1% 12.3% $22.30 0 0 I-75/I-4 Corridor Totals 6,332,171 -65,659 -1.0% 12.6% 12.7% $20.50 0 0 Northwest Totals 2,663,377 9,273 0.3% 9.6% 9.7% $20.94 0 148,800 Pinellas Outlying Totals 2,234,021 -28,856 -1.3% 26.9% 26.9% $18.44 0 0 St. Pete CBD Totals 2,168,064 3,483 0.2% 7.6% 7.7% $27.68 0 0 Tampa CBD Totals 6,024,782 56,002 0.9% 10.2% 10.5% $28.19 0 0 Westshore Totals 11,818,161 115,392 1.0% 8.2% 9.0% $30.37 0 267,754 Tampa Bay Totals 34,893,619 276,834 0.8% 11.0% 11.4% $25.28 0 416,554 Gateway/Bayside A 2,469,633 70,972 2.9% 5.5% 5.8% $23.87 0 0 I-75/I-4 Corridor A 3,280,175 -64,600 -2.0% 9.2% 9.3% $25.69 0 0 Northwest A 1,012,125 -2,243 -0.2% 2.1% 2.1% $26.85 0 148,800 Pinellas Outlying A 1,037,202 -7,010 -0.7% 20.3% 20.3% $21.06 0 0 St. Pete CBD A 1,633,077 -380 0.0% 6.8% 7.0% $28.82 0 0 Tampa CBD A 4,572,871 52,189 1.1% 10.7% 10.9% $29.50 0 0 Westshore A 7,409,363 75,169 1.0% 6.1% 6.7% $34.16 0 267,754 Tampa Bay A 21,414,446 124,097 0.6% 8.0% 8.3% $29.34 0 416,554 Gateway/Bayside B 1,183,410 116,227 9.8% 25.8% 25.8% $20.05 0 0 I-75/I-4 Corridor B 3,051,996 -1,059 0.0% 16.4% 16.4% $18.44 0 0 Northwest B 1,651,252 11,516 0.7% 14.2% 14.4% $20.34 0 0 Pinellas Outlying B 1,196,819 -21,846 -1.8% 32.7% 32.7% $16.96 0 0 St. Pete CBD B 534,987 3,863 0.7% 9.8% 9.8% $22.85 0 0 Tampa CBD B 1,451,911 3,813 0.3% 8.9% 9.1% $22.80 0 0 Westshore B 4,408,798 40,223 0.9% 11.7% 13.0% $25.54 0 0 Tampa Bay B 13,479,173 152,737 1.1% 15.8% 16.3% $20.99 0 0