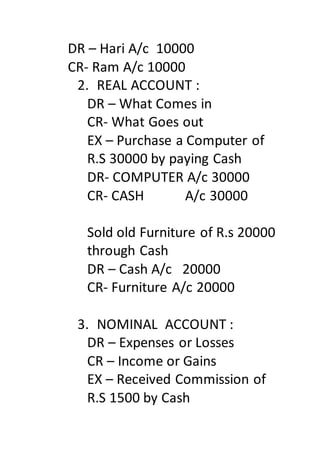

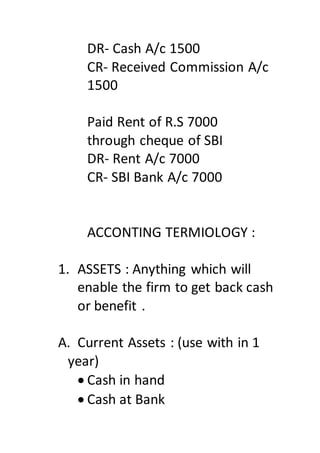

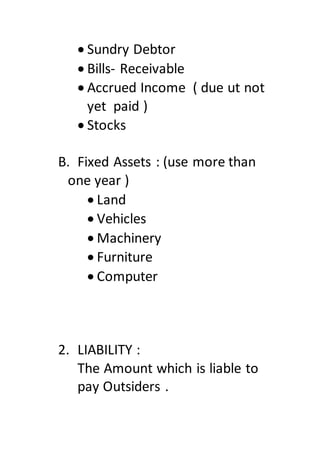

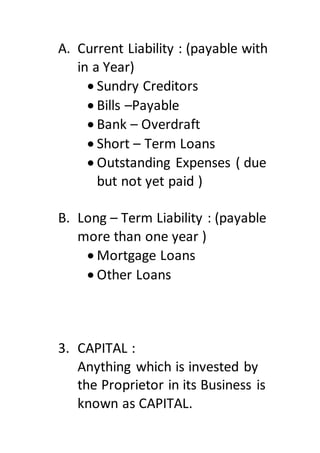

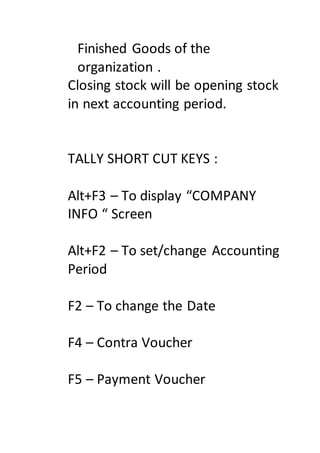

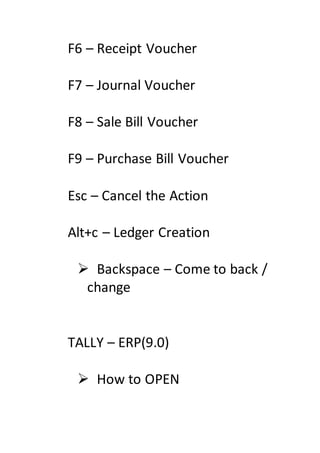

This document provides an overview of accounting concepts and the Tally ERP-9 accounting software. It defines key accounting terms like transactions, accounts, assets, liabilities, capital, and discusses account types. It also summarizes the accounting cycle including recording transactions, classifying accounts, summarizing results, and preparing financial statements. Finally, it outlines the basic features and shortcuts of Tally ERP-9 for creating companies, accounting vouchers, ledgers and setting the accounting period.