Sustainable rural financial services in ghana

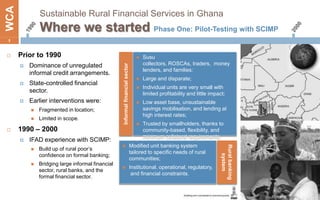

- 1. WCA Sustainable Rural Financial Services in Ghana Where we started Phase One: Pilot-Testing with SCIMP 1 Prior to 1990 Susu collectors, ROSCAs, traders, money Informal financial sector Dominance of unregulated lenders, and families: informal credit arrangements. Large and disparate; State-controlled financial Individual units are very small with sector. limited profitability and little impact; Earlier interventions were: Low asset base, unsustainable Fragmented in location; savings mobilisation, and lending at high interest rates; Limited in scope. Trusted by smallholders, thanks to 1990 – 2000 community-based, flexibility, and minimum collateral requirements. IFAD experience with SCIMP: Modified unit banking system Rural banking Build up of rural poor’s tailored to specific needs of rural system confidence on formal banking; communities; Bridging large informal financial Institutional, operational, regulatory, sector, rural banks, and the and financial constraints. formal financial sector.

- 2. WCA Sustainable Rural Financial Services in Ghana Where we are Phase Two: Nationwide Scaling-Up with RFSP 2 2000 – 2010 Strategic focus up-scaled from SCIMP to countrywide project RFSP intervening at macro, meso, and micro levels: Easy access by the rural poor; responsive to their specific needs; and sustainable. Sustainability Innovation Lessons learned - challenges 6% RoE by 2007 Rural Banking Major achievements of RFSP Improvement of access to lending 80% of rural banks Introduced tailored products by small-scale farmers below are profitable. financial products. expectation, in spite of the increased saving; Growth Efficiency Contradiction between IFAD’s 133 rural banks Mergers matching-grant approach (smart Increased from 115 in Increased mergers subsidy) and the Government’s 2002. among rural banks. continued pursuance of subsidized interest rate programmes; Competency Governance Upgraded National Policy Insufficient pilot-testing; Standards of regulatory for microfinance Co-financiers’ tendency to upscale on bodies enhanced. developed. its own (AfDB and the Bank).

- 3. WCA Sustainable Rural Financial Services in Ghana What is next Phase Three: Continuation and Replication 3 Replication in WCA 2010 and on… IFAD launched Unsuccessful replication: RAFIP, successor of RFSP Insufficient pilot-testing and Cameroon, Niger preserving the good features straight to nationwide programme led to many challenges; and capitalizing on the 20- years of experience: Low demand of the Government and continued emphasis on credit Specific purpose for financing interest subsidy; agricultural value chains; Poor governance; Complementary to two ongoing agricultural value chains and one Low population density (Niger); rural enterprise programmes; Senegal, Nigeria Knowledge management served Disengagement from credit lines; for: Capacity building of Apex Bank Decision not to replicate in Senegal and rural banks to concretize in 2004; their coordinating role. Replication and expansion of RFSP features to RUFIN in Nigeria.

Editor's Notes

- A 20-year proactive effort in introduction, adapting and up-scaling innovations in rural financial services in Ghana.IFAD’s (and other donor’s) earlier interventions and assistance in Ghana was limited in location and scope: at a time of state control, and overall poor economic performance Until new opportunities under the mid 1980s Economic Recovery Programme.Smallholders relied heavily on informal credit arrangements – IFAD was one of the first formal credit positive experience with the “Proximity Factor” of the Smallholder Credit, Input Supply and Marketing Project (SCIMP) from 1990 to 2000.Main experience working extensively with some rural banks in few regions providing formal financial services which were hitherto seen to be “distant and frightening” to the rural poor.CHALLENGE was to facilitate forward and backward linkages between large informal network, rural banks, and the formal financial sector.Constrains of the informal financial sector.Nature and constrains of the rural banking system at the time.

- From 2000, strategic focus is shifted from SCIMP (Smallholder credit, input supply and marketing project) – smaller, geographically-targeted interventions in poverty areas to expanded RFSP (Rural Financial Services Project) countrywide project focusing on one sector only with broader economic strategies and policies which are adapted for: easy access by the rural poor, responsive to their specific needs, and sustainability of the rural financial services.The most significant results of RFSP was fostering innovative approaches, contributing to building a more solid microfinance subsector, included products (e.g. money transfer services and new saving products adapted to lower-income clients).It also strengthened the regulatory and oversight bodies (such as Bank of Ghana, Ministry of Finance) as well as the capacity of apex bodies of rural banks (ARB Apex Bank Ltd).Rural banks achieved operational / financial sustainability. Financial sustainability of rural banks and their apex organizations has improved – Return on equity of 6% by 2007. Currently, 80% of the rural banks are profitable.Number of rural banks also increased from 115 in 2002 to 133 today, and the geographic coverage of northern agricultural region extended.Discussion is underway to promote further merger activities among the smaller banks operating within the same geographical zones, as a way to further enhance profitability and efficiency.Competencies and standards of regulatory bodies have been upgraded and strengthened.It contributed to a national policy and governance system for microfinance and to professionalising the subsector.Challenges still remain:At micro level, access to lending products has not increased according to expectation, particularly for small-scale farmers.Rural finance-matching grants (grant + loan + individual equity model) – smart subsidy (non-distortionary, transparent, targeted, capped, and economically justified) providing a lump-sum credit to small investments without subsidizing interest rates. Policy dialogue has sensitized the Government to the distortionary effects of subsidized interest rate programmes, although the latter continues to exist.The co-financing strategy (approximately half IFAD and the other half split about evenly between the Bank and AFDB) facilitated the leverage of ample funding spread across all three levels of the banking sector.Limitations and drawbacks: pilot-testing was considered insufficient, and tendency to upscale on its own.

- From 2010 IFAD launched RAFIP (IFAD loan SDR 10 million and Italian Grant USD 1.5 million). As a successor to and preserving many features of RFSP, RAFIP will tap into financing agricultural value chains and not establishing credit lines and specifies that the Apex Bank and rural banks will play a coordinating role to ensure consistency of methodologies, criteria and terms.IFAD experienced unsuccessful replications in Cameroon and Niger: In spite of insufficient pilot-testing, IFAD went straight to nationwide approach, facing many implementation challenges. Furthermore, the low demand and confidence of the government leading to lack of ownership, and continued emphasis on heavily subsidized grant programmes also contributed to the unsuccessful implementation. Finally, the poor governance system and low population density (in the case of Niger) impacted negatively to the sustainability.The knowledge gained from Ghana, Cameroon and Niger was served in Senegal Nigeria. In 2004, IFAD decided not to replicate the RFSP experience in Senegal, due to lack of comparative advantage. In 2006, IFAD replicated and expanded RFSP features to RUFIN and so far, the outcome is positive.