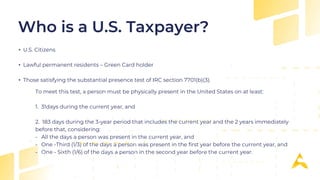

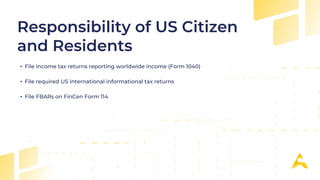

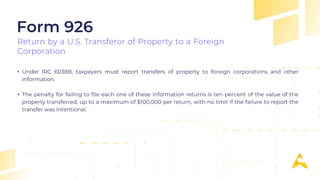

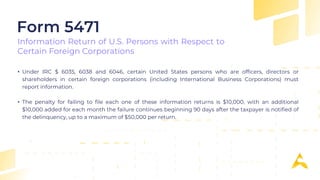

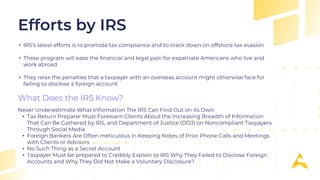

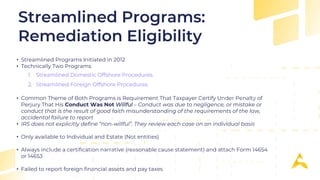

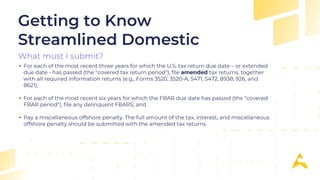

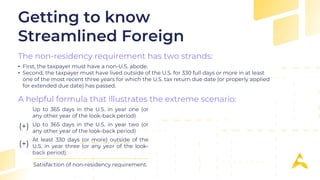

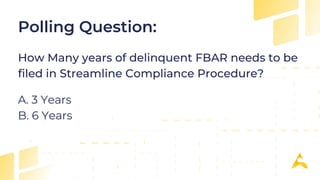

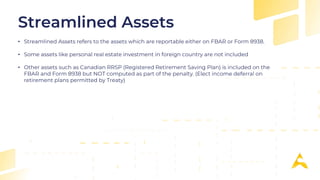

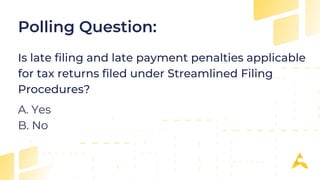

The webinar covers the responsibilities of U.S. citizens and residents related to foreign asset disclosure and reporting, emphasizing streamlined procedures for tax compliance. It outlines eligibility criteria, various forms like FBAR and Form 8938, and penalties for failures in reporting. Additionally, it discusses streamlined programs aimed at remediating non-compliance issues for individuals living abroad or in the U.S.