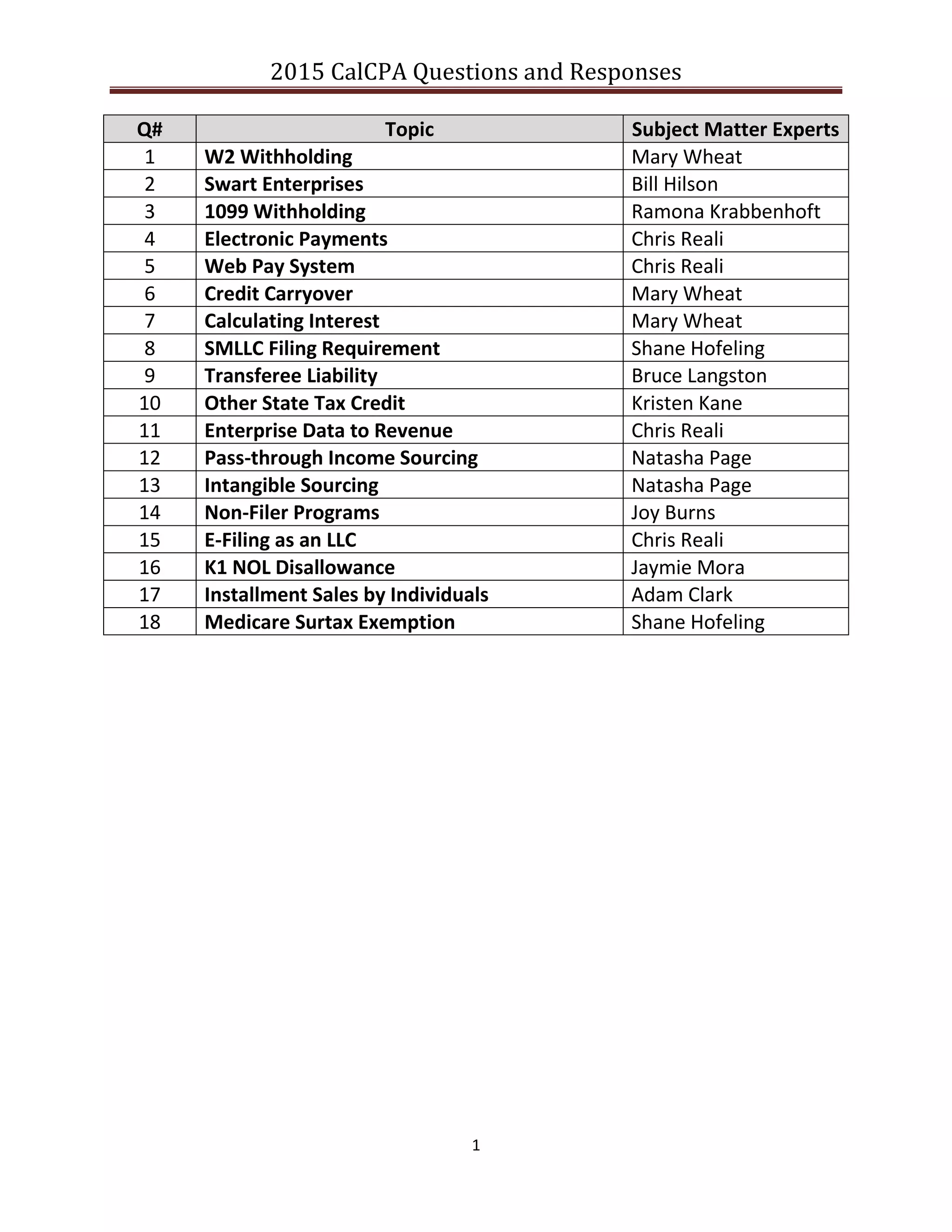

The document contains a series of questions and responses from the California Franchise Tax Board (FTB) addressing various tax-related issues, including W2 and 1099 withholding, LLC filing requirements, and refund processes. It outlines procedures for taxpayers to validate withholding discrepancies, discusses the impact of recent legal decisions on business tax obligations, and provides guidance on using the new MyFTB platform. Additionally, the FTB plans to release further guidance on the out-of-state tax credit and enhance user training for tax practitioners in 2016.

![2015 CalCPA Questions and Responses

6

Response:

Currently, taxpayers may call the Franchise Tax Board 800.852.5711 to get a current and/or

future balance including any applicable penalties and interest.

Beginning January 4, 2016, taxpayers and tax preparers who register for a new MyFTB account

at www.ftb.ca.gov will be able to calculate a current or future balance due. They can enter the

planned payment date and calculate the projected balance due for that date, including any

applicable penalties and interest.

Question #8

SMLLC Filing Requirement

A Single Member Limited Liability Company (SMLLC) doing business as a partnership holds a

personal residence. The SMLLC has no other activity or assets, and no business is conducted on

the premises. Does the LLC need to register with the CA Secretary of State? Are they required

to pay the $800 LLC Annual Tax for the privilege of doing business in CA?

Response:

As the Franchise Tax Board ("FTB") does not administer the registration of limited liability

companies ("LLCs"), FTB would defer to the California Secretary of State for the determination

of filing requirements. However, it appears the obligation to register with the California

Secretary of State arises under the definition of "transacting intrastate business" in the

California Corporations Code sections 191 and 17708.03, which defines that term as, "…

enter[ing] into repeated and successive transactions of business in this state, other than in

interstate or foreign commerce." For specific questions about the requirement to register to do

business in California, taxpayers should contact the California Secretary of State.

However, the requirement for registration with the California Secretary of State is not the same

as the requirement to file and pay the LLC annual tax and fee. California Revenue and Taxation

Code ("RTC") sections 17941 and 17942 requires the annual tax and fee to be paid if the LLC is

doing business in California. RTC section 23101(a) defines doing business as "… actively

engaging in any transaction for the purpose of financial or pecuniary gain or profit." For taxable

years beginning on or after January 1, 2011, a taxpayer is also "doing business" in California if

any of the following conditions are satisfied: (1) a taxpayer is organized or commercially

domiciled in California or (2) a taxpayer's California sales, property, or payroll exceed the

amounts then applicable amounts under paragraphs (2), (3), or (4) respectively, of subdivision

(b) of Section 23101.

In order to provide a specific answer to the question, some additional information may be

necessary. A SMLLC by its operation only has one member. In order to be doing business as a](https://image.slidesharecdn.com/2015-151022234400-lva1-app6891/75/2015-CalCPA-FTB-Q-A-6-2048.jpg)