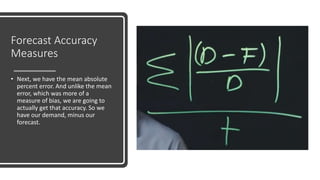

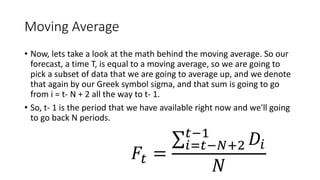

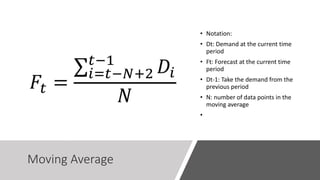

This document discusses various measures for evaluating forecast accuracy, including mean error, mean absolute percent error, and mean squared error. It explains that mean error measures bias while mean absolute percent error and mean squared error measure accuracy. Mean squared error gives more weight to large errors, which are most important to avoid. The document also covers moving averages, which average a subset of historical data to smooth out fluctuations and forecast future values. It notes the moving average period N is a key parameter, with smaller N producing more reactive forecasts and larger N producing more stable forecasts.