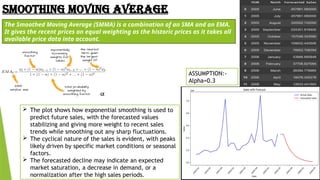

The document presents a comparative analysis of various time series forecasting techniques including simple moving averages, Holt’s model, Winter’s model, and regression models, using sales data from 2005. It summarizes the methodologies used for data cleaning, anomaly detection, and forecasting, identifying key trends and relationships between sales and quantities ordered. The conclusion highlights the strengths of each forecasting method in terms of capturing trends and seasonality in sales data.