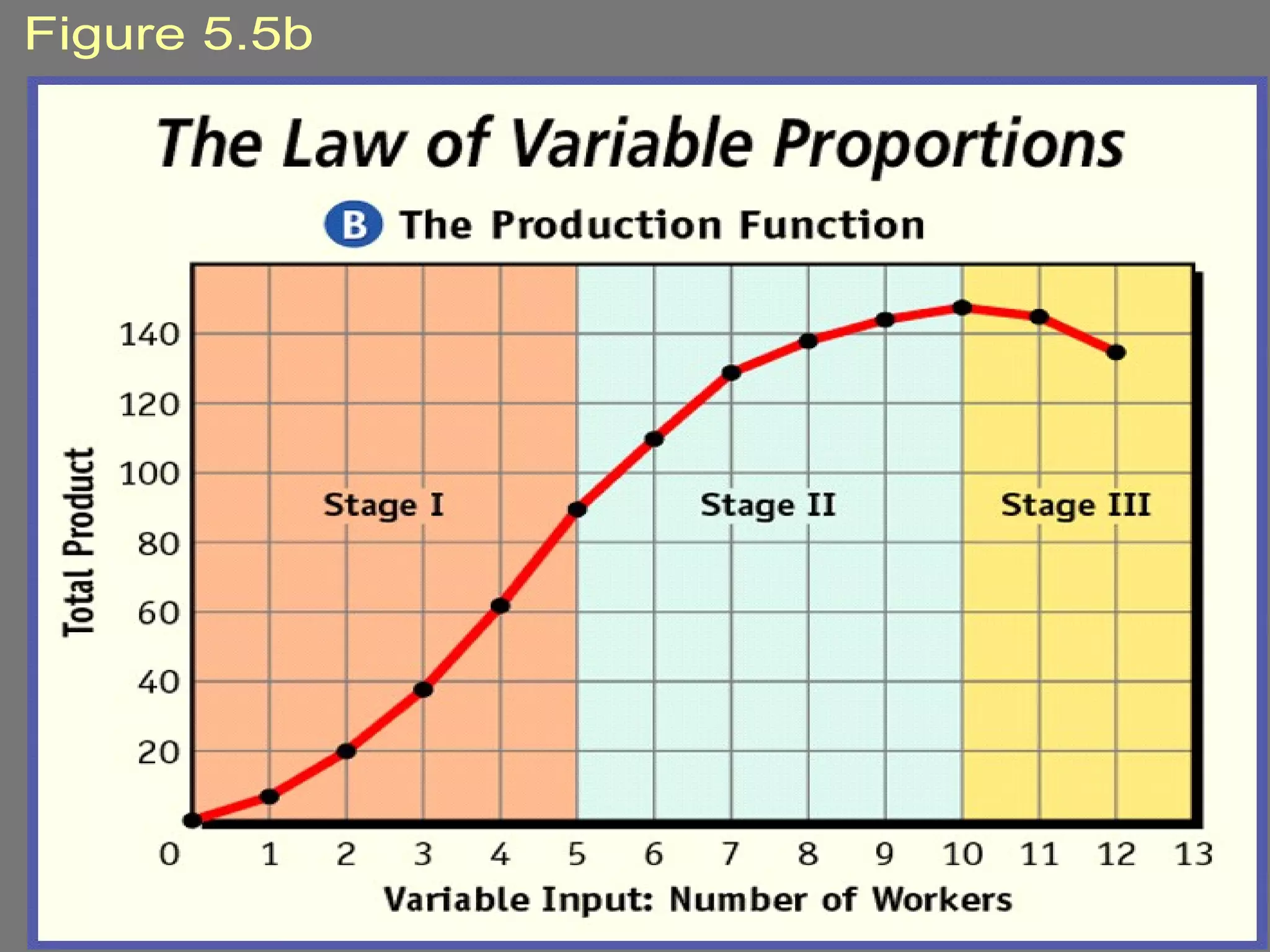

Supply refers to the quantity of a product offered for sale. The law of supply states that more of a product will be offered at a higher price and less at a lower price. Supply curves show the relationship between price and quantity supplied, and can be individual or market curves representing one firm or multiple firms. Factors that affect supply include costs of inputs, productivity, technology, taxes, expectations, government regulations, and number of sellers. When these factors change, the supply curve shifts representing a change in quantity supplied at each price level.