📘 Subsidiary Books Summary

* Definition: Subsidiary Books are used to record similar types of transactions.

* Purpose: They prevent a single book from becoming confusing. They allow for simple and systematic recordkeeping.

* Concept: Instead of recording everything in one place, a business keeps different books for different purposes (e.g., one for purchases, one for sales, one for cash).

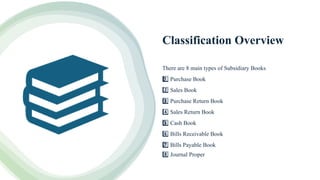

* 8 Main Types:

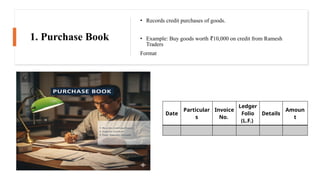

* Purchase Book: Records credit purchases of goods.

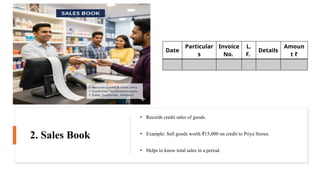

* Sales Book: Records credit sales of goods.

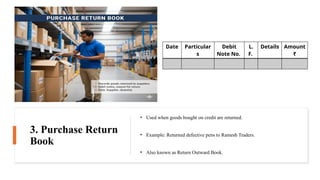

* Purchase Return Book (Return Outward): Records goods returned to suppliers.

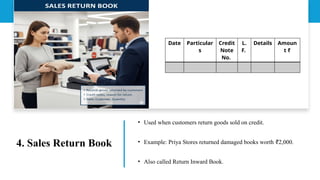

* Sales Return Book (Return Inward): Records goods returned by customers.

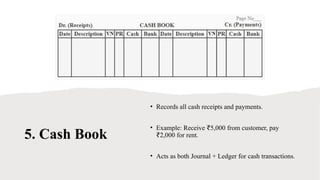

* Cash Book: Records all cash receipts and payments (acts as a Journal + Ledger for cash).

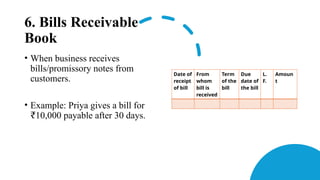

* Bills Receivable Book: Records bills/promissory notes received from customers.

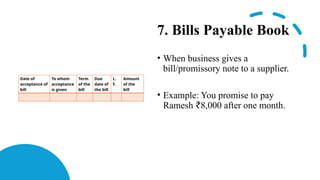

* Bills Payable Book: Records bills/promissory notes given to suppliers.

* Journal Proper: Records rare or special transactions (e.g., depreciation, goods lost by fire).