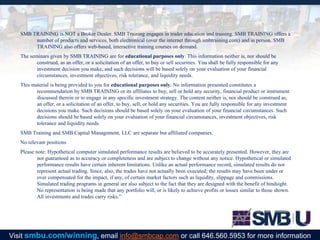

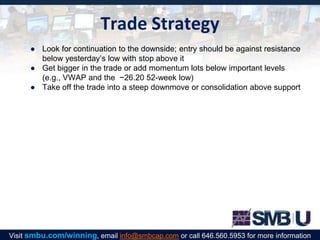

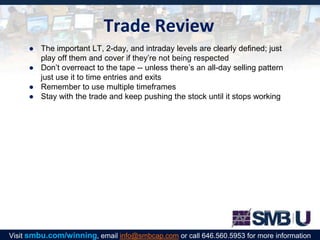

The document discusses a short trade idea on Seagate Technology (STX) stock. It notes that Seagate announced weaker than expected preliminary Q3 2016 financial results, driving the stock down 11% in pre-market trading. Charts of STX and the S&P 500 are presented, along with trade strategy details such as looking for continuation of the down move on STX and adding to positions at important support levels. Management guidelines emphasize using multiple time frames and technical levels to enter and exit the trade.