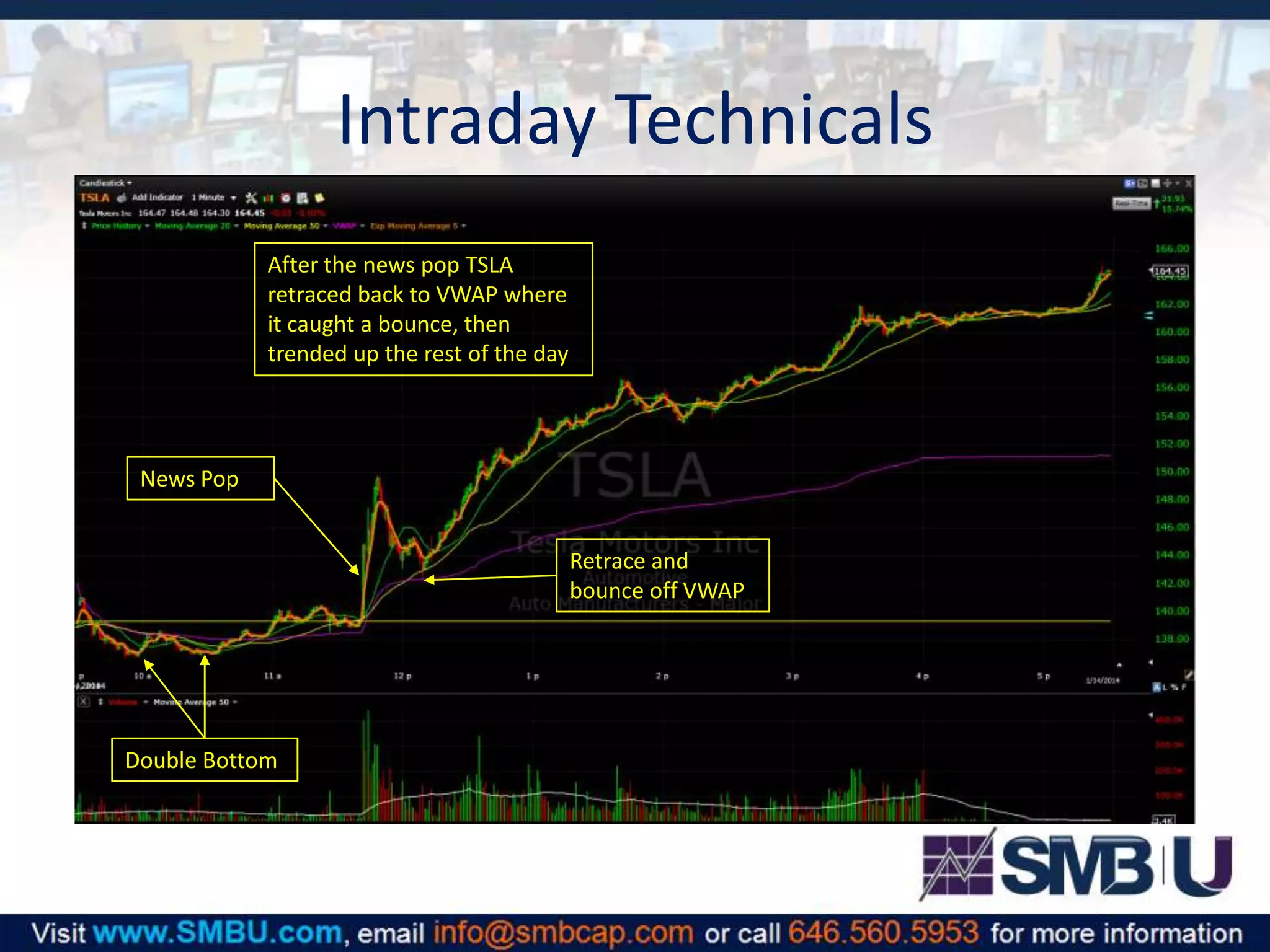

- The document discusses intraday trades of Tesla (TSLA) stock after it reversed from a double bottom pattern and trended higher throughout the day.

- Positive company news around vehicle deliveries and an interview with Elon Musk helped propel the stock higher.

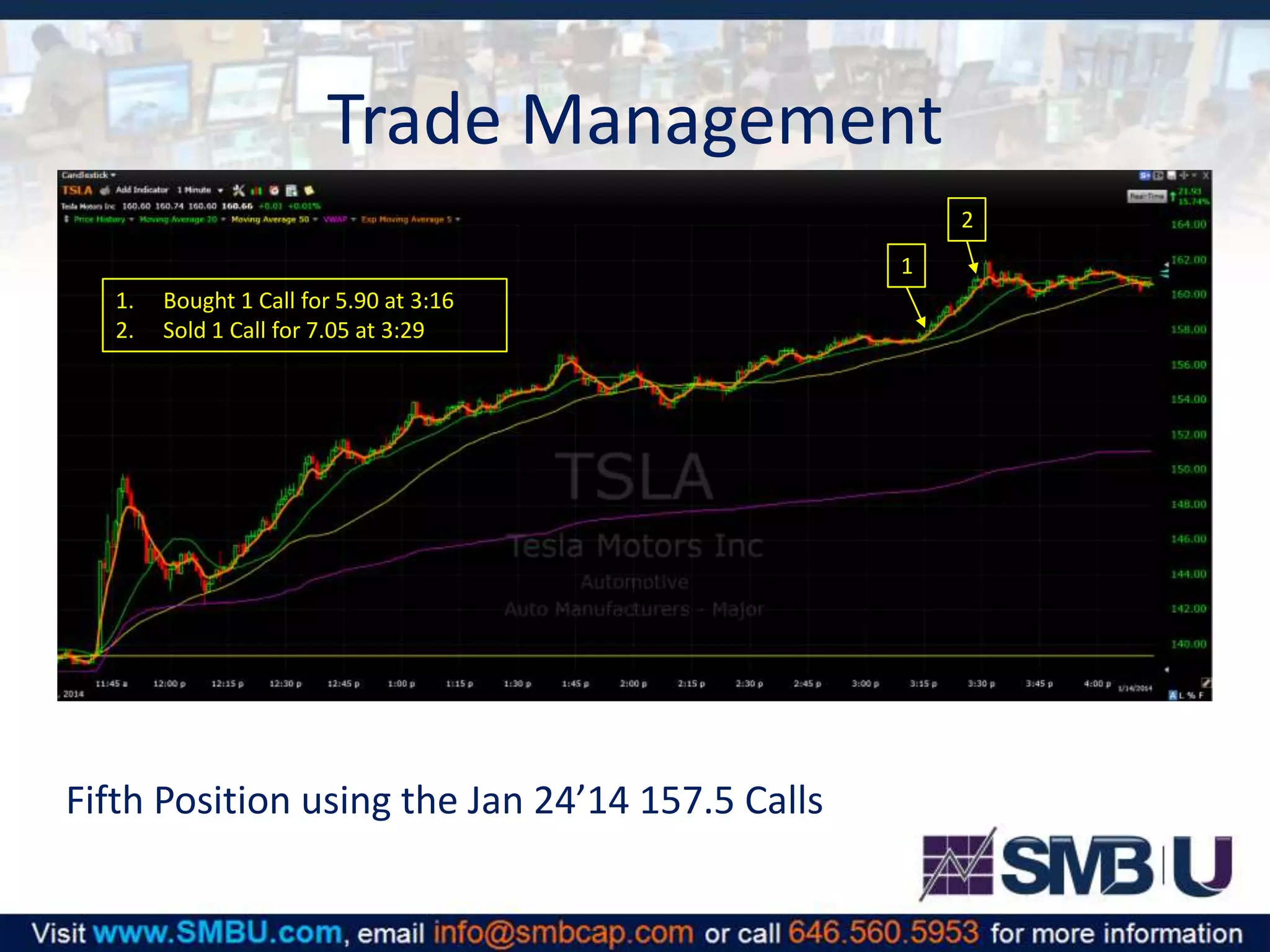

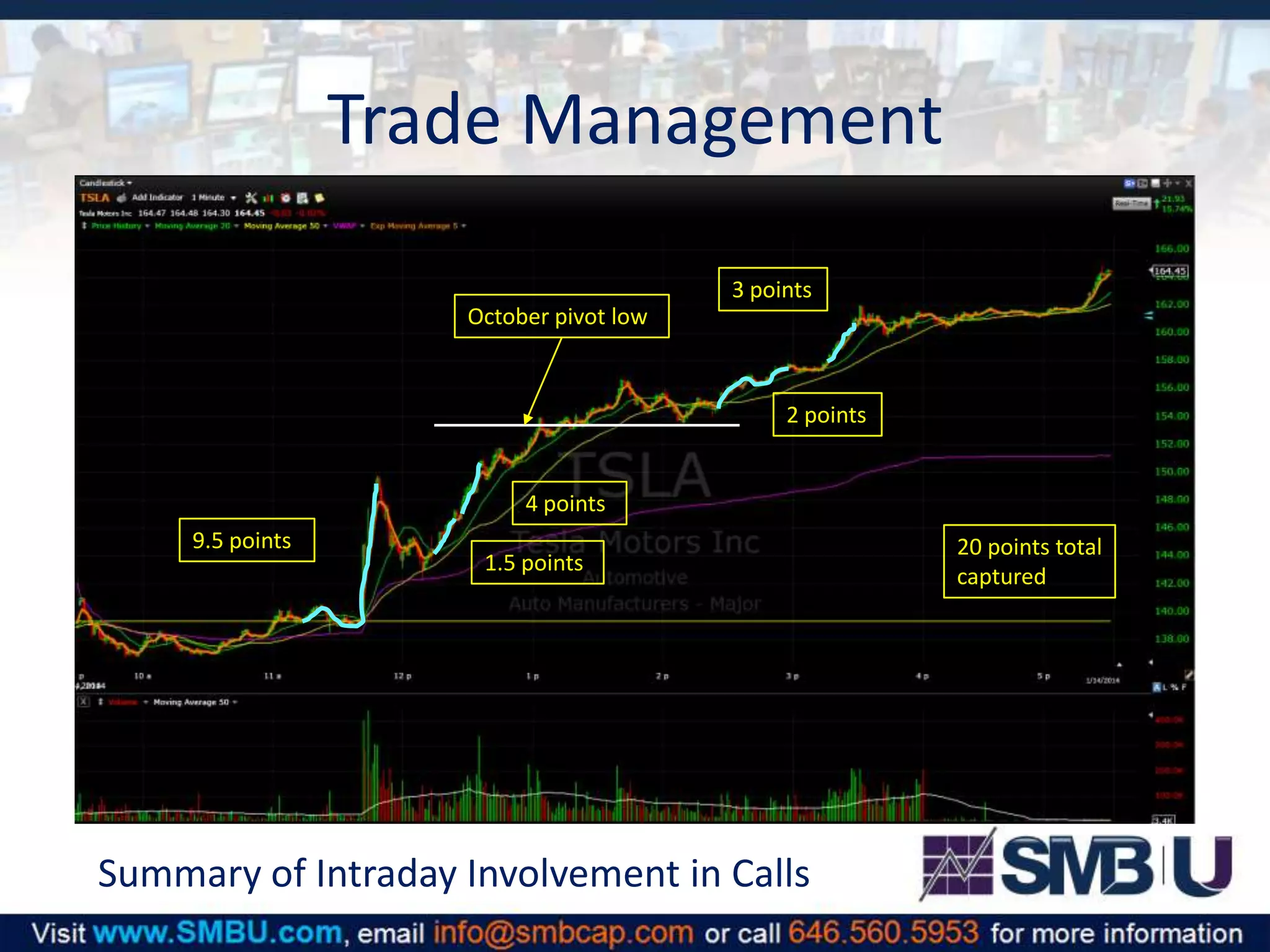

- The author entered and exited several call option positions in TSLA throughout the day, capturing a total of 20 points in profits from the intraday momentum moves.

- They were happy with their trade entries and exits but acknowledged struggles deciding between intraday versus swing trades, and were content to close positions at the end of the day.