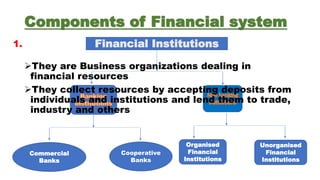

The document discusses the structure of a financial system. A financial system consists of savers (individuals), intermediaries, markets, and investors (users of savings). Financial institutions collect resources by accepting deposits and lending to businesses. The main components of a financial system are commercial banks, cooperative banks, organized financial institutions, and unorganized financial institutions. Financial markets allow for the buying and selling of financial claims and services, and include money markets, bond markets, stock markets, and derivative markets. Financial instruments used to raise capital include shares, warrants, debentures and bonds. Financial services include leasing, hire purchase, factoring, merchant banking, credit rating, mergers, and fund-based and fee-based services.