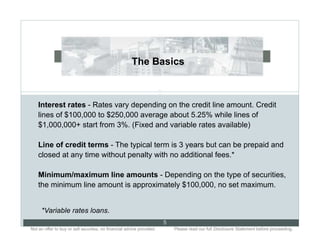

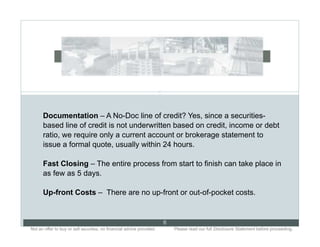

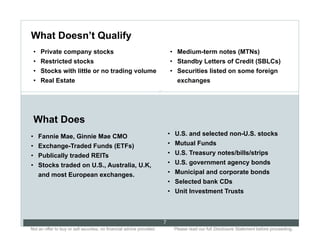

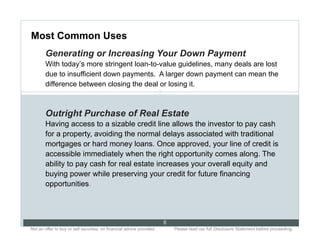

The document discusses securities-based financing solutions for real estate professionals. It outlines challenges in traditional financing due to tighter lending standards. It then presents securities-based lines of credit as an alternative, where investors can use their investment portfolios as collateral for loans to invest in real estate. Key benefits include flexible terms, fast approval times, and tax deductibility of interest payments. Common uses include increasing down payments, purchasing properties outright, and funding rehab costs.