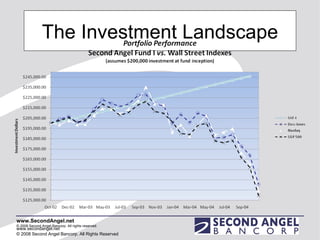

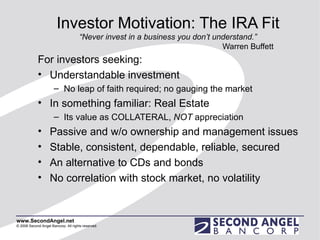

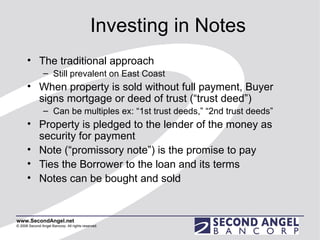

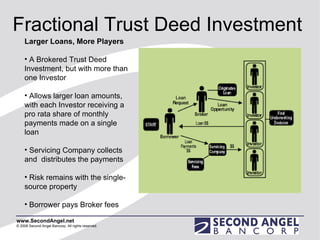

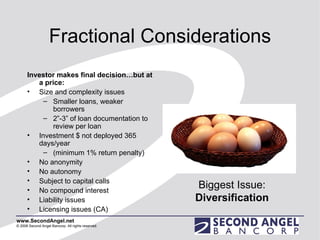

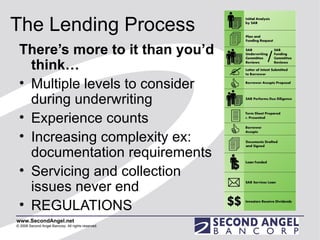

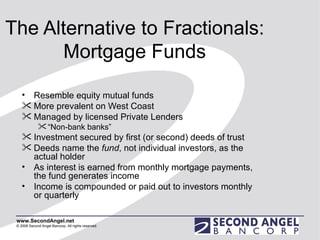

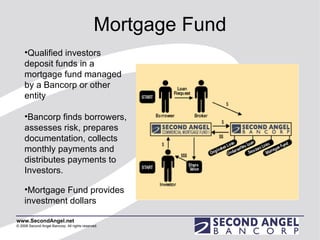

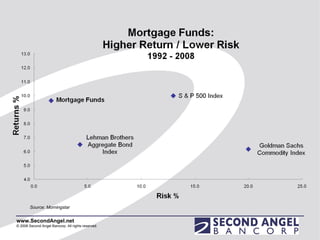

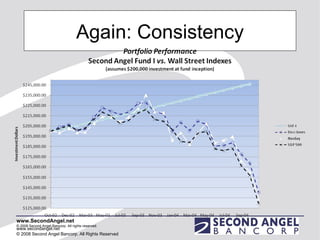

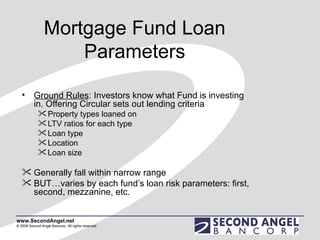

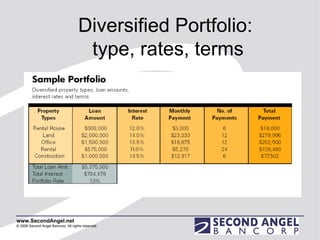

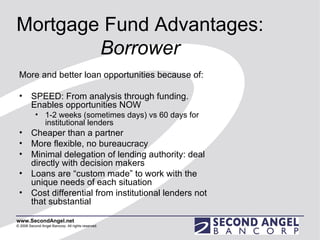

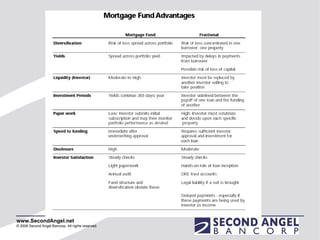

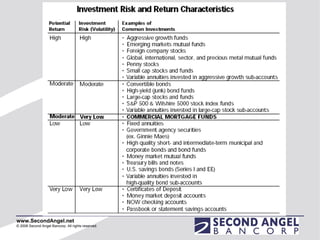

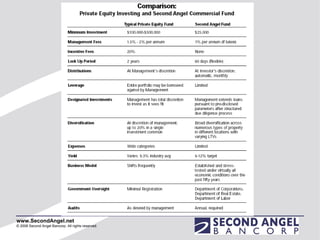

The document summarizes investment opportunities for self-directed IRAs in preserving and growing assets through private real estate lending. It discusses the current economic landscape and outlines different approaches for investors, including investing in fractional trust deeds, mortgage funds, and private lending more broadly. Mortgage funds are positioned as providing consistent returns, low volatility, instant diversification, and other advantages for both investors and borrowers.

![Historical Investment Results 9 percent to 12 percent returns (2x to 3x returns of CDs) [10% avg across various economic cycles] Compounding interest [doubles every 6 1/2 years] “ The most powerful force in the universe is compound interest.” Albert Einstein Monthly dividends [ paid approx. $2,000/month per $200,000 account] High reinvestment rate by investors Reasons: Feel secure, like the returns](https://image.slidesharecdn.com/SecondAngelIRAinvestmentwebinar-122695551703-phpapp03/85/Second-Angel-Ira-Investment-Webinar-7-320.jpg)

![This is Private Money Loans based on and secured by the protective equity of real property The focus is on the PROPERTY: equity and the borrower , not extraneous factors: Equity lending vs cash flow lending Loan To Value (“LTV”) ratios/ “protective equity” Exit Strategy: Property’s marketability & liquidation value Two investment approaches Fractional Trust Deeds/ Buying Notes Mortgage Funds See www.Wikipedia.com , “ Private Money Investing .” [We wrote the entry…]](https://image.slidesharecdn.com/SecondAngelIRAinvestmentwebinar-122695551703-phpapp03/85/Second-Angel-Ira-Investment-Webinar-8-320.jpg)

![Private Lending Niche Lending Specialties [examples] Residential First and Seconds Rehabs REOs Commercial Retail, Office, Warehouses, Churches, Gas Stations Commercial Construction-Completion Land Acquisition & Entitlement (not too popular…)](https://image.slidesharecdn.com/SecondAngelIRAinvestmentwebinar-122695551703-phpapp03/85/Second-Angel-Ira-Investment-Webinar-29-320.jpg)

![Finding & Selecting a Fractional or Mortgage Fund Investment Decide: Fractional or Fund (or both) Geographical area Investment size Property type: residential/commercial Risk appetite: [note that yields fall within narrow range…] Investor Eligibility/Amount to invest ***MANAGER TRACK RECORD*** Philosophy Response to queries Starting point: www.Scotsmanguide.com The industry’s bible](https://image.slidesharecdn.com/SecondAngelIRAinvestmentwebinar-122695551703-phpapp03/85/Second-Angel-Ira-Investment-Webinar-31-320.jpg)

![Thanks Questions: Richard Zahm (415) 730-1042 [email_address] www.SecondAngel.net](https://image.slidesharecdn.com/SecondAngelIRAinvestmentwebinar-122695551703-phpapp03/85/Second-Angel-Ira-Investment-Webinar-33-320.jpg)