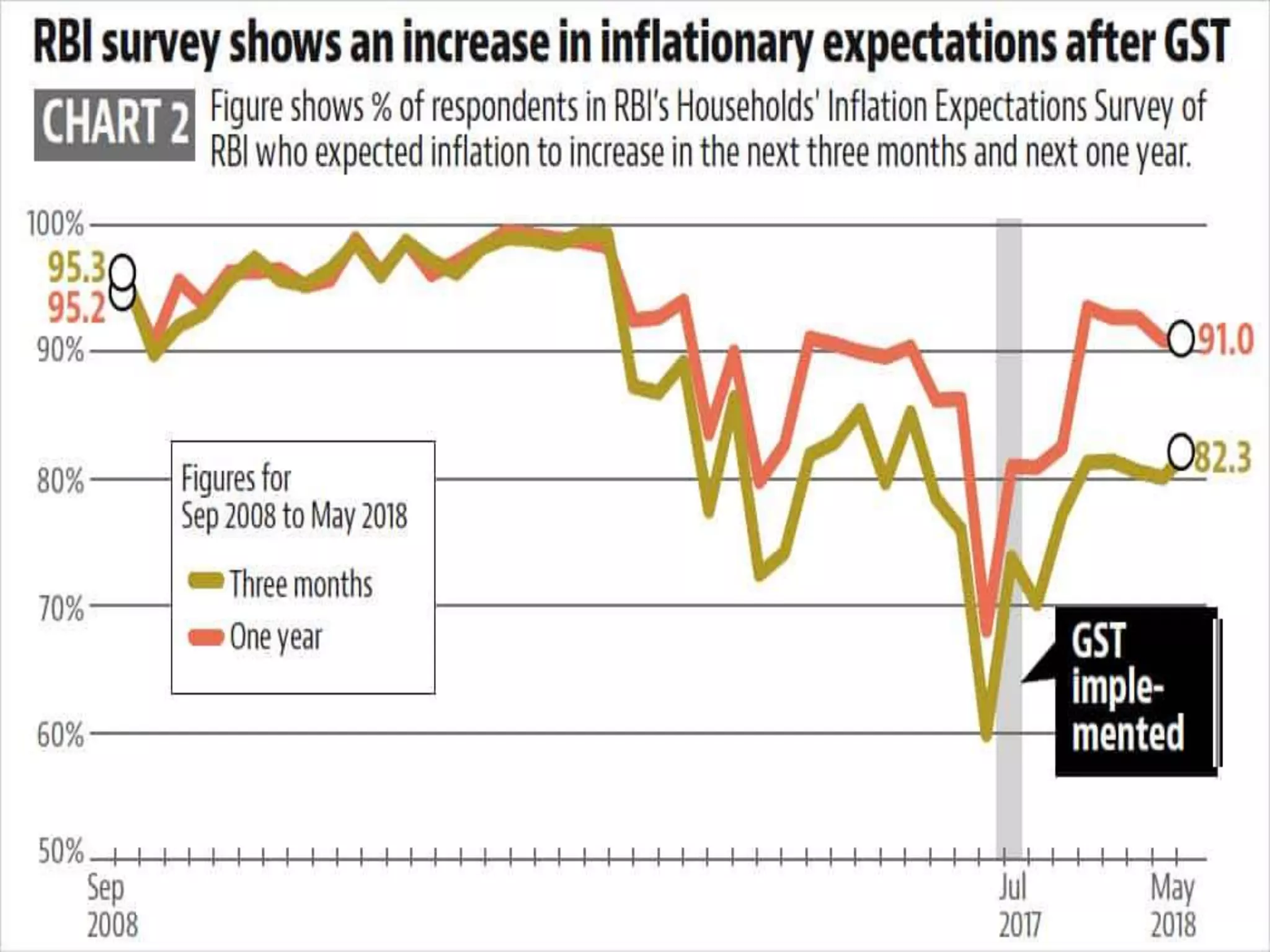

The document discusses various strategies to cope with inflation in India, including both monetary and fiscal measures. It outlines major causes of inflation such as increased money supply and government spending. Specific steps taken include credit control, increasing taxes, and demonetization. Price controls and rationing are also discussed as direct measures, along with minimum support prices (MSP) for farmers and price stabilization funds. Challenges in implementing these policies include calculating MSP and registering farmers. Overall the strategies aim to control inflation through monetary, fiscal, price and wage policies.