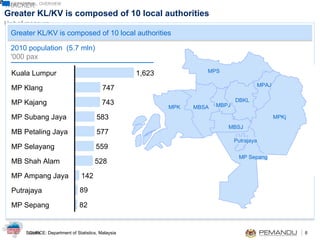

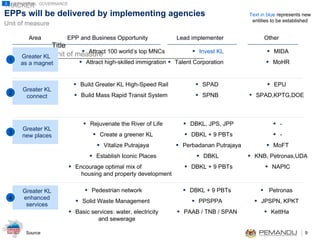

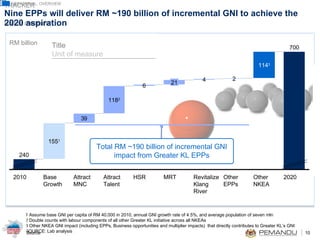

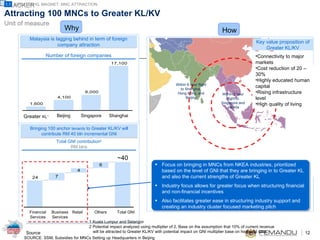

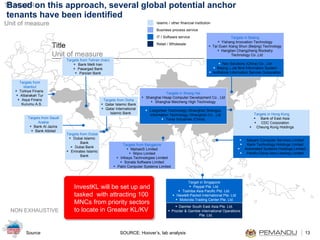

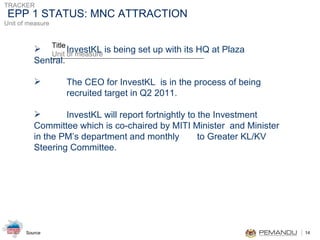

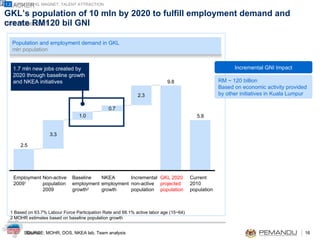

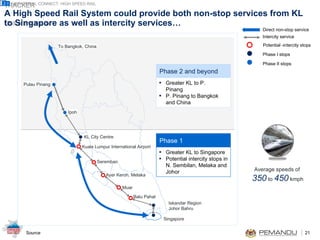

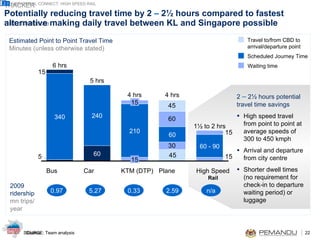

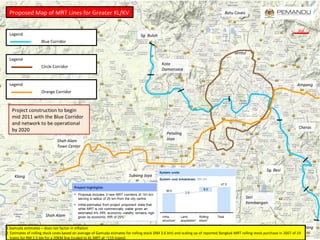

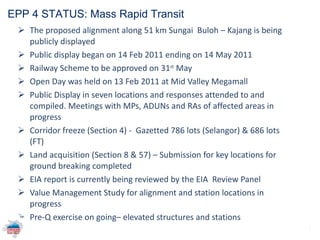

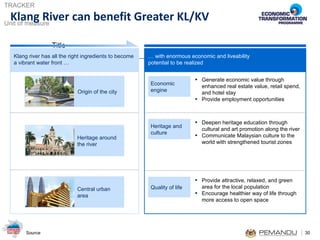

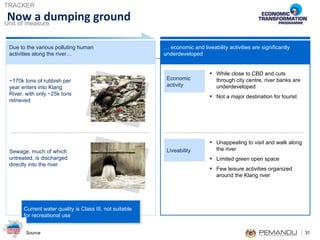

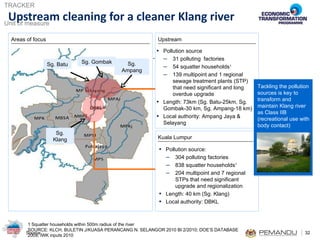

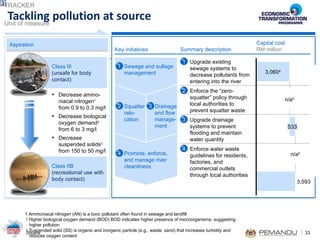

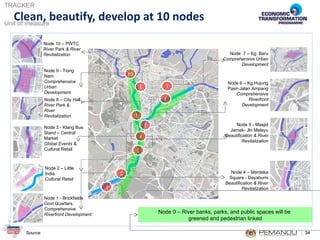

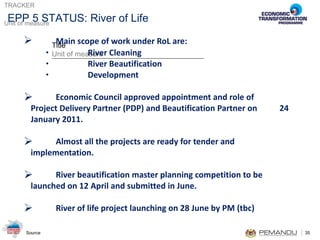

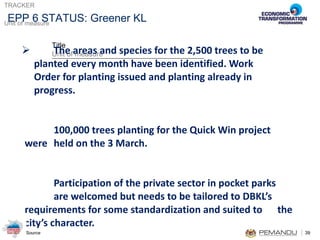

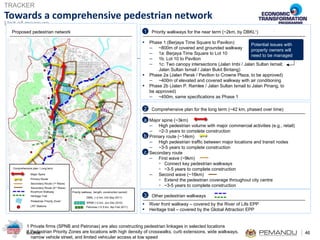

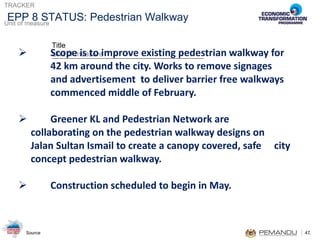

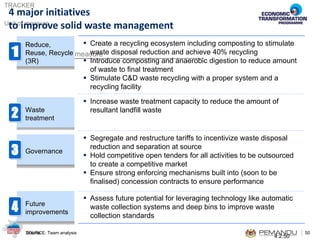

The document discusses strategies to develop Greater Kuala Lumpur/Klang Valley (GKL) and achieve the goal of being among the world's top 20 performing cities by 2020. It outlines 11 initiatives prioritized across 4 strategic thrusts - making GKL a magnet, connecting places in GKL, developing new places, and enhancing services. Key initiatives include attracting 100 top multinational corporations, developing high-speed rail and mass rapid transit connections, rejuvenating rivers and green spaces, and improving basic infrastructure. The initiatives are estimated to contribute approximately RM190 billion in additional gross national income to GKL by 2020.