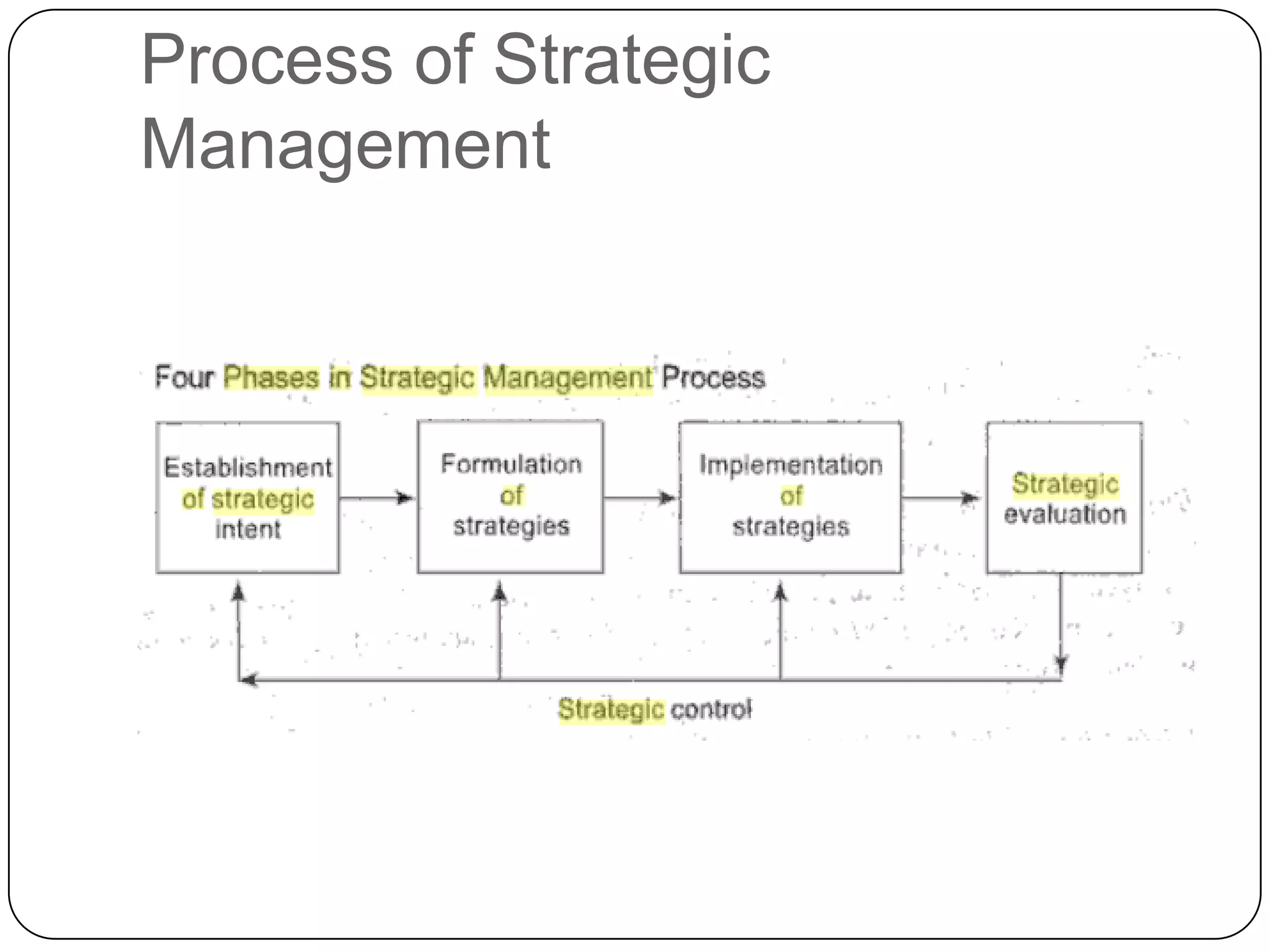

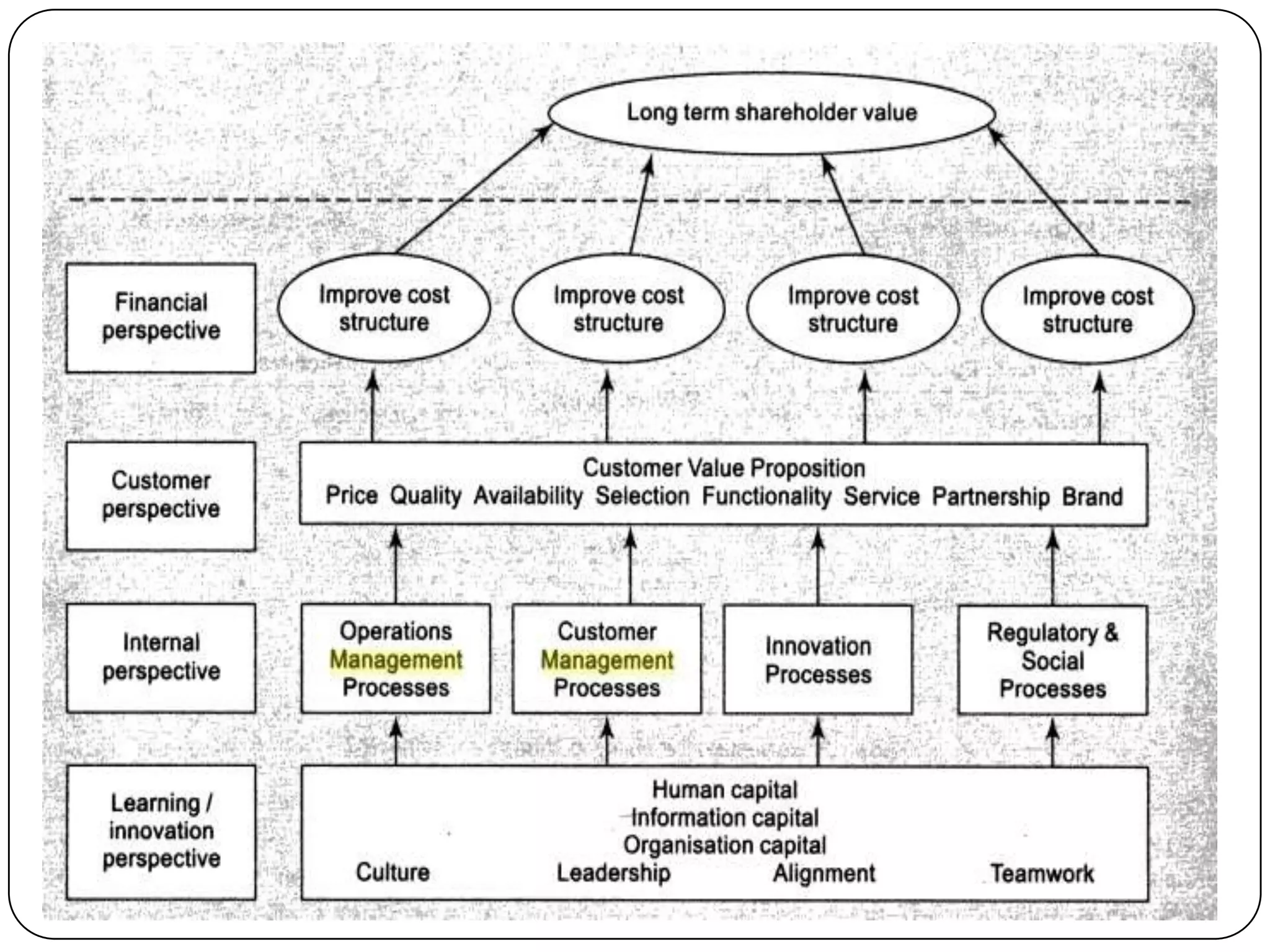

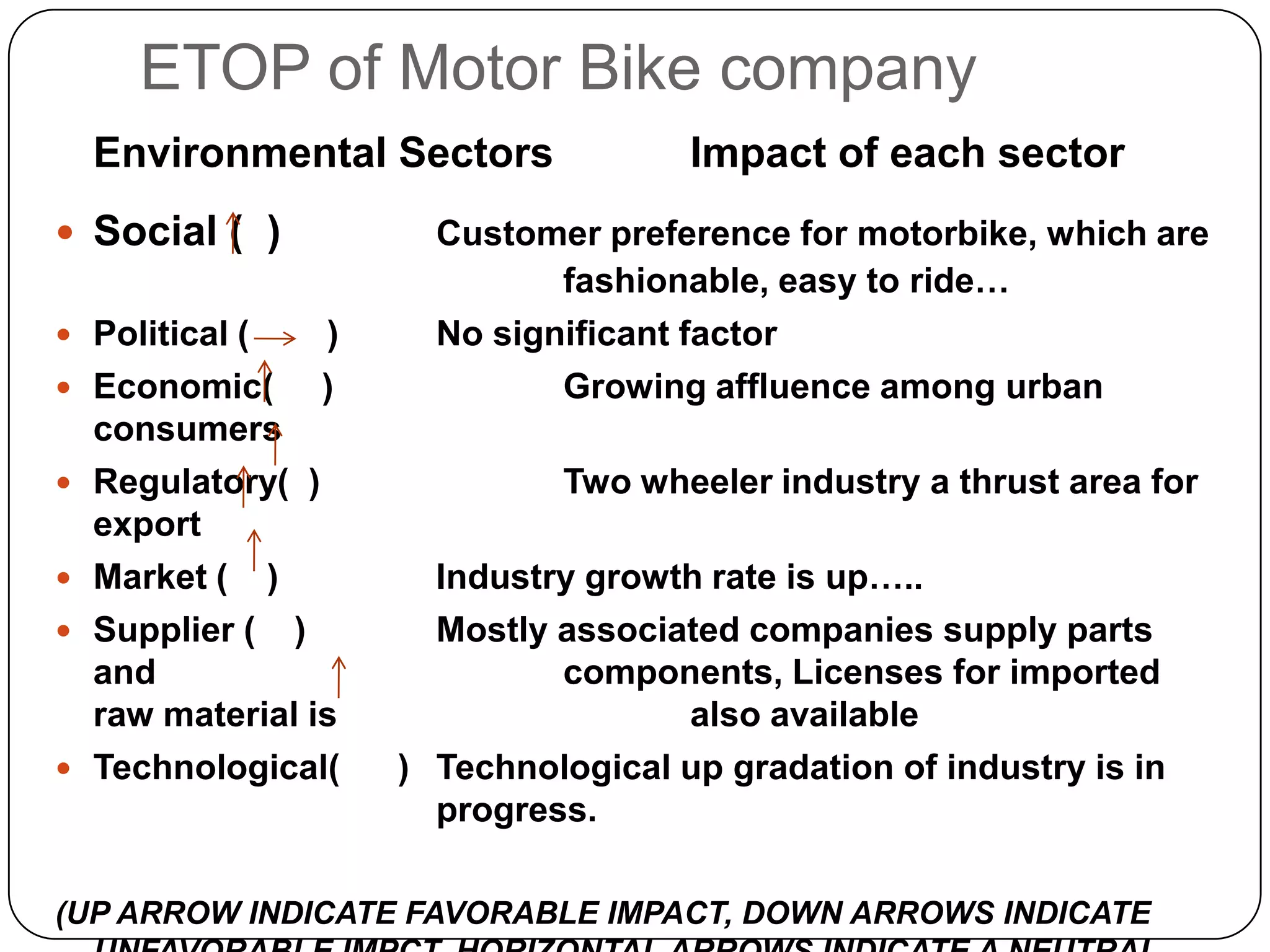

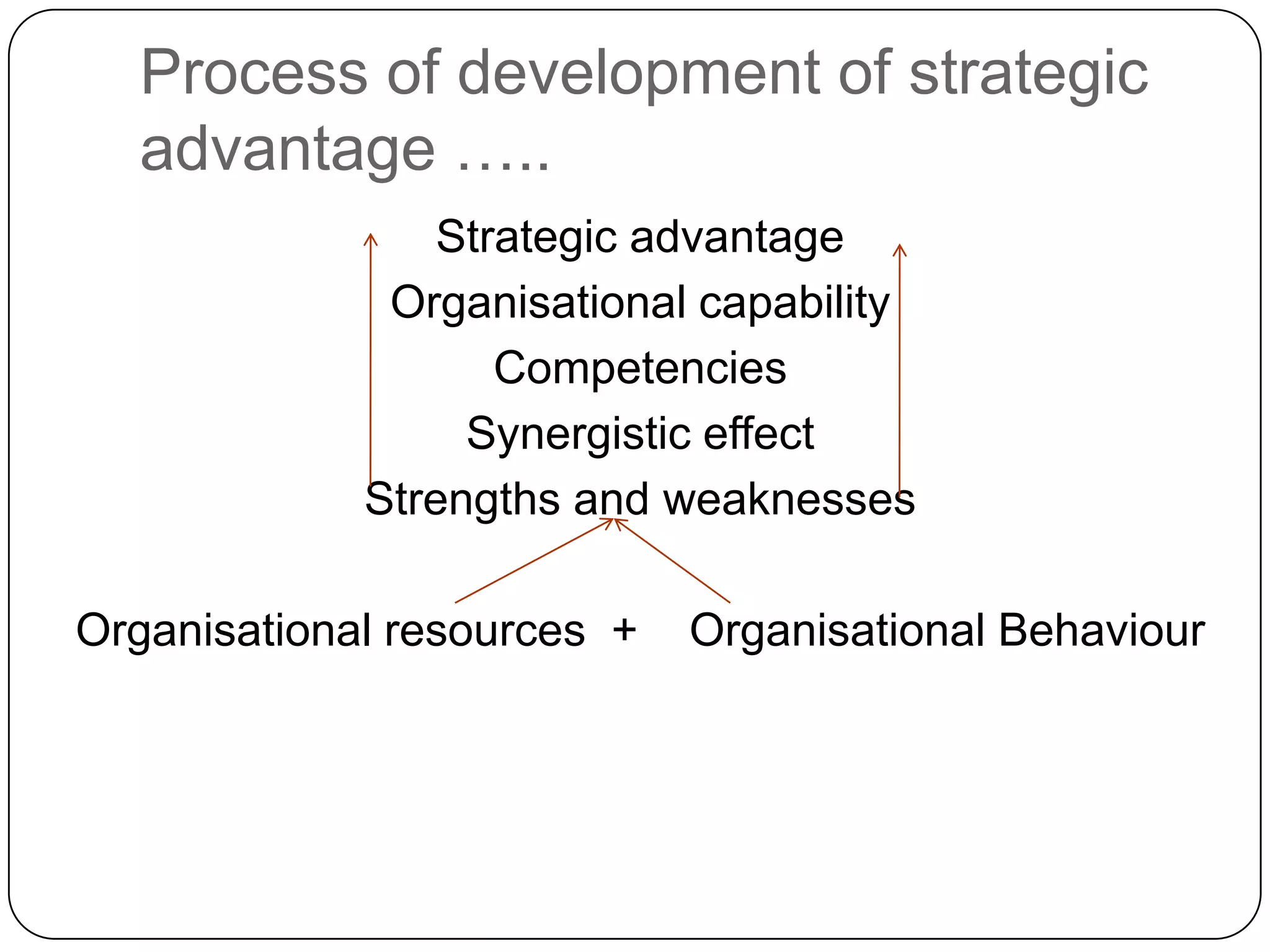

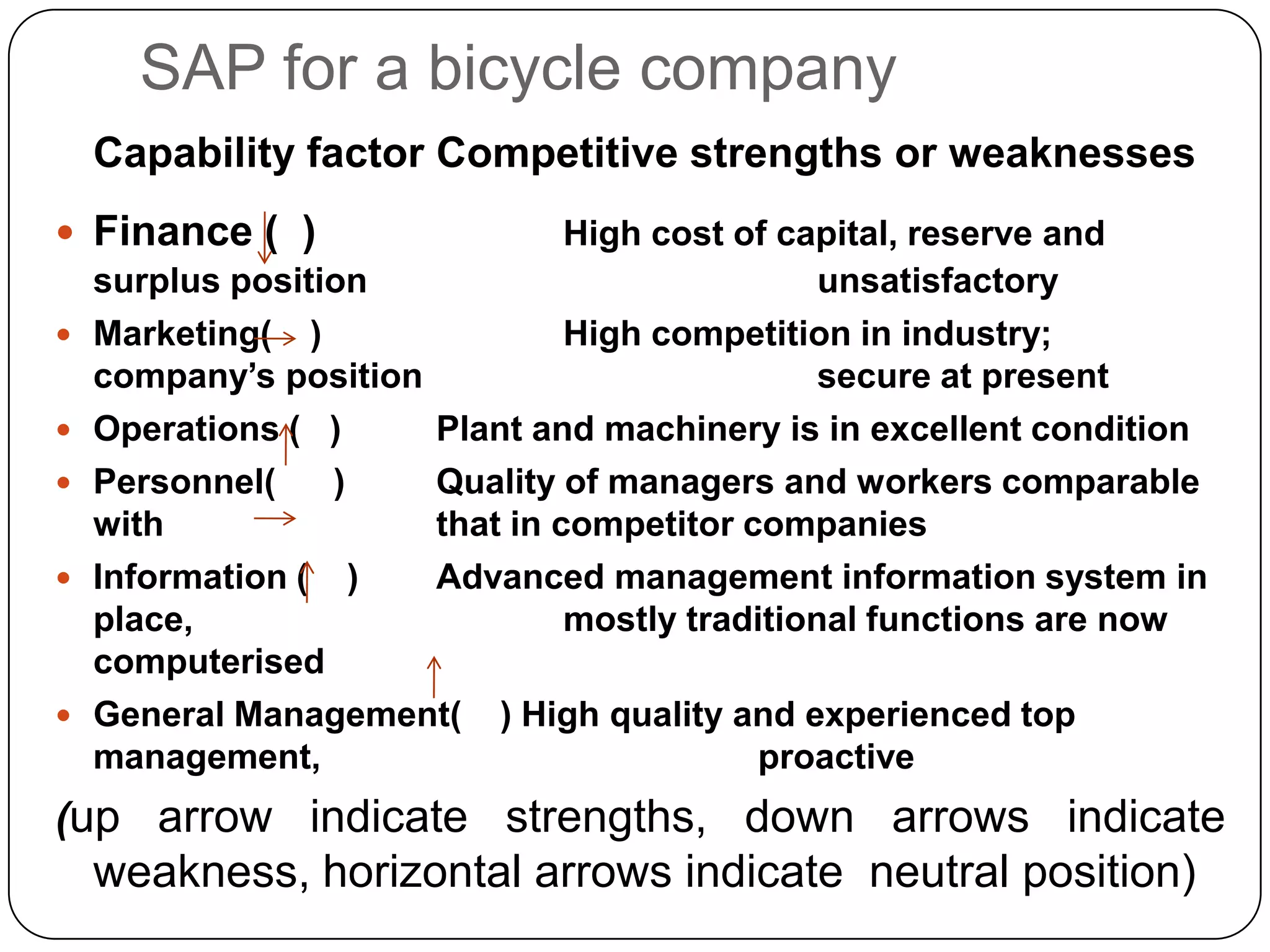

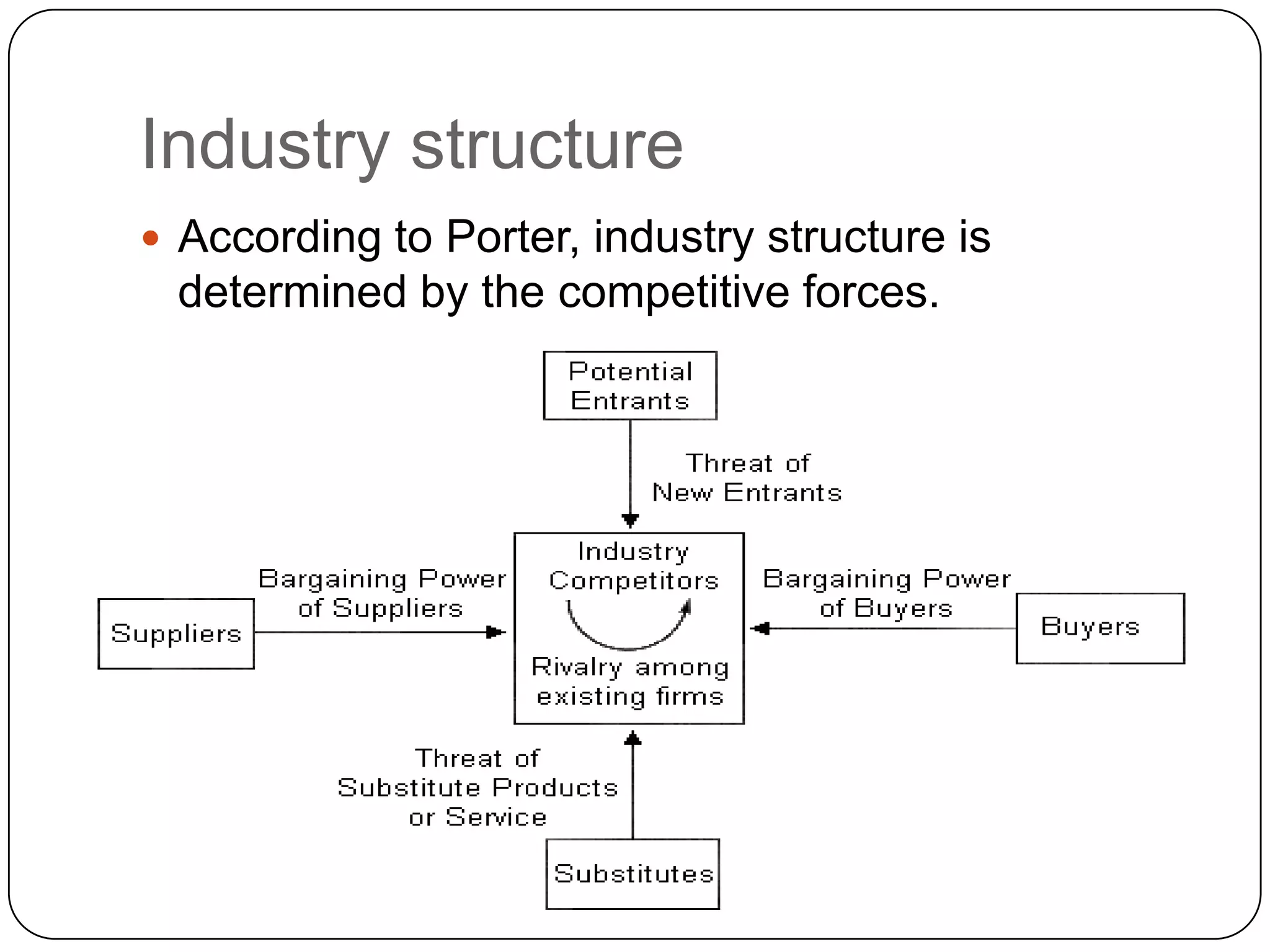

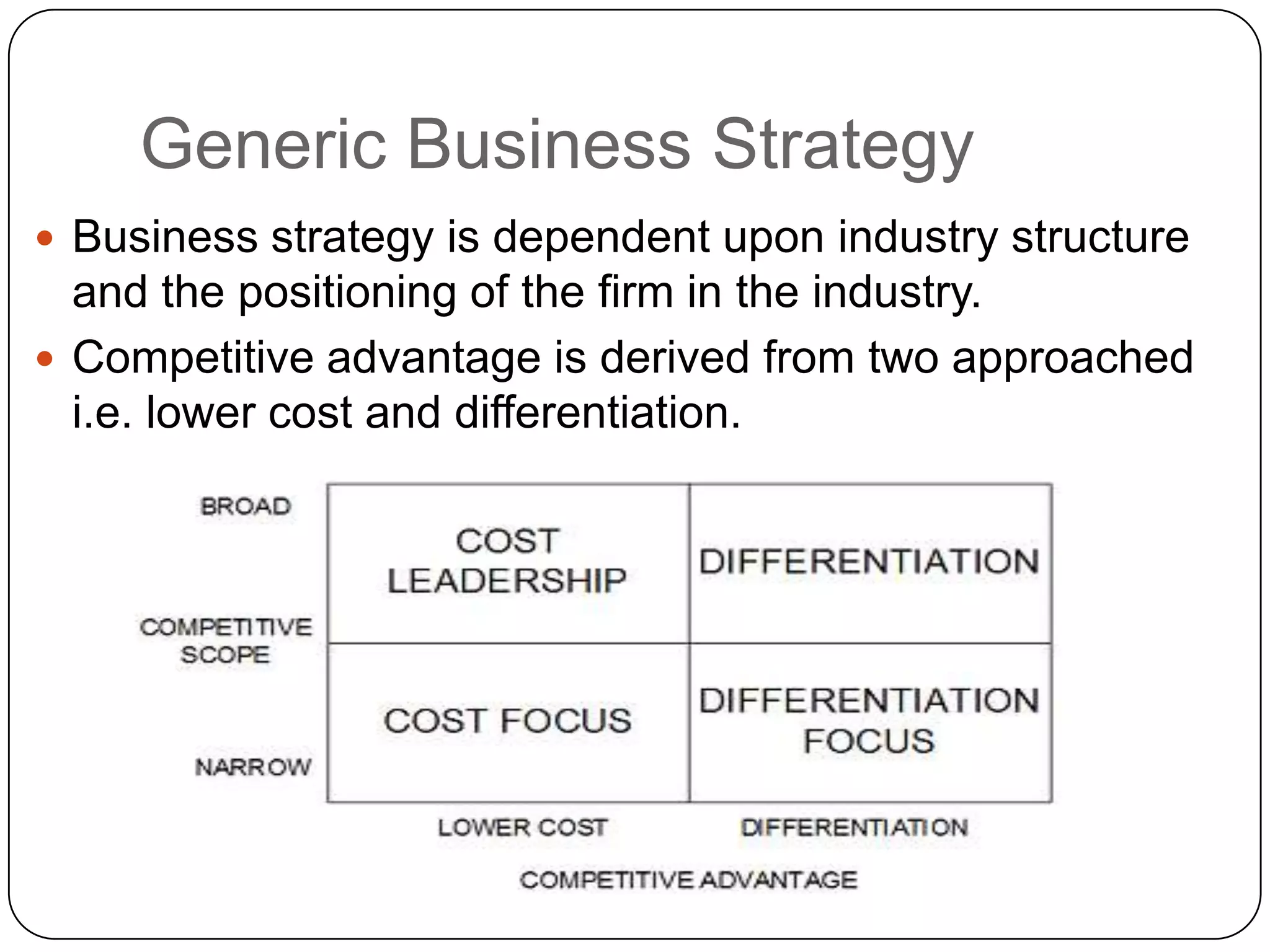

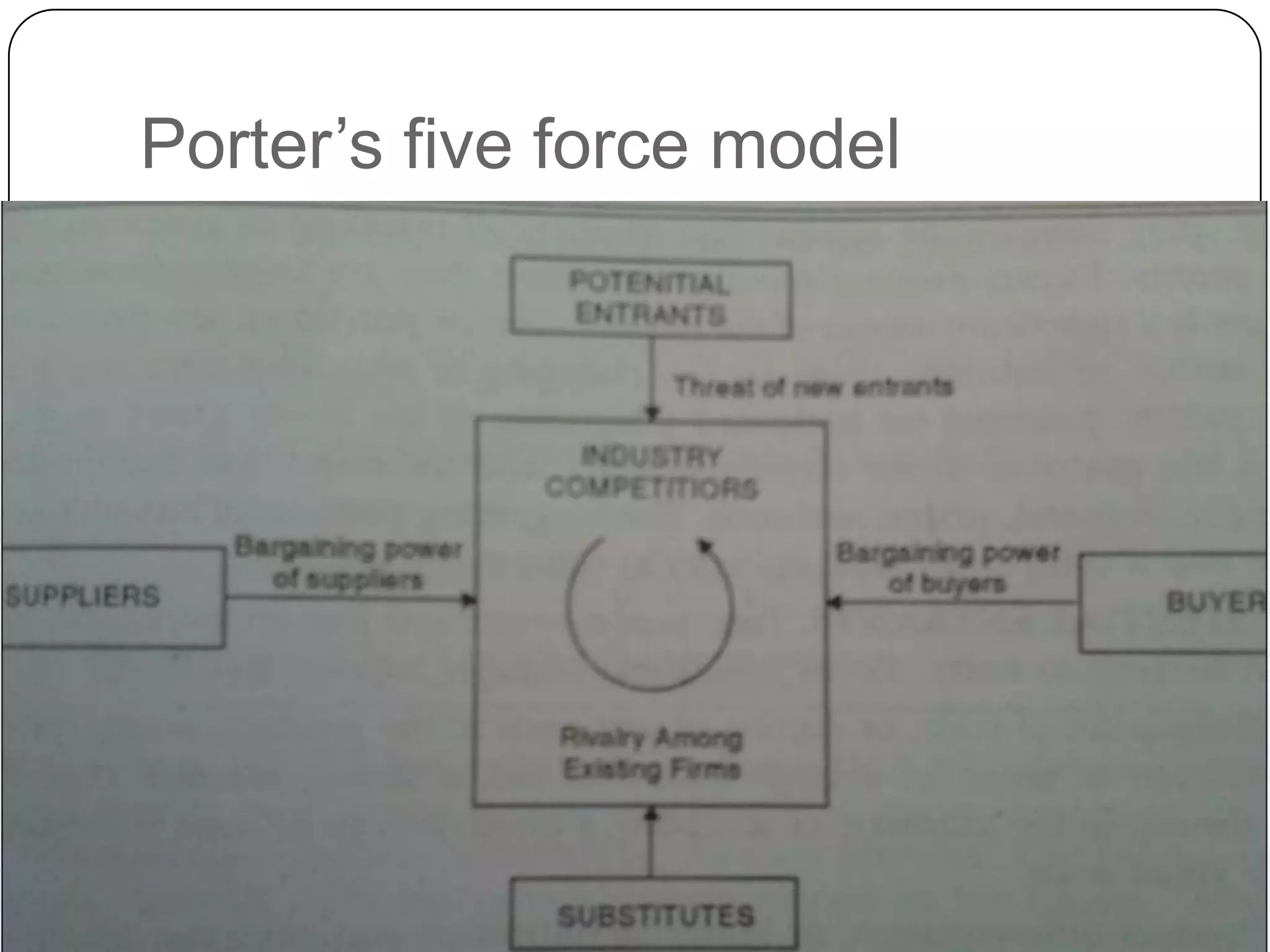

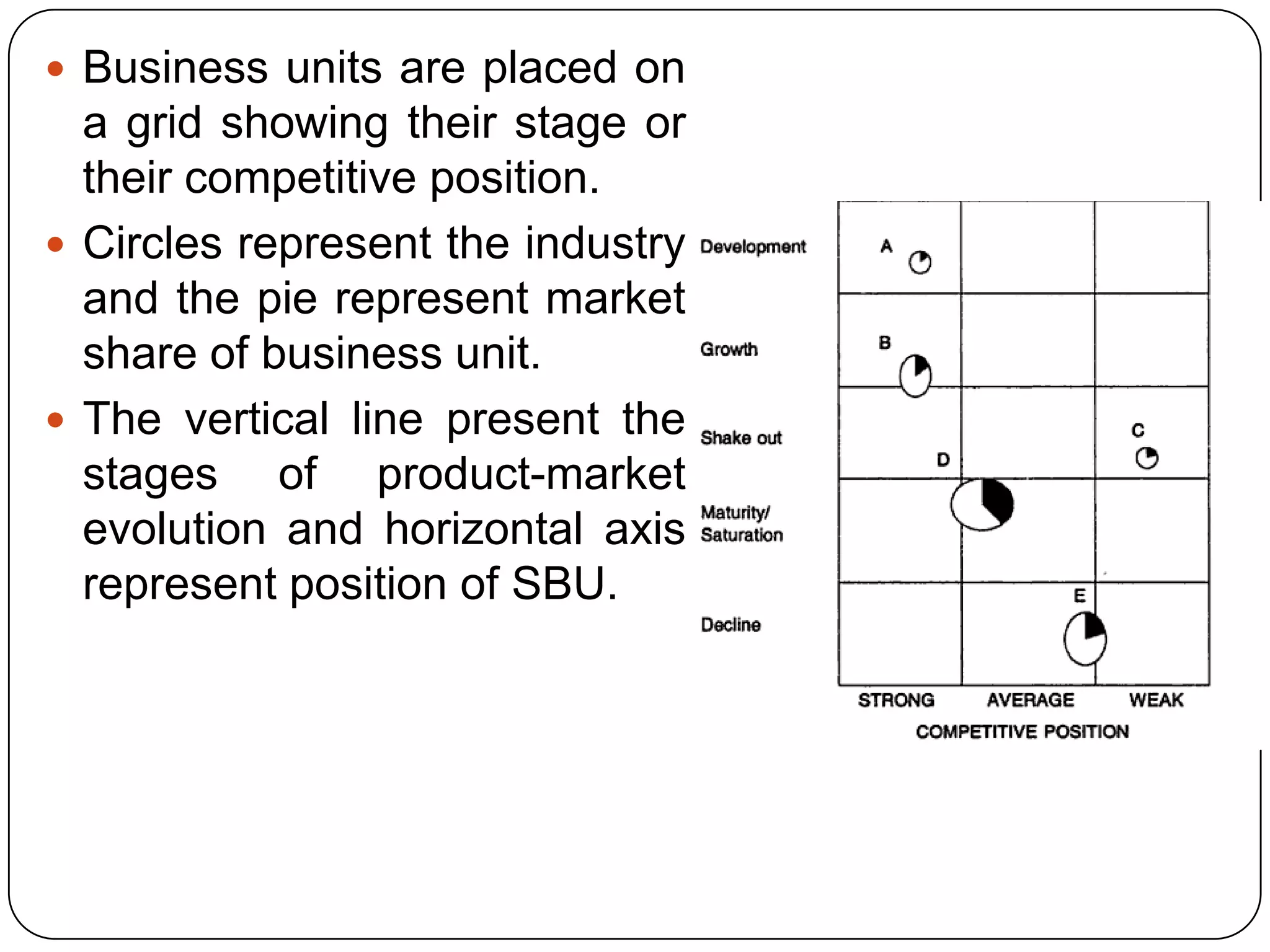

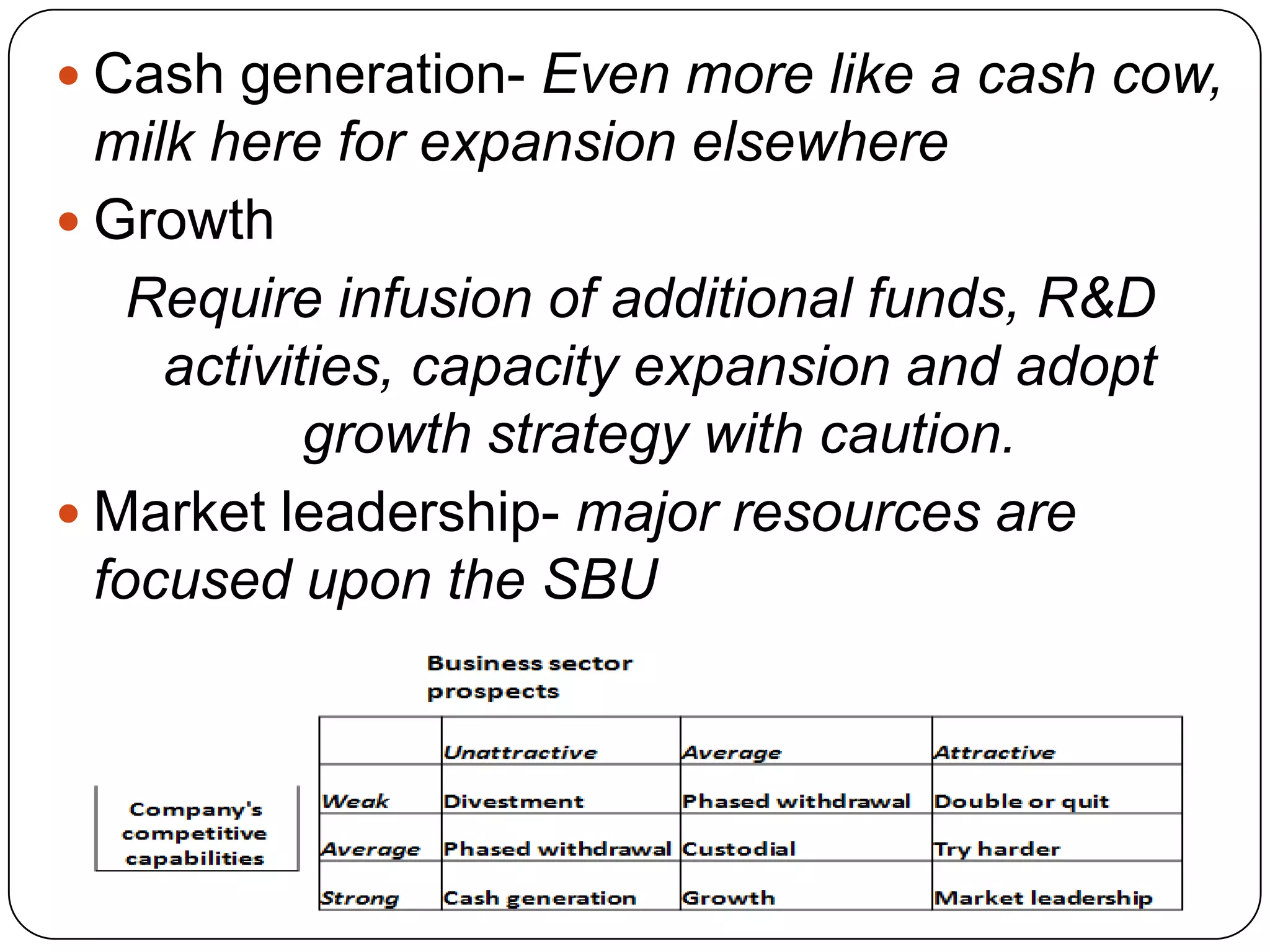

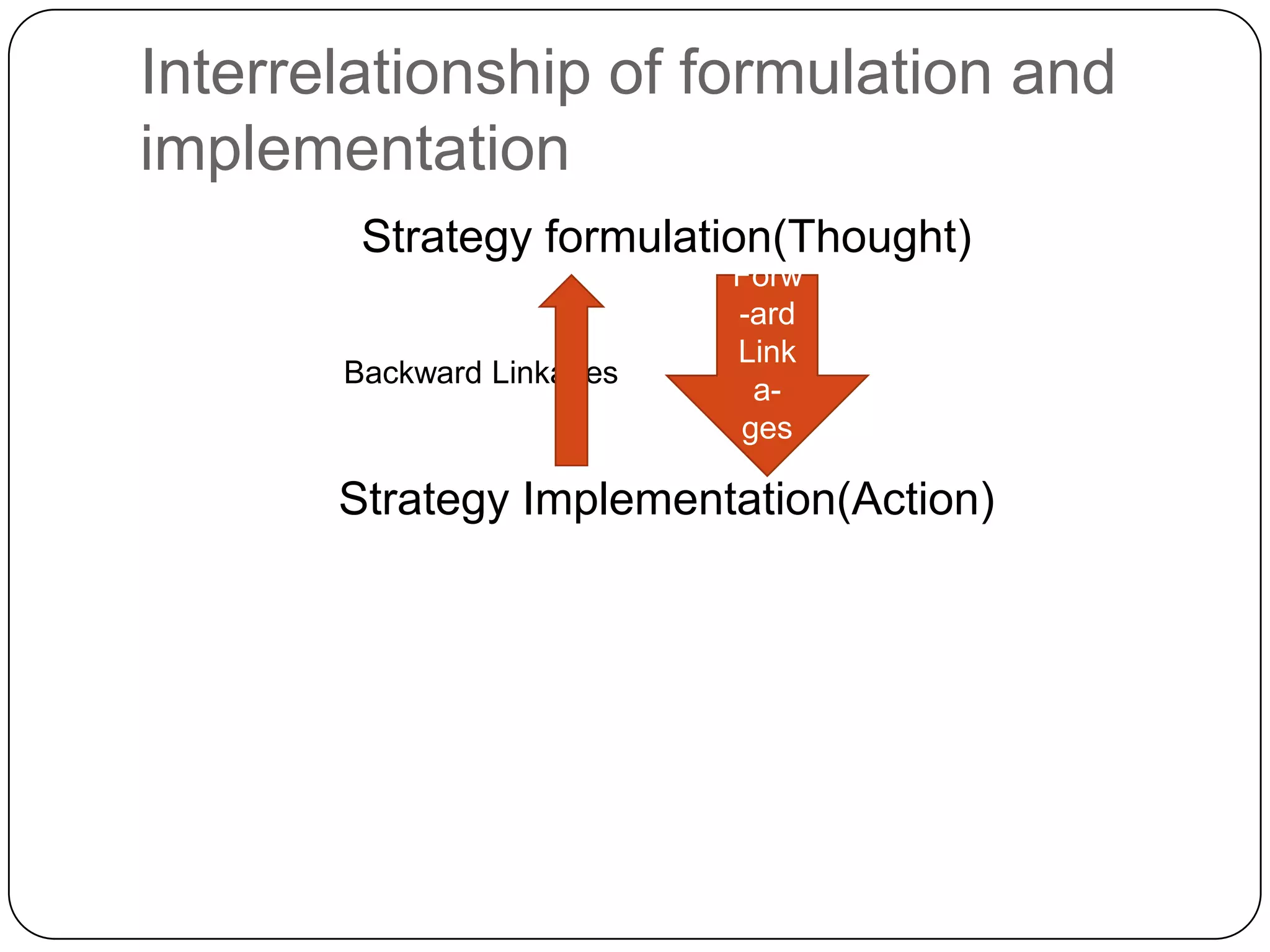

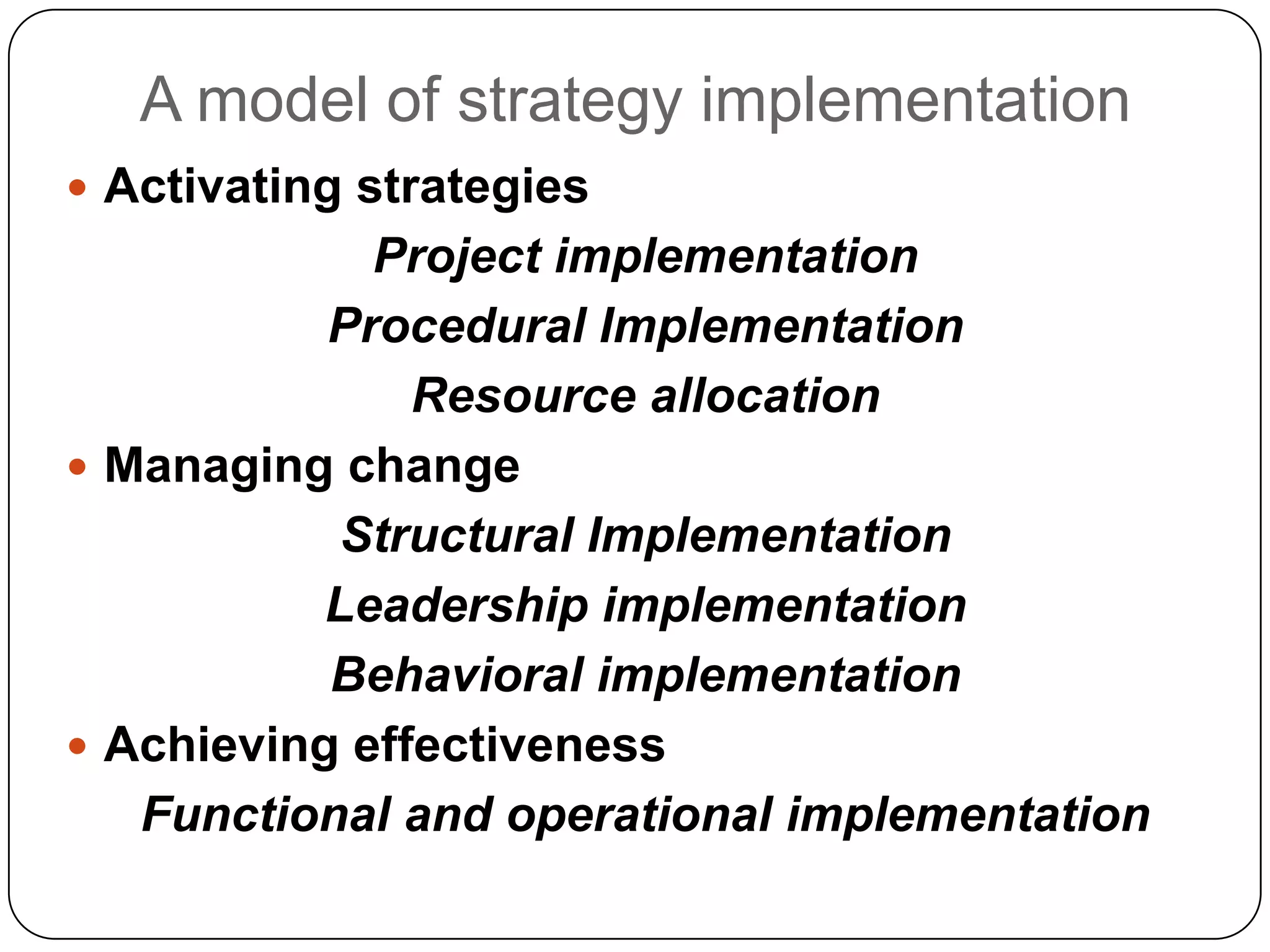

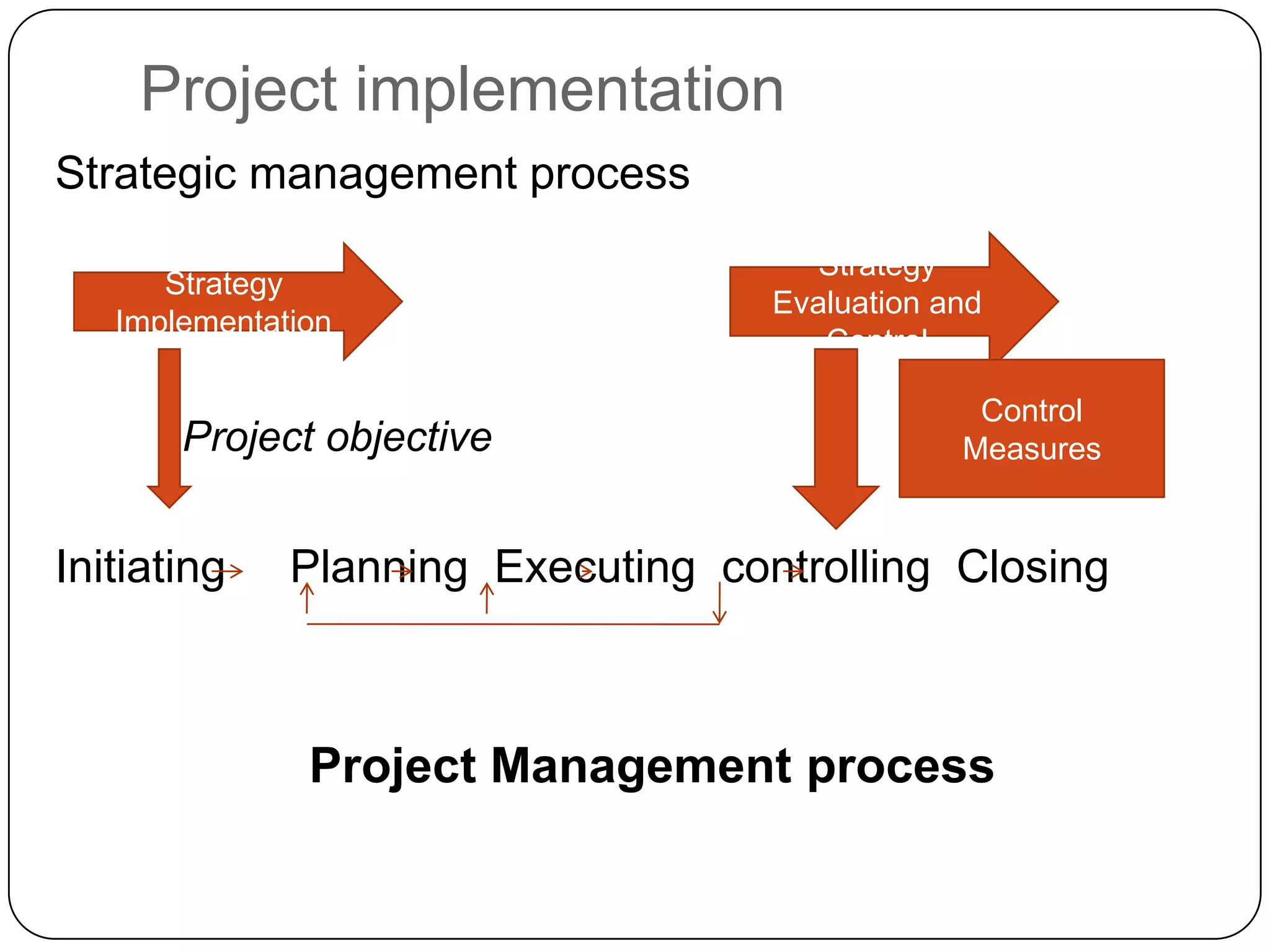

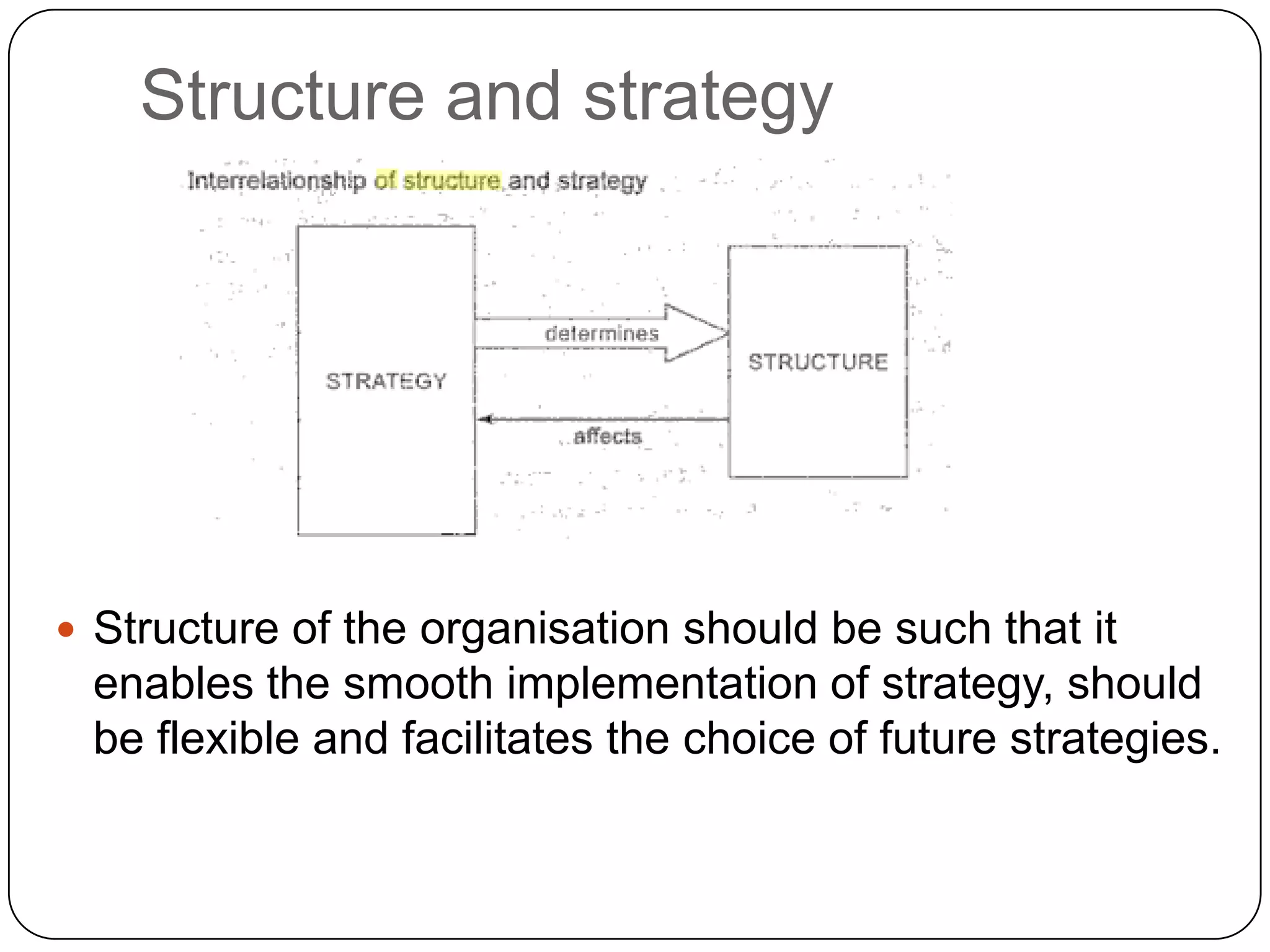

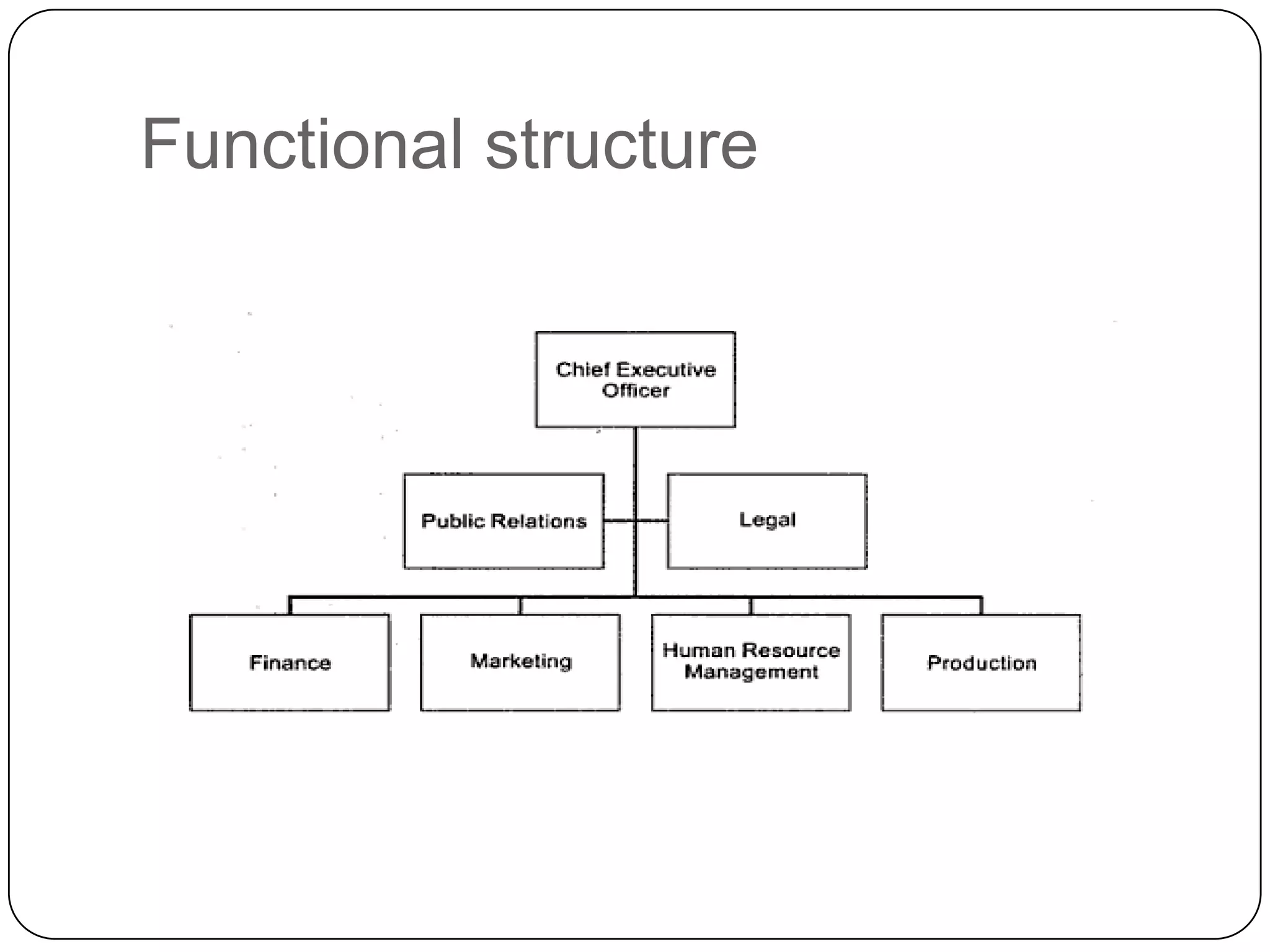

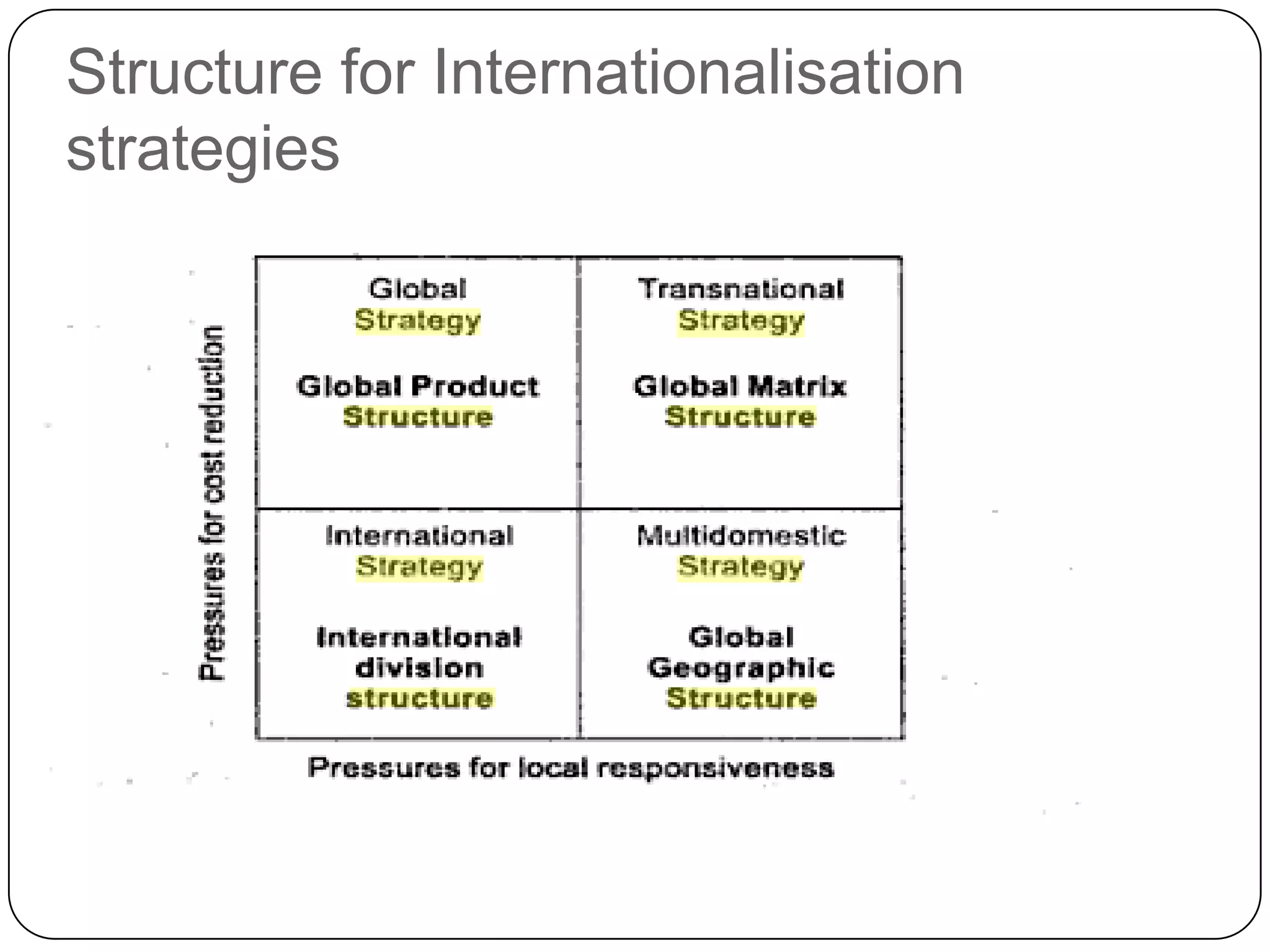

The document discusses strategic management, emphasizing its importance in establishing an organization's long-term goals and aligning resources. It differentiates between strategy and policy, highlighting their respective roles in decision-making and day-to-day operations. Additionally, it outlines the roles of key individuals and teams in formulating and implementing strategies within various organizational contexts.