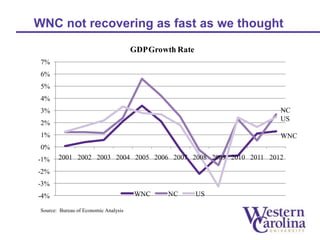

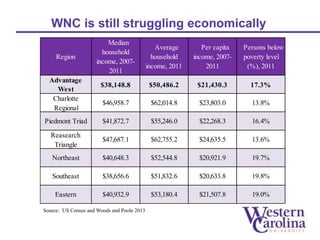

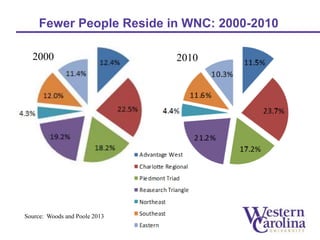

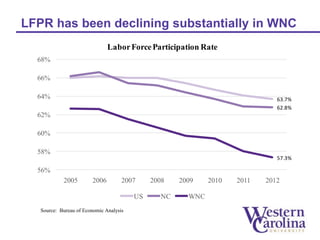

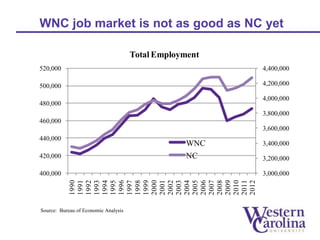

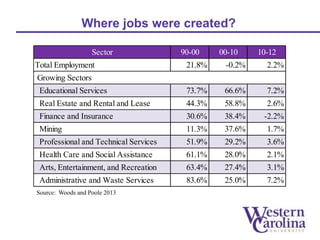

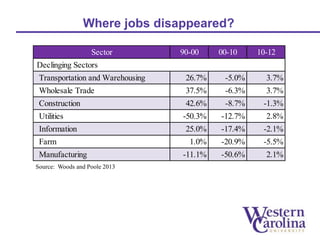

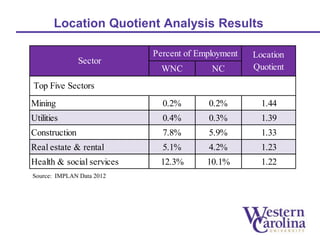

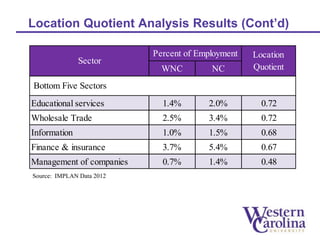

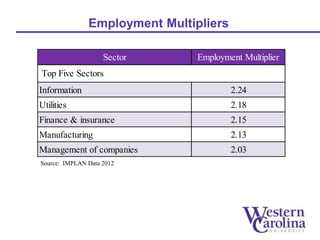

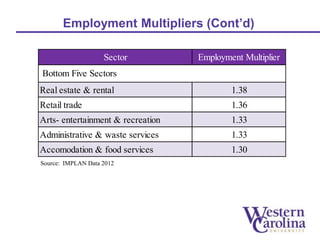

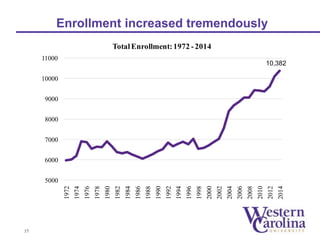

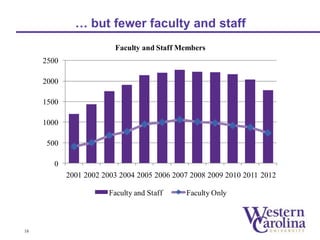

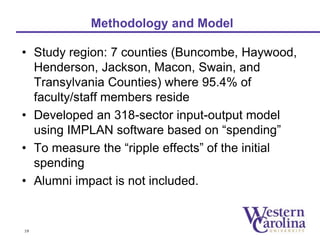

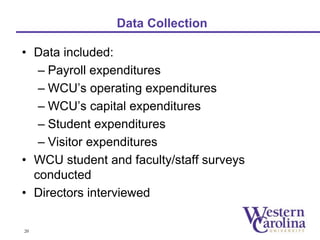

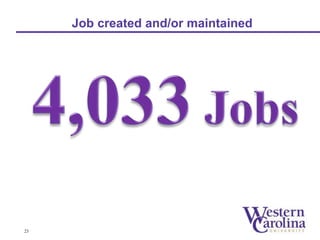

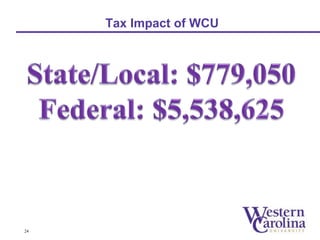

The 2014 regional outlook report assesses the economic activities and challenges facing Western North Carolina (WNC), highlighting that the region is not recovering economically as quickly as anticipated, with stagnant job growth and declining labor force participation rates. It analyzes employment trends by sector, identifying growing areas such as educational services and real estate, while noting significant losses in manufacturing and construction. Additionally, the report evaluates the economic and fiscal impact of Western Carolina University, emphasizing increased enrollment and the importance of faculty/staff spending in the local economy.