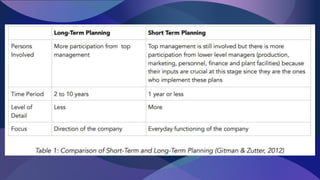

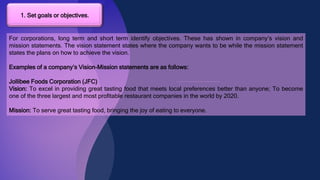

The document discusses the importance of financial planning for organizations. It explains that financial planning helps businesses achieve their objectives by ensuring sufficient funds and reducing uncertainties. The document then outlines the key components of financial planning, including setting goals and identifying resources, tasks, responsibilities, evaluation systems, and contingency plans. It also distinguishes between long-term financial planning, which guides strategic goals, and short-term planning, which specifies actions and their anticipated impacts.