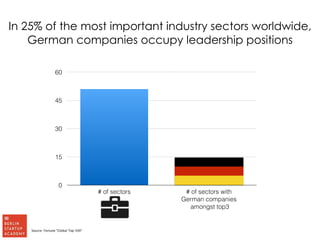

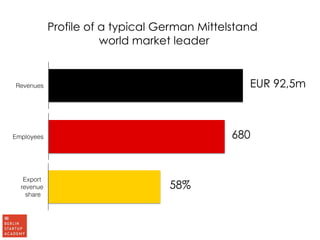

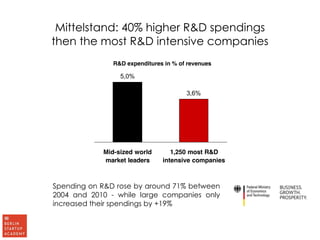

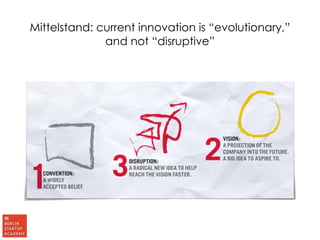

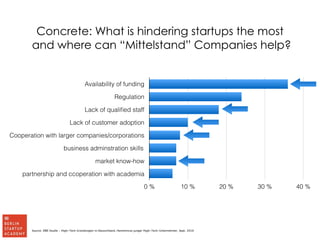

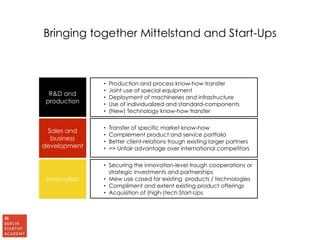

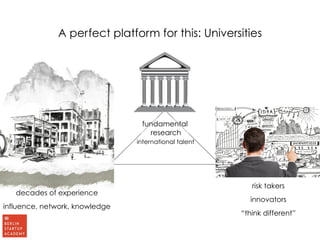

The document discusses the role of Germany's Mittelstand and startups in the economy, highlighting the innovation, leadership in various industries, and significant R&D spending. It identifies challenges faced by startups, such as funding and regulation, and suggests collaboration between Mittelstand companies and startups to enhance innovation and market positioning. The document emphasizes the importance of long-term thinking, international talent, and fostering entrepreneurship through partnerships and dialogue.