- Starbucks is an international coffeehouse chain known for its "third place" environment and focus on quality coffee and customer experience. It has over 19,000 stores globally and generates most of its revenue from company-operated retail stores and specialty operations.

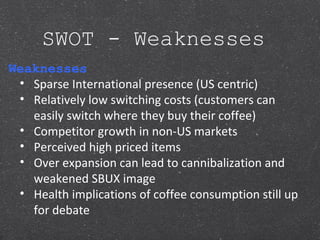

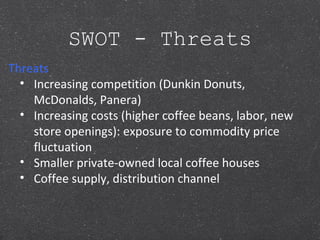

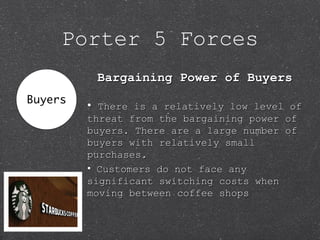

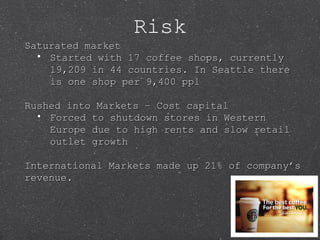

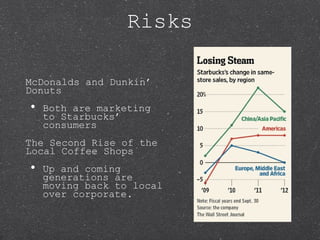

- Starbucks aims to provide an informal meeting space and quiet respite from daily life through amenities like Wi-Fi access and events. However, market saturation and competition from local cafes and fast food chains pose risks to further growth.

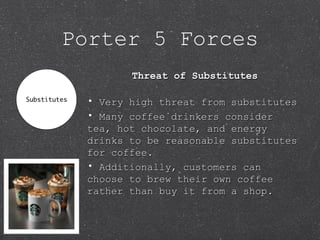

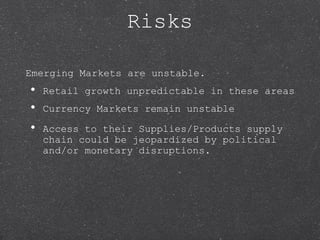

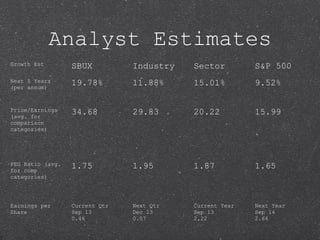

- While Starbucks faces threats from substitutes and competition, its strong brand recognition and loyal customer base provide advantages. Looking ahead, expanding into emerging markets and higher-margin food sales present opportunities for continued revenue growth.