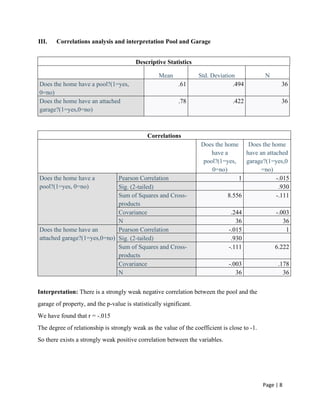

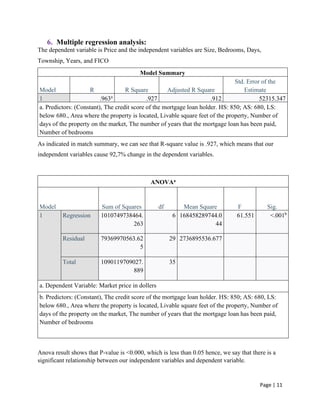

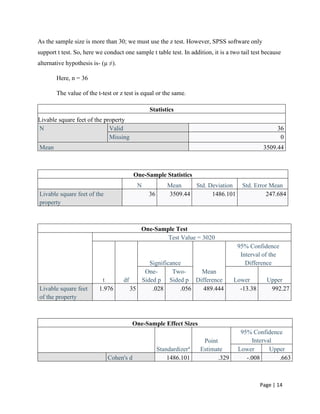

This term paper on SPSS presents statistical analyses related to real estate properties, including frequency distributions, descriptive statistics, correlation analysis, and multiple regression analysis. The study finds significant correlations between various properties metrics, such as a strong correlation between livable square feet and market price. The paper was prepared by Group 8 of the MBA 2021 batch at Bangladesh University of Professionals as part of a business statistics course.