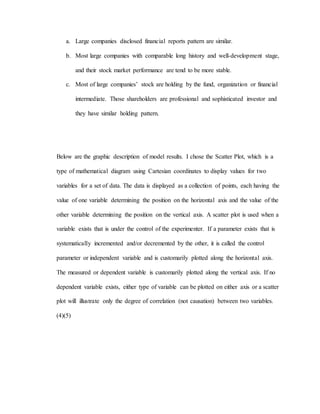

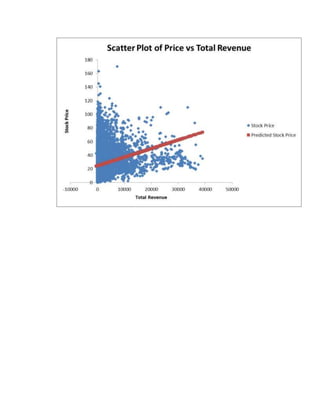

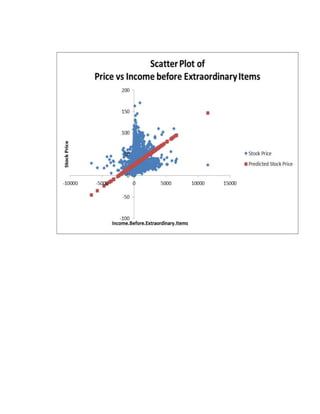

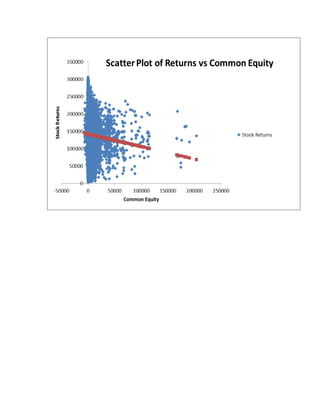

This document discusses analyzing the relationship between earnings reported in 10-Q financial filings and stock market value. It will use descriptive statistics, correlation analysis, and regression models to test the relationship between market value (stock price and returns) and earnings metrics reported in 10-Qs. The key variables examined are total receivables, total revenue, common equity, cash and cash equivalents, net income, and total assets from 10-Qs against subsequent stock price and returns. The regression models aim to see how stock price and returns are influenced by earnings figures disclosed in 10-Q filings.