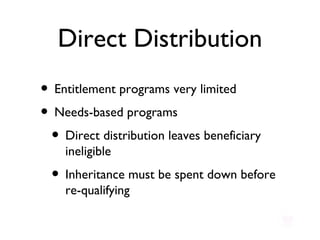

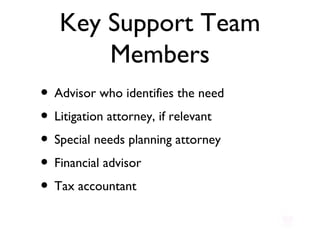

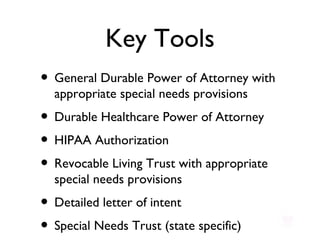

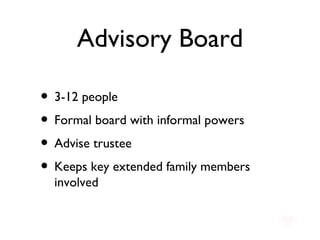

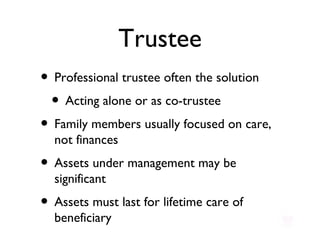

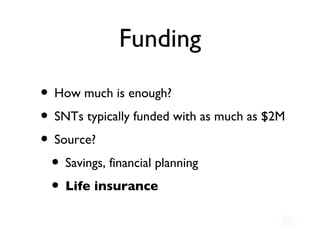

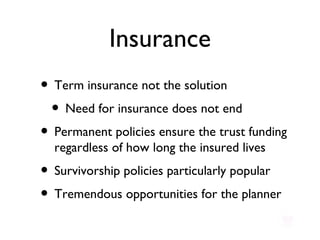

There are over 51 million people with disabilities in the United States, including 13-16% of families who have children with special needs. This document discusses the importance of special needs planning to ensure proper care and financial support for those with disabilities. It outlines government support programs and challenges families may face, including maintaining eligibility for benefits and ensuring long-term care. Directly distributing assets or relying only on family can jeopardize benefits and long-term support. The document recommends working with an advisory team that includes attorneys, financial advisors, and others to establish trusts, powers of attorney, and other tools to protect privacy, assets, and quality of care for the special needs beneficiary.

![Special Needs Trust Self-settled [(d)(4)(A) trust/Medicaid Payback Trust] Pooled account [(d)(4)(C) trust] Third party-settled](https://image.slidesharecdn.com/specialneedsplanning-12664610238971-phpapp02/85/Special-Needs-Planning-15-320.jpg)

![Law Offices of David G. Ledbetter 1695 Service Road NE Grand Rapids, Michigan 49503 (616) 459-3333 [email_address] [email_address] [email_address] [email_address] [email_address]](https://image.slidesharecdn.com/specialneedsplanning-12664610238971-phpapp02/85/Special-Needs-Planning-27-320.jpg)