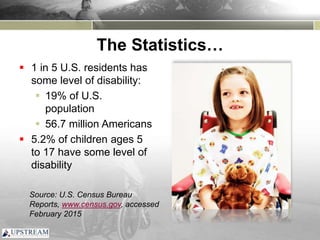

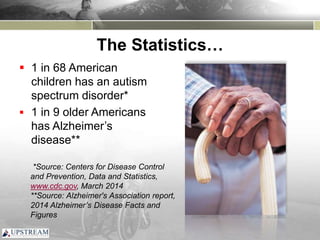

The document discusses special needs planning, emphasizing the importance of financial and personal care planning for individuals with disabilities and their families. It outlines steps for creating a personal care plan, transition plan, legal plan, and financial plan, addressing various needs and government benefits available. Key techniques like special needs trusts are highlighted to help preserve assets while ensuring access to required benefits.