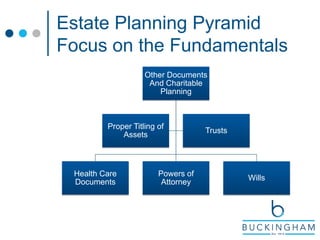

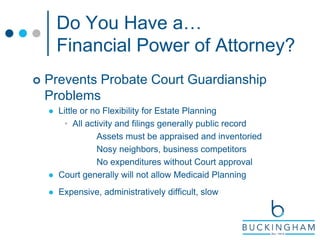

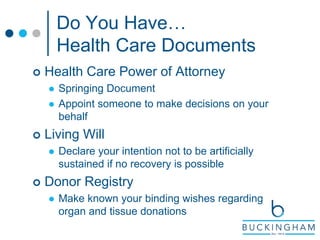

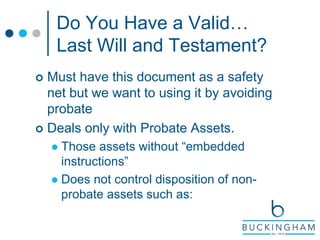

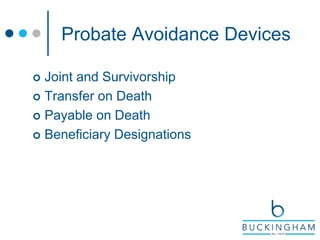

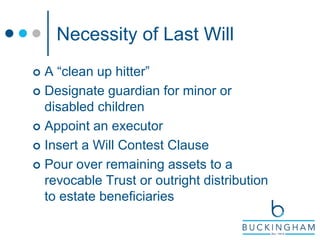

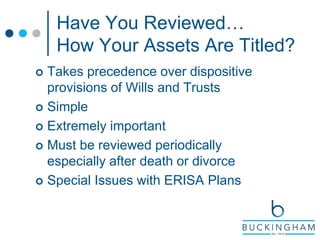

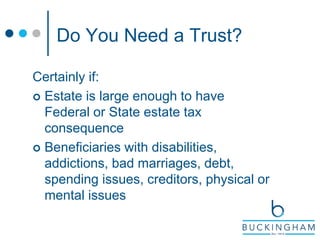

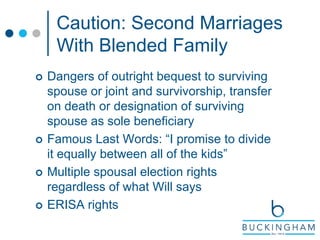

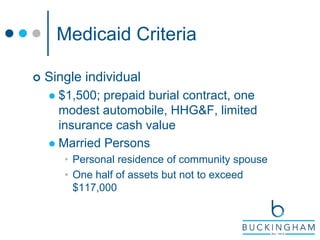

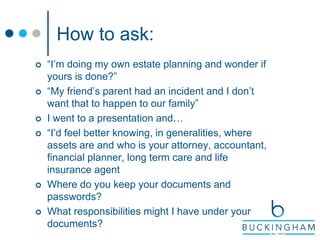

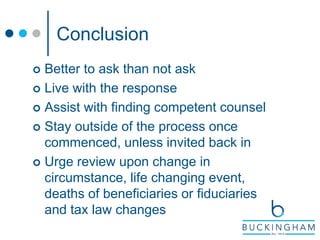

The document provides guidance on how to discuss estate planning with parents, emphasizing the importance of critical documents such as financial durable powers of attorney, health care documents, and wills. It outlines the necessity of proper asset titling and considerations for establishing trusts, particularly in complex family situations. Additionally, it offers strategies for initiating the conversation and encourages assistance in finding legal counsel while respecting the process and privacy of the parents.