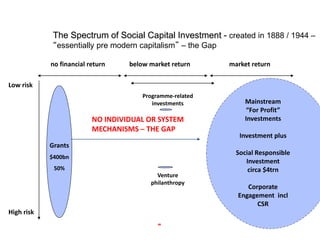

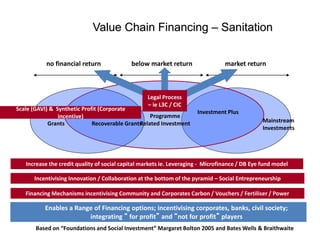

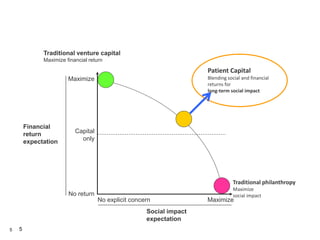

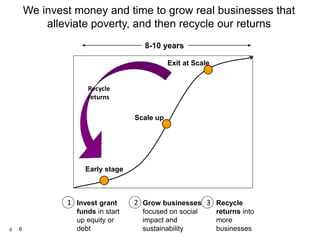

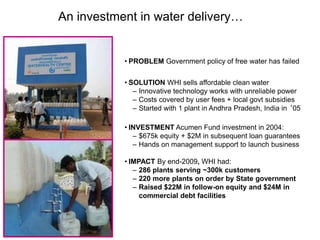

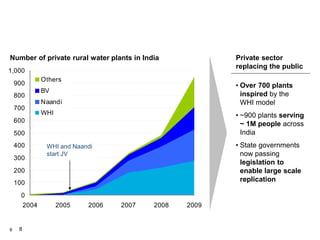

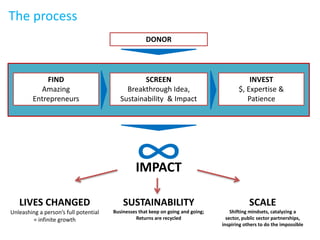

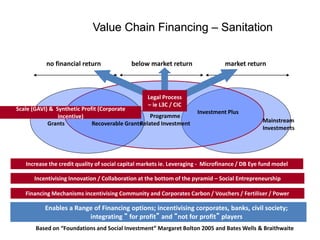

The document discusses various approaches to impact investing, including venture philanthropy and social finance, emphasizing the integration of financial returns with social outcomes. It highlights the need for innovative financing mechanisms to support social entrepreneurs and the importance of patient capital in fostering long-term social impact. Case studies, such as the investment in a clean water delivery initiative in India, illustrate the potential of blending social and financial investments to create sustainable businesses that alleviate poverty.