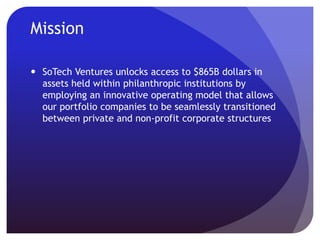

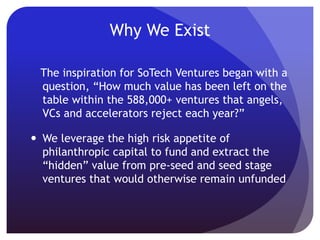

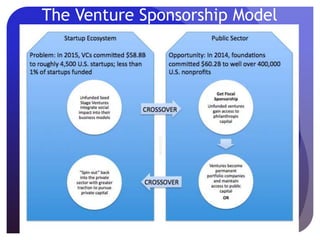

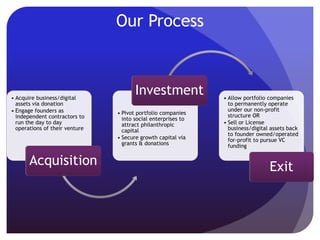

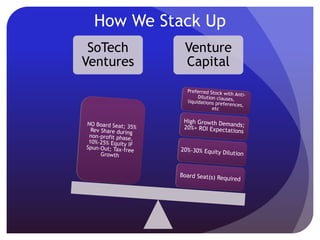

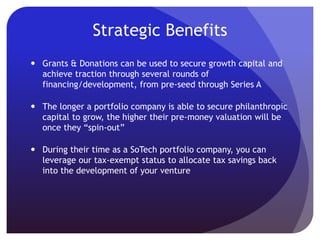

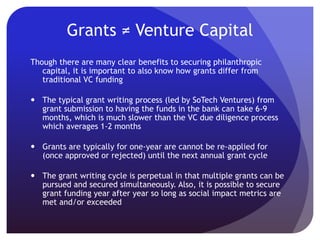

SoTech Ventures aims to leverage $865B in philanthropic capital by acquiring startup and corporate assets through donation, then licensing them back in exchange for equity or revenue shares. This provides subsidized funding to commercialize the assets while generating social impact. For startups, SoTech helps restructure them, secure grants, and eventually access public markets. For corporations, SoTech helps re-engineer product lines to attract grants and highlight CSR efforts. SoTech oversees impact tracking, grant writing, and legal compliance to support portfolio companies in raising additional philanthropic funding over multiple rounds.