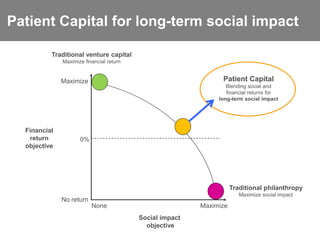

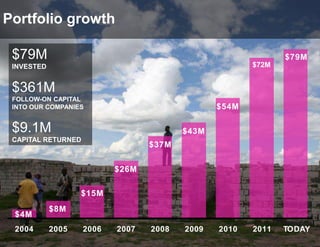

Acumen Fund is a nonprofit social investment fund that provides patient capital to companies focused on sustainably serving the poor. Over the past decade, Acumen has invested $79 million in 69 companies across multiple industries like housing, health, energy, agriculture and education, reaching over 90 million individuals and creating 57,000 jobs. Acumen seeks potential "game changing" investments that have the ability to significantly impact poverty at a large scale and become financially self-sustaining. The organization operates through local offices in multiple emerging markets and plans to expand its global footprint and portfolio size to $150 million impacting 150 million lives by 2015.