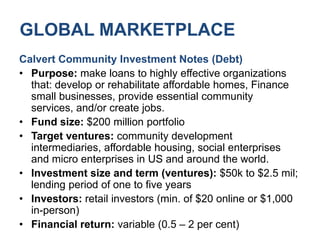

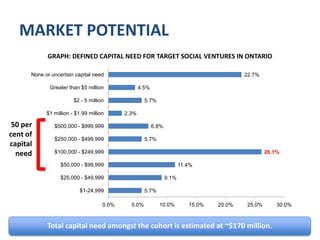

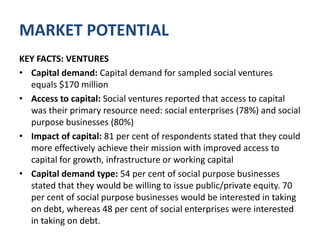

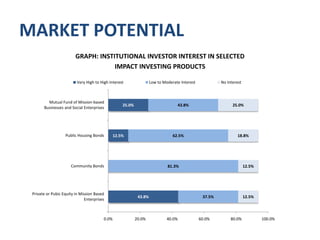

Impact investing aims to generate financial returns while also creating positive social and environmental impacts. The global impact investing market is estimated at $50 billion currently but projected to grow significantly in coming years. In Canada, the market is estimated at $2 billion currently across community investment funds, foundations, and impact investment deals. There is potential for further growth as social ventures in Ontario have an estimated $170 million in capital needs, while institutional investors show interest in impact investment products. However, gaps remain around intermediation between investors and ventures, impact measurement standards, and support for funds and ventures.