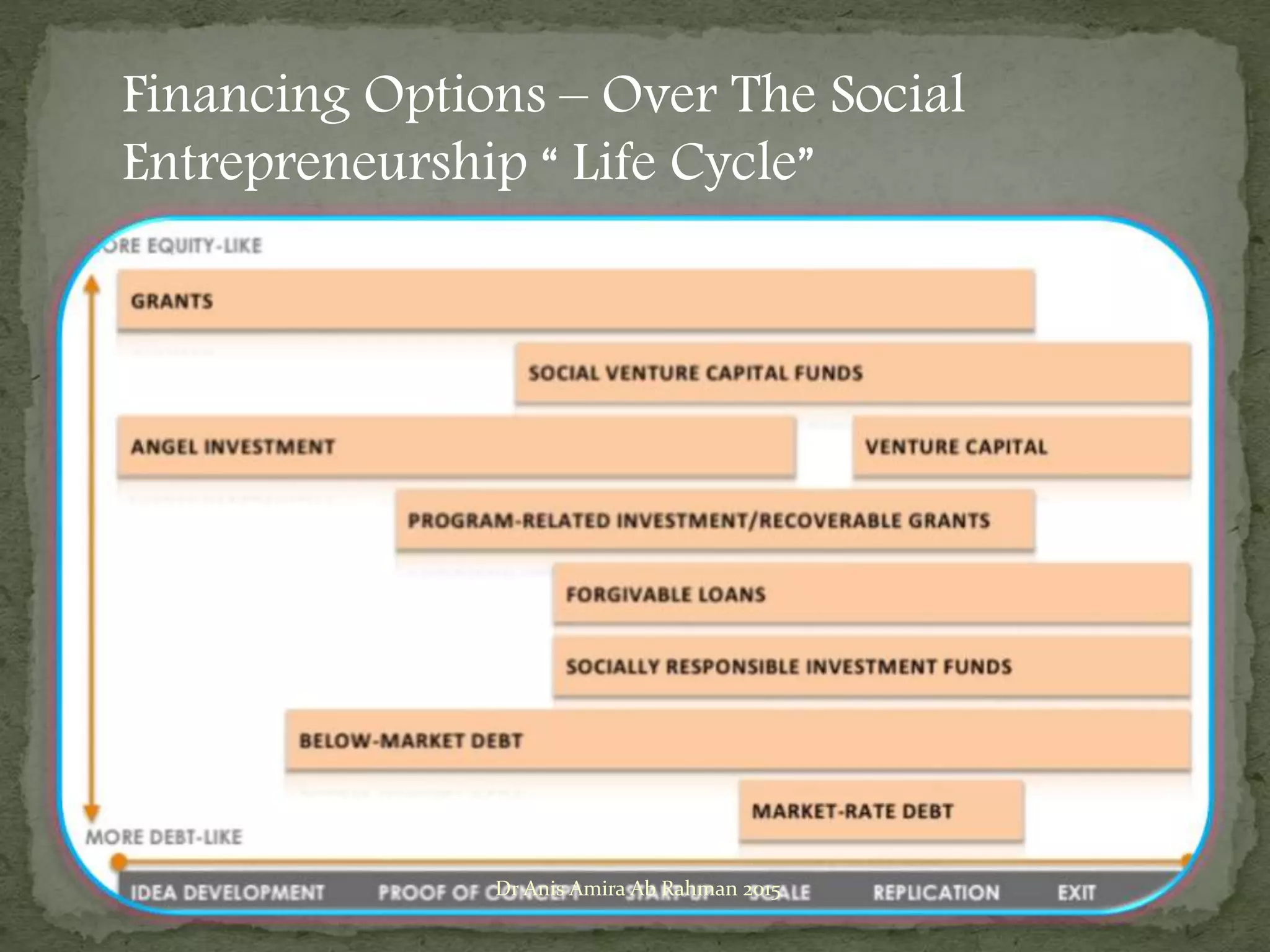

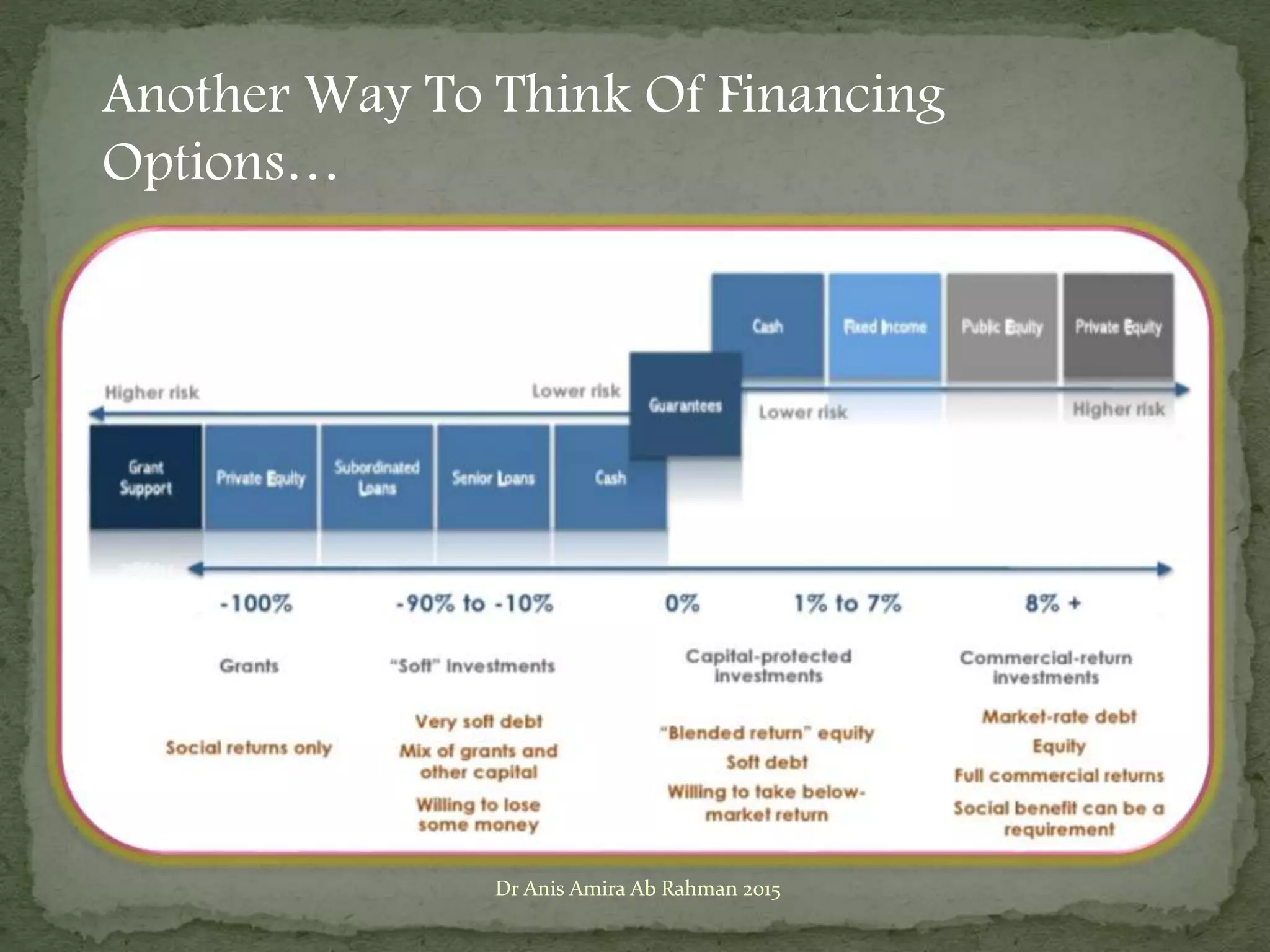

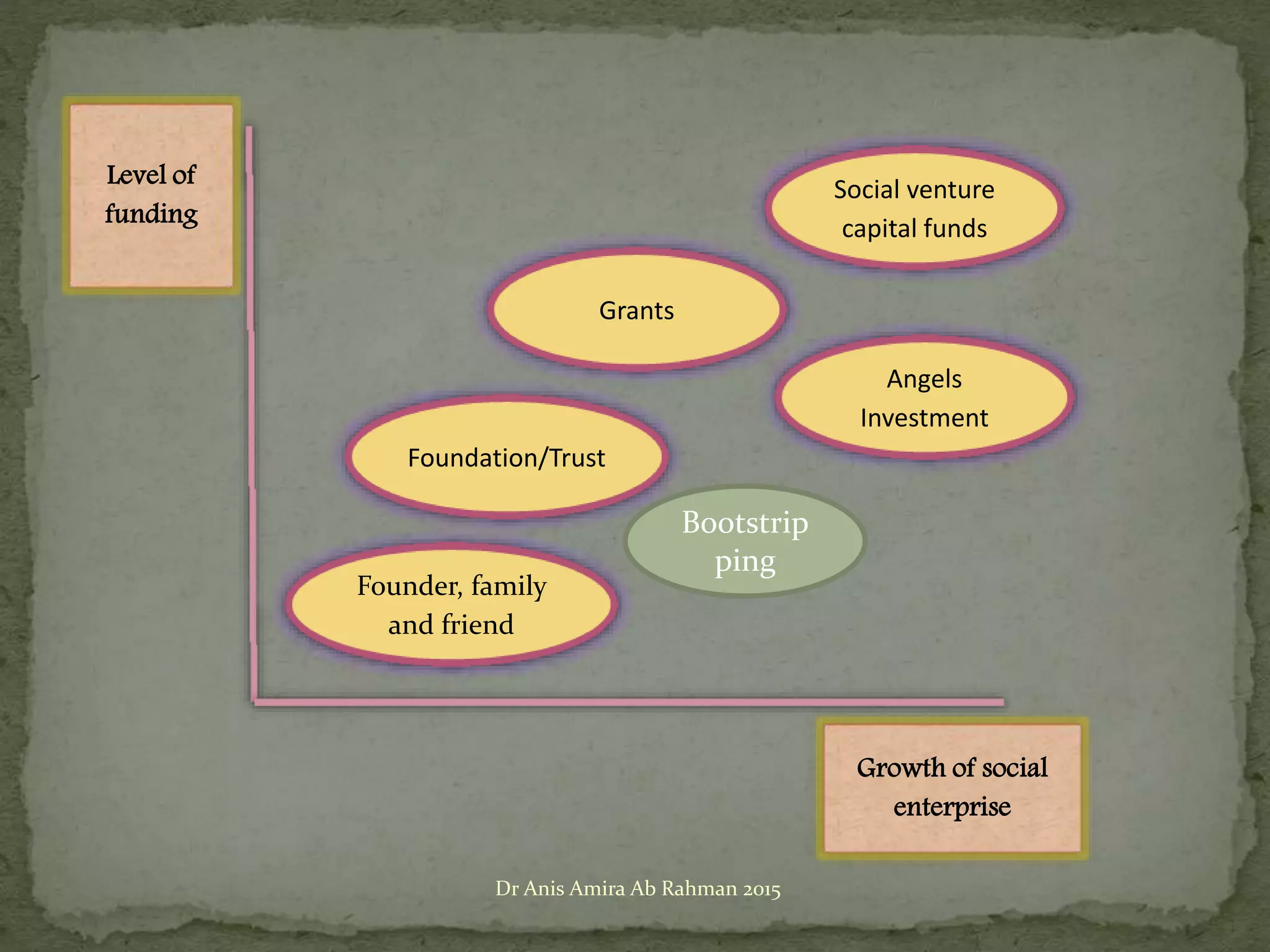

The document discusses various strategies for generating earned income for non-profits, including launching new business ventures, getting paid for existing services, and building revenue relationships with for-profit organizations. It also outlines different funding options for social enterprises at various stages of growth, such as using personal savings, seeking grants, engaging angel investors, or working with social venture capital funds. Securing financing requires clearly presenting the business case and demonstrating strong management of risks and resources.