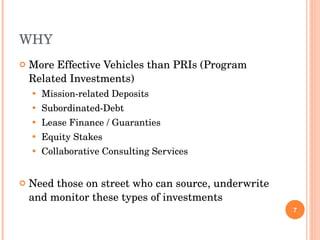

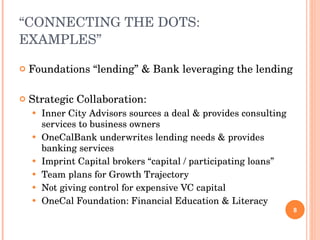

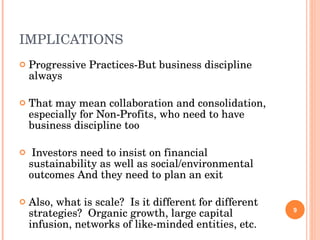

The document discusses a panel on socially responsible collaboration and banking your values. It introduces the panel participants from organizations like OneCalifornia Bank, OneCalifornia Foundation, Inner City Advisors, and Imprint Capital Advisors. The panel discusses OneCalifornia Bank's innovative social business model and examples of collaborations between organizations to provide economic development, financial literacy, and impact investing that leverages capital for social goals.