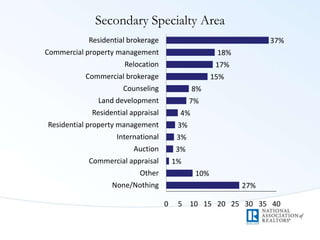

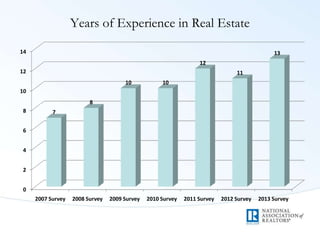

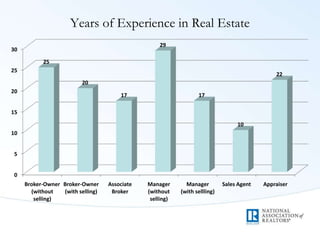

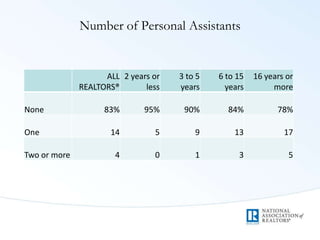

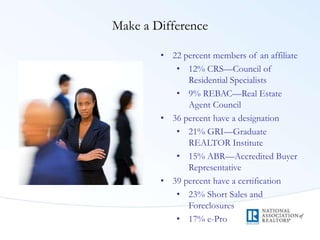

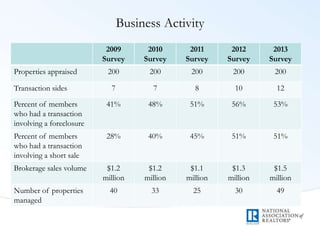

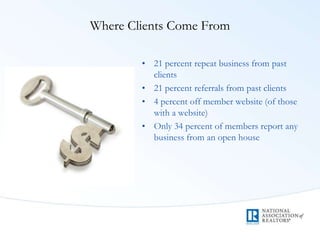

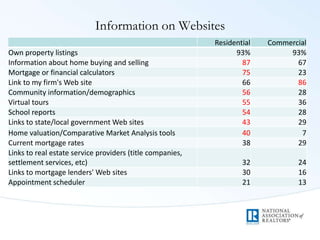

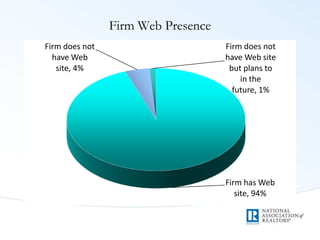

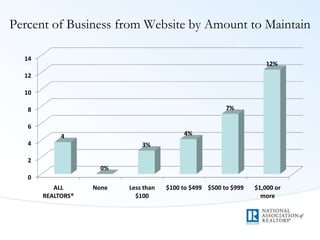

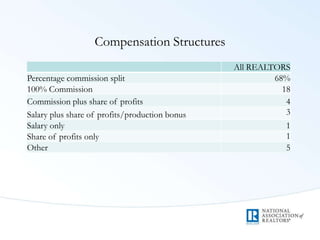

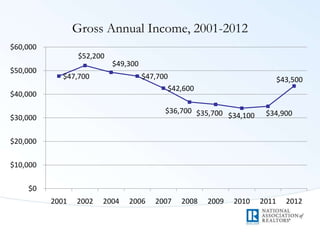

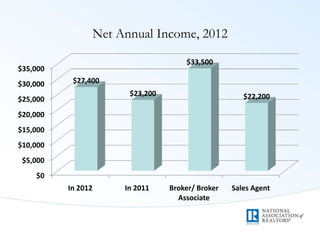

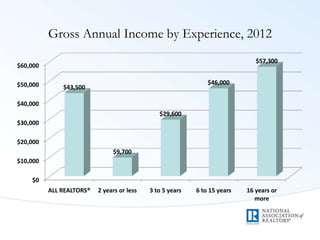

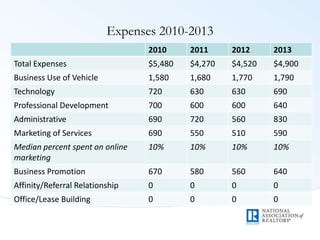

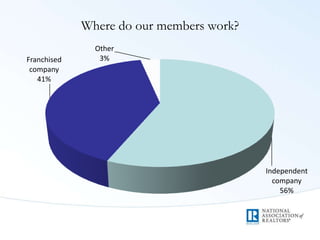

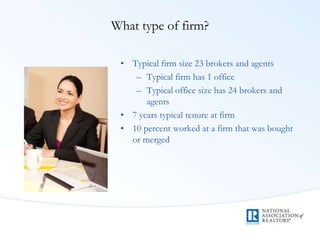

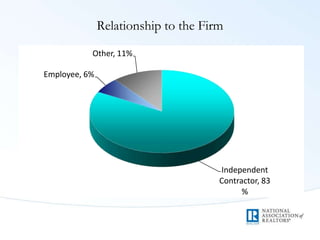

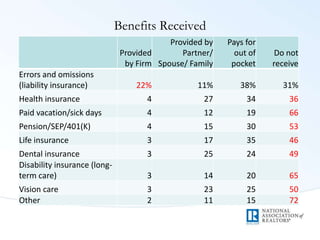

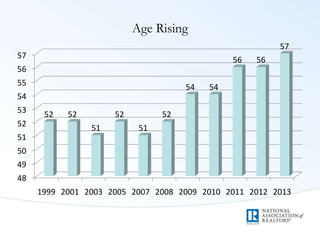

The document presents findings from a 2013 survey of over 4,800 real estate professionals on their business characteristics, technology usage, income, expenses and demographics. It shows that most members are residential brokers around 57 years old earning $43,500 annually. The survey also examines topics like years of experience, assistants used, designations held, transaction activity, website spending and more.