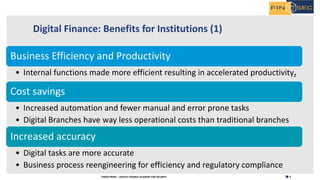

The document provides an introduction to digital finance, discussing major trends driving innovation in the finance industry such as globalization and technology. It outlines the history and types of digital finance services, and describes how digital transformation benefits financial institutions through increased efficiency, productivity, and customer-centric operations. The importance of digital finance in promoting financial inclusion by expanding accessibility and lowering costs is also highlighted.