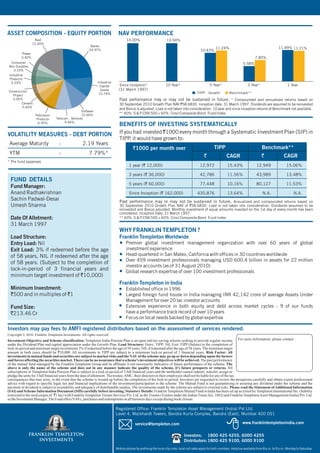

Templeton India Pension Plan (TIPP) is an open-end tax saving scheme that aims to provide regular income through dividends and capital appreciation. It has a lock-in period of 3 years and allows tax deductions of up to Rs. 1 lakh per year. The fund invests up to 40% in equities for growth potential and the rest in debt instruments for stability. The objective is to help investors build their retirement corpus by starting contributions early and benefitting from long-term capital appreciation to stay ahead of inflation.