ELSS Mutual Funds – Why and How?

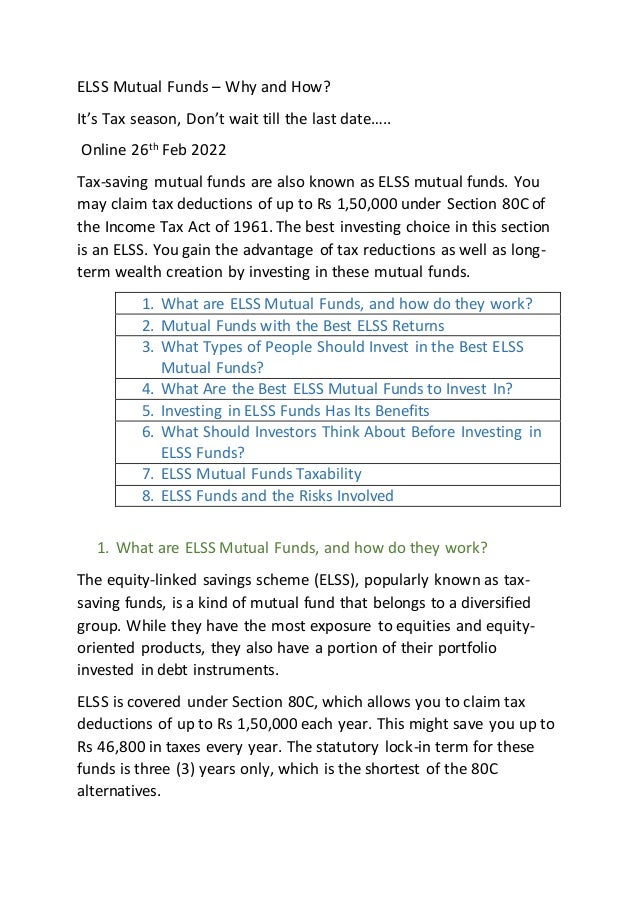

- 1. ELSS Mutual Funds – Why and How? It’s Tax season, Don’t wait till the last date….. Online 26th Feb 2022 Tax-saving mutual funds are also known as ELSS mutual funds. You may claim tax deductions of up to Rs 1,50,000 under Section 80C of the Income Tax Act of 1961. The best investing choice in this section is an ELSS. You gain the advantage of tax reductions as well as long- term wealth creation by investing in these mutual funds. 1. What are ELSS Mutual Funds, and how do they work? 2. Mutual Funds with the Best ELSS Returns 3. What Types of People Should Invest in the Best ELSS Mutual Funds? 4. What Are the Best ELSS Mutual Funds to Invest In? 5. Investing in ELSS Funds Has Its Benefits 6. What Should Investors Think About Before Investing in ELSS Funds? 7. ELSS Mutual Funds Taxability 8. ELSS Funds and the Risks Involved 1. What are ELSS Mutual Funds, and how do they work? The equity-linked savings scheme (ELSS), popularly known as tax- saving funds, is a kind of mutual fund that belongs to a diversified group. While they have the most exposure to equities and equity- oriented products, they also have a portion of their portfolio invested in debt instruments. ELSS is covered under Section 80C, which allows you to claim tax deductions of up to Rs 1,50,000 each year. This might save you up to Rs 46,800 in taxes every year. The statutory lock-in term for these funds is three (3) years only, which is the shortest of the 80C alternatives.

- 2. 2. Mutual Funds with the Best ELSS Returns Table 1. Return Performance of ELSS category in last 10 ten years as on 25th Feb 2022. Best ELSS Mutual Fund Schemes performance in last 10 years as on 25th Feb 2022. Scheme Name AMC Name Launch Date AUM (Crore) Expense Ratio (%) Invested Amount Current Value Annualized Return (%) Axis Long Term Equity Fund Reg Gr Axis MF 05-12- 2009 32,136.06 1.61 10000 53680.9 18.28 Quant Tax Gr Quant MF 01-04- 2000 788.62 2.62 10000 52814.75 18.09 IDFCTax Advtg (ELSS) Reg Gr IDFCMF 26-12- 2008 3,582.68 2 10000 48787.85 17.15 DSPTax Saver Reg Gr DSPMF 05-01- 2007 9,855.59 1.82 10000 48563.5 17.1 Sundaram Tax Savings Fund Reg Gr Sundaram MF 02-01- 2013 945.88 2.36 10000 45649.41 16.38 Invesco India Tax Gr Invesco MF 29-12- 2006 1,900.21 2.06 10000 45383.72 16.31 BOI AXA Tax Advtg Reg Gr BOI MF 25-02- 2009 546.15 2.55 10000 44249.17 16.02 Canara Robeco Equity TaxSaver Reg Gr Canara MF 05-02- 2009 3,208.77 2.17 10000 43083.49 15.71 JM Tax Gain Fund Gr JM MF 31-03- 2008 66.12 2.44 10000 42801.34 15.63 ICICI Pru Long Term Equity (Tax Saving) Gr ICICI Pru MF 19-08- 1999 9,950.37 1.77 10000 41317.53 15.22 3. What Types of People Should Invest in the Best ELSS Mutual Funds? Any one individual or a HUF who wants to save up to Rs 46,800 per year on taxes can consider investing in ELSS. On the other hand, ELSS funds are only ideal for people who are ready to Category Average Return(%) Maximum Return (%) Minimum Return(%) Median Return(%) Equity: ELSS 14.79 18.3 12.02 14.54

- 3. take a risk and can commit to staying invested for at least the three-year lock-in term. Investors should stick with them for at least five years to get the highest profits from mutual funds. A suitable time frame is five years. You will give your assets the time they need to cycle through market cycles and deliver outstanding long-term returns. Young investors in their early professional careers have the opportunity to invest with a long-term view. Young investors are most suited for ELSS since they have more time on their hands to maximize the power of compounding and earn high returns while saving up to Rs 46,800 per year in taxes. 4. What Are the Best ELSS Mutual Funds to Invest In? a) Returns on Investments - Compare the fund's performance against that of its rivals to confirm that it has been constant over time. You may invest in the suggested funds based on these factors. However, keep in mind that previous success does not guarantee future results. Future results are contingent on market movements and the choices of the fund management. b) History of the Fund - Choose fund firms that have a track record of consistent performance over a lengthy period, such as 5 to 10 years. The quality of equities in a fund's portfolio and benchmark determines its success. c) Expense Ratio - The expense ratio shows how much of your money is spent on fund management. Higher take-home returns are associated with a lower spending ratio. As a result, if two funds have a comparable track record and asset allocation, you should choose the one with the lowest cost ratio. d) Financial Ratios - To evaluate a fund's performance, use metrics such as Standard Deviation, Sharpe ratio, Sortino ratio, Alpha, and Beta. A fund with a greater standard deviation and beta

- 4. than one with a lower deviation and beta is riskier. Funds having a higher Sharpe Ratio provide better returns in exchange for taking on more risk. The job of the fund manager is critical. 5. Investing in ELSS Funds Has Its Benefits a. The advantage of a tax refund, as well as an increase in wealth, is a win-win situation for Tax Savers u/s 80c - ELSS is the only investment option that delivers tax benefits under Section 80C of the Income Tax Act of 1961 and contributes to wealth accumulation. The ELSS funds' equity exposure allows you to achieve high returns if you remain invested for at least five years. b. Section 80C choices with the shortest lock-in duration - ELSS mutual funds have only a three-year (3 Years) lock-in period, which is the shortest of all the tax-saving investment alternatives available under Section 80C of the Income Tax Act, 1961. As a result, ELSS mutual funds have higher liquidity than any other Section 80C investment. c. Potential for higher-than-inflation returns - The only Section 80C investment choice that has the potential to outperform inflation in ELSS mutual funds. This is what sets ELSS apart from other tax-advantaged investing alternatives. d. Money management by experts - All mutual funds are managed by 'fund managers,' who are financial experts. These are people that have a proven track record of managing portfolios and possess a variety of financial credentials. Every fund manager is supported by a team of market researchers and analysts who choose just the highest-performing assets that will benefit investors over time

- 5. e. Option to invest every month - You may start investing in the best ELSS funds with as little as a Rs 1000 SIP. Furthermore, there is no upper limit to the amount of money that may be invested. 6. Comparison of ELSS to other tax-saving investments, Other savings plans that aid in wealth growth include FDs, PPFs, and NSCs, to mention a few. However, the profits from these methods are taxed. This is where ELSS (Tax Saving Mutual Funds) shines out because of its dual benefit: better returns and no taxes. This, along with the lowest three-year lock-in period, is another incentive to invest in ELSS (Tax Saving Mutual Funds) right now. Here's a short rundown of how ELSS outperforms other popular tax-saving investments: Returns on Investments Lock-in Period Tax on Returns Investment Returns Lock-in Period Tax on Returns 5-Year Bank FixedDeposit 6% to 7% 5 years Yes PublicProvidentFund(PPF) 7% to 8% 15 years No National SavingsCertificate (NSC) 7% to 8% 5 years Yes National PensionSystem(NPS) 8% to 10% Till Retirement Partially Taxable ELSS Funds 10 % to 18% 3 years Partially Taxable 7. What Should Investors Consider Before Investing in ELSS Funds? Before investing in ELSS mutual funds, investors should consider the following important factors: 1. Period of confinement - ELSS mutual funds, like any other tax- saving investing option, have a lock-in period. ELSS is a three- year Scheme that is required. There are no measures in place to allow for early withdrawals. As a result, investors must be ready to commit to staying for at least three years after purchasing units.

- 6. 2. Factor of Risk - Because ELSS mutual funds are equity-oriented, market changes inevitably affect them. Furthermore, these funds are subject to all of the risks associated with an equity fund. As a result, while investing in ELSS mutual funds, investors must be ready to accept these risks. It's critical to evaluate your risk profile. 3. SIP and lump sum investments - You may invest in mutual funds in one of two ways: as a lump sum amount or as part of a systematic investing strategy (SIP). Most investors choose SIPs because they may spread their investments out over time. SIPs allow you to invest a little amount regularly. Investing in a systematic investment plan (SIP) is recommended because it delivers the long-term advantage of rupee cost averaging. A lump-sum investment is typically not recommended unless there is a good prospect of achieving huge profits. 8. ELSS Mutual Funds Taxability - Because ELSS mutual funds are a kind of equity fund, they are taxed similarly to equity funds. Any dividends paid by these funds are added to your income and taxed according to your tax bracket. Dividends were tax- free in the hands of investors until Budget 2020 since the fund house was expected to pay dividend distribution tax. There is no way to benefit from short-term capital gains since there is a three-year lock-in period. As a result, there is no tax on short-term capital gains on the sale of ELSS mutual fund units. Long-term capital gains of up to Rs 1 lakh per year are free from taxation. Long-term profits over Rs 1 lakh are taxed at a rate of 10%, with no indexation advantage. 9. ELSS Funds and the Risks They Involve Because ELSS mutual funds are equity-oriented, they are subject to the same levels and types of risks as other equity mutual funds. However, by remaining invested for at least five years, these risks

- 7. may be greatly reduced. In addition, the three-year required lock-in term greatly reduces the danger. Frequently Asked Questions 1. What is the best way to invest in ELSS mutual funds online? Ans- Regular ELSS Schemes are available via a mutual fund distributor. You may invest in an ELSS mutual fund's direct plan online via an AMC. You must first register with the AMC. Fill in your personal information, such as your name, phone number, and so on, on the application form. You may finish your eKYC by providing your PAN and Aadhaar numbers. You may advise your bank to send the required cash to the fund house on a certain date and begin investing in an ELSS mutual fund by giving online instructions to your bank. Online platforms such as Swaraj Finpro invest help you to invest in ELSS mutual funds. Swaraj Finpro Invest is a website where you may invest your money. From the list of fund houses, you must choose a mutual fund house. Choose an ELSS mutual fund plan that meets your investing goals and risk tolerance, then click Invest Now. Choose the amount you want to put into the ELSS mutual fund scheme and whether you want to make a one-time or monthly SIP investment. 2. Without a Demat account, how can you invest in ELSS mutual funds? Ans - By visiting the AMC's branch, you may invest in mutual funds directly with the mutual fund business. For KYC compliance, all you have to do is complete the application form and provide self-attested identification and address verification.

- 8. You may submit a check for the first amount, and a PIN and folio number will be assigned to you. You may also go to a mutual fund distributor and invest in a mutual fund's regular plan. Through an AMC, you may invest in a mutual fund's direct plan online. Fill out the registration form and enter your PAN and Aadhaar data to complete your eKYC. You may also put your money into an internet site like Swaraj Finpro invest. 3. How can I invest in ELSS mutual funds using a systematic investment plan (SIP)? a) Before investing in a mutual fund, you must first complete your KYC by clicking https://swarajfinpro.finsuite.in/0/Client- Page/Swaraj-Finpro-Account-Opening/. You may do so by filling out a KYC registration form and submitting self-attested identification and address evidence to a KRA (KYC Registration Agency) online. b) The next step is to go to the fund house's website and choose a mutual fund strategy. c) You may establish a username and password by filling out an application form with the needed information such as your name, mobile number, and PAN. d) You next input your bank account information and the amount of the SIP auto-debit. e) You may pick a mutual fund plan by logging into your account with the fund company. f) The initial SIP payment must be made online, and the following payment must be made after 30 days. (The AMC will notify you of the necessary data.) g) You may keep the SIP going till the end of the specified term. (You have control over the SIP's duration.) 4. What is the best way to invest a lump amount in an ELSS mutual fund?

- 9. Ans - A direct arrangement with the asset management company allows you to invest a lump sum amount in a mutual fund. You have the option of investing either offline or online. At the mutual fund house's branch, you must complete your KYC by presenting a self-attested identification and address verification, as well as passport-size pictures. You might use an online platform like Swaraj Finpro invest to invest a lump sum money in mutual funds. All you have to do now is go to Swaraj Finpro invest and choose a mutual fund firm. If you wish to invest a lump sum amount in a mutual fund, choose the amount and manner of investment as Lumpsum. 5. What is the best way to invest in mutual funds? (STP way) Ans - A systematic transfer plan, or STP, enables you to transfer (switch) a set number of units from one mutual fund scheme to another within the same mutual fund company regularly. Depending on market circumstances, you may want to plan an STP from an equity to a debt plan or vice versa. 6. How I can invest in STP mutual funds in easy steps? Ans – Choose the long-term mutual fund plan (destination fund) in which you want to invest. After that, you may choose the mutual fund plan (source fund) where you wish to put your lump sum money. You have the option of deciding when the lump sum money deposited will be transferred to the destination fund. STPs may be selected on a daily, weekly, or monthly basis, according to your preferences. 7. What is the minimum amount of money required to invest in ELSS mutual funds? Ans - SIP stands for Systematic Investment Plan, and it's a way of investing in mutual funds. You may invest a certain amount in a mutual fund plan of your choosing regularly. Through the

- 10. SIP, you may invest as little as Rs 500 every installment in a mutual fund. 8. What is the best way to invest in mutual funds on behalf of minors? Ans - In the name of a minor kid, you may invest in mutual funds. In the mutual fund folio, the minor kid is the only owner. The mutual fund folio's guardian must be a parent or a court- appointed guardian. When starting a mutual fund folio, provide documentation that indicates the child's date of birth, such as a passport or birth certificate. You'll also need paperwork to prove the parent/connection guardians with the minor kid. (For a parent, it may be a passport; for a guardian, it could be a copy of the court order.) To invest in mutual funds in the name of a minor kid, the parent or guardian must be KYC-compliant. Even a little child's mutual fund folio may be used to set up a SIP or STP instruction. It would, however, end if the minor kid reached the age of eighteen. 9. How can you make a short-term investment in mutual funds? Depending on your financial goals and risk tolerance, you may want to investigate mutual funds. To accomplish your short-term financial objectives, invest in debt funds. You may invest in direct debt mutual funds with the mutual fund firm either physically or online. You may, however, invest in ordinary debt fund plans via a mutual fund distributor. Debt funds may be purchased via an internet platform such as Swaraj Finpro invest. 10. How mutual funds be used to invest in gold? Gold ETFs and gold funds may be purchased either online or via a mutual fund distributor. You may also use a mutual fund distributor to invest in these funds.

- 11. You might, however, use the SIP technique to invest in gold funds or gold ETFs. You may put in as little as Rs 500 for every payment. Online platforms such as Swaraj Finpro invest allow you to invest in gold ETFs and gold funds. 11. What are the best ways to invest in mutual funds for retirement? For retirement, you may invest in equity mutual funds or ELSS mutual funds. To attain long-term financial objectives such as retirement planning, you must invest in equity funds for the long term. Through an asset management firm, you may invest in direct equity funds and ELSS. Regular plans of these mutual funds, on the other hand, might be purchased via a broker. Through online platforms like Swaraj Finpro invest, you may invest in equity funds and ELSS. 12. What are the best ways to invest in international mutual funds? You may invest directly in International Mutual Funds in India via an AMC. It is a mutual fund scheme in India that invests in international company equities. You could want to look at fund of funds schemes that invest in overseas mutual funds or have a portfolio that resembles a stock market index like the Nasdaq 100 or the S& P 500. Through an internet platform like https://swarajfinpro.com/ invest, you may invest in International Mutual Funds. Go to https://swarajfinpro.com/ to get started. From the list of fund houses, you must choose a mutual fund house. Choose an International Mutual Fund from the 'Equity' category that meets your investing goals and risk tolerance, then click Invest Now.

- 12. Select the amount you want to put into the mutual fund and whether you want to make a one-time or recurring investment. 13. As a student, how do you invest in mutual funds? Ans - If you are a student above the age of 18, you may simply invest in mutual funds. A Mutual Fund Distributor may also help you invest in regular mutual fund schemes. However, you must complete your KYC at the mutual fund house's branch by presenting a self-attested identification and address evidence as well as a passport-size photo. Before investing in mutual funds, you may complete eKYC by entering your PAN and Aadhaar data online.