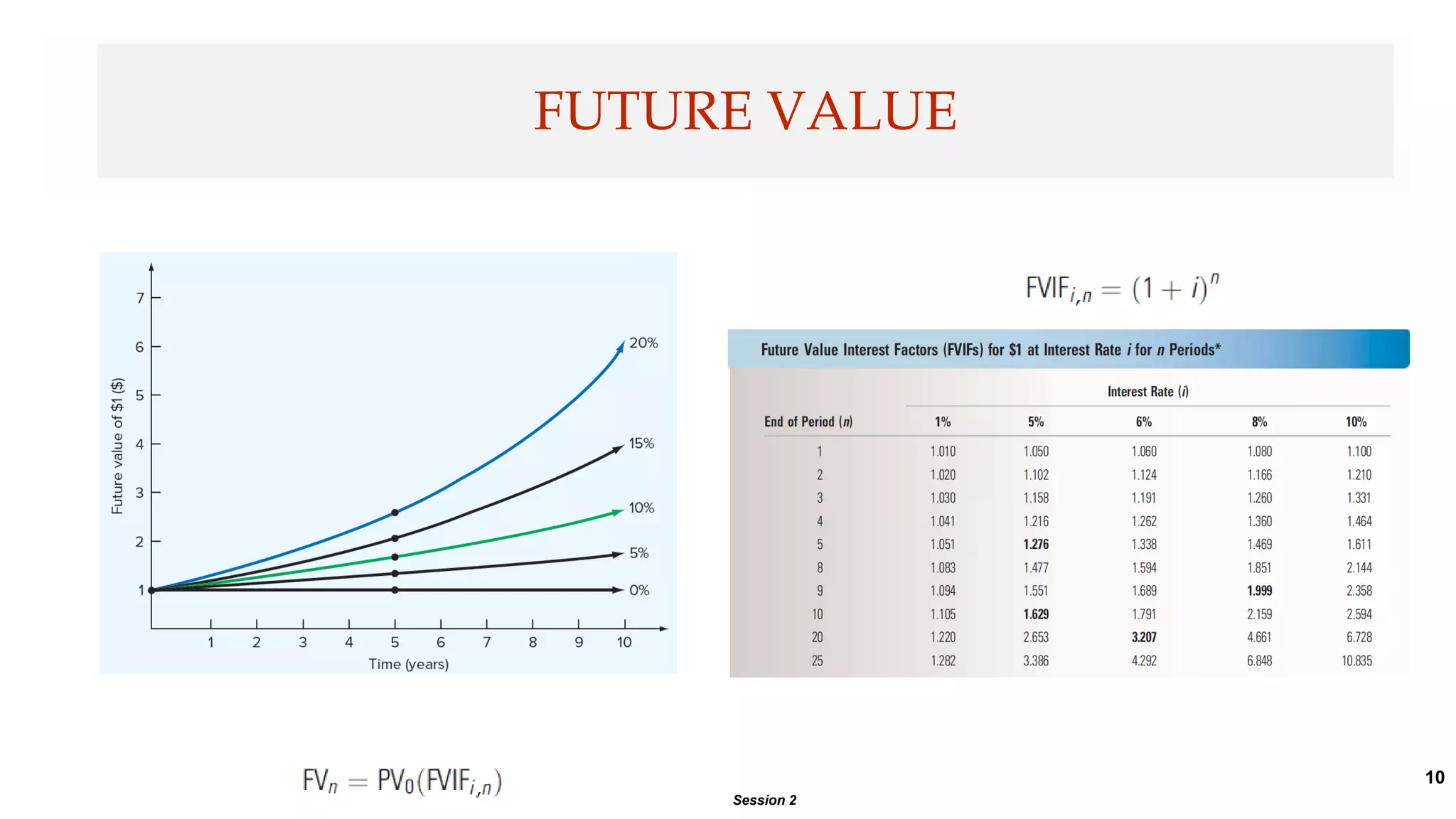

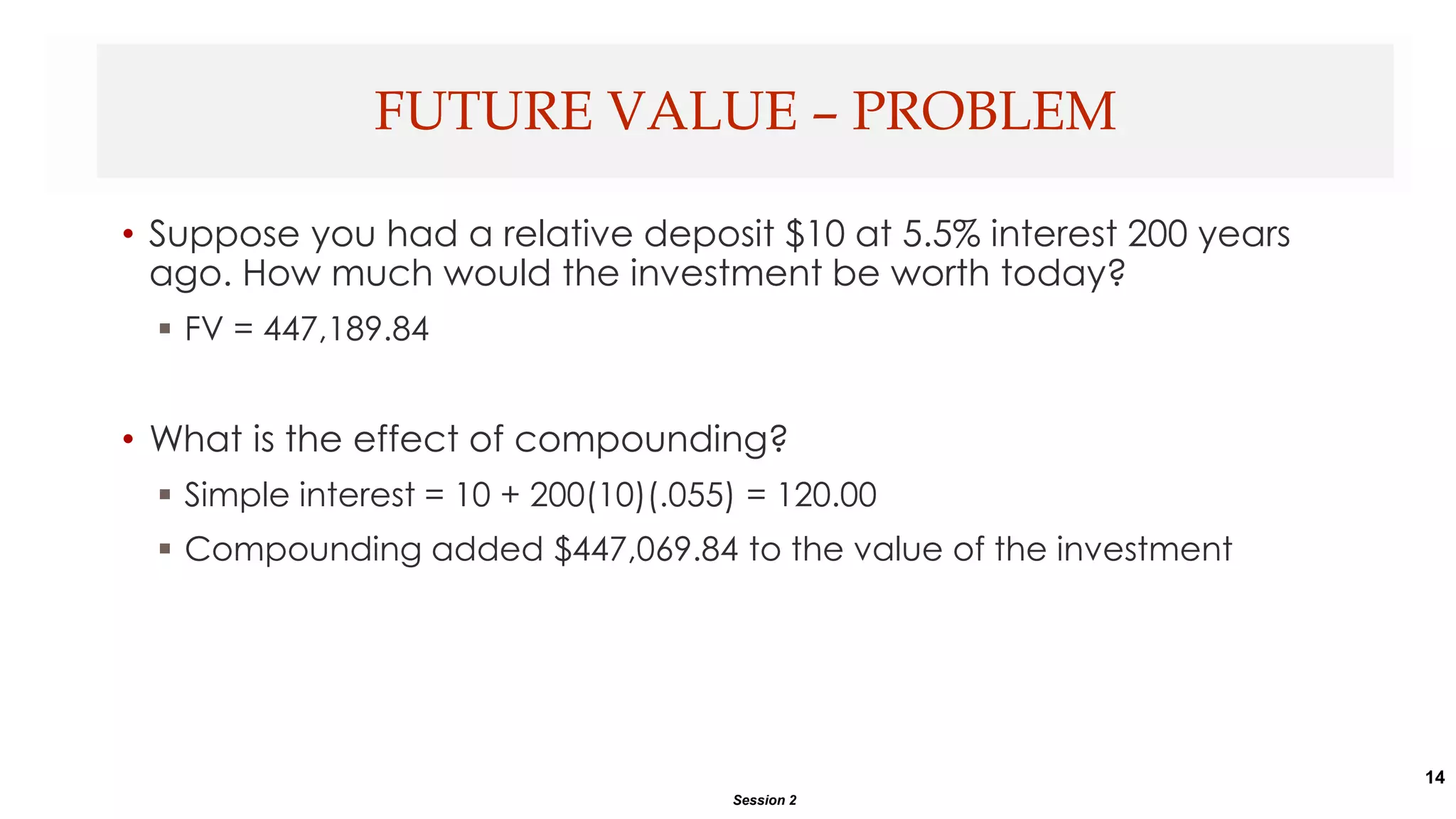

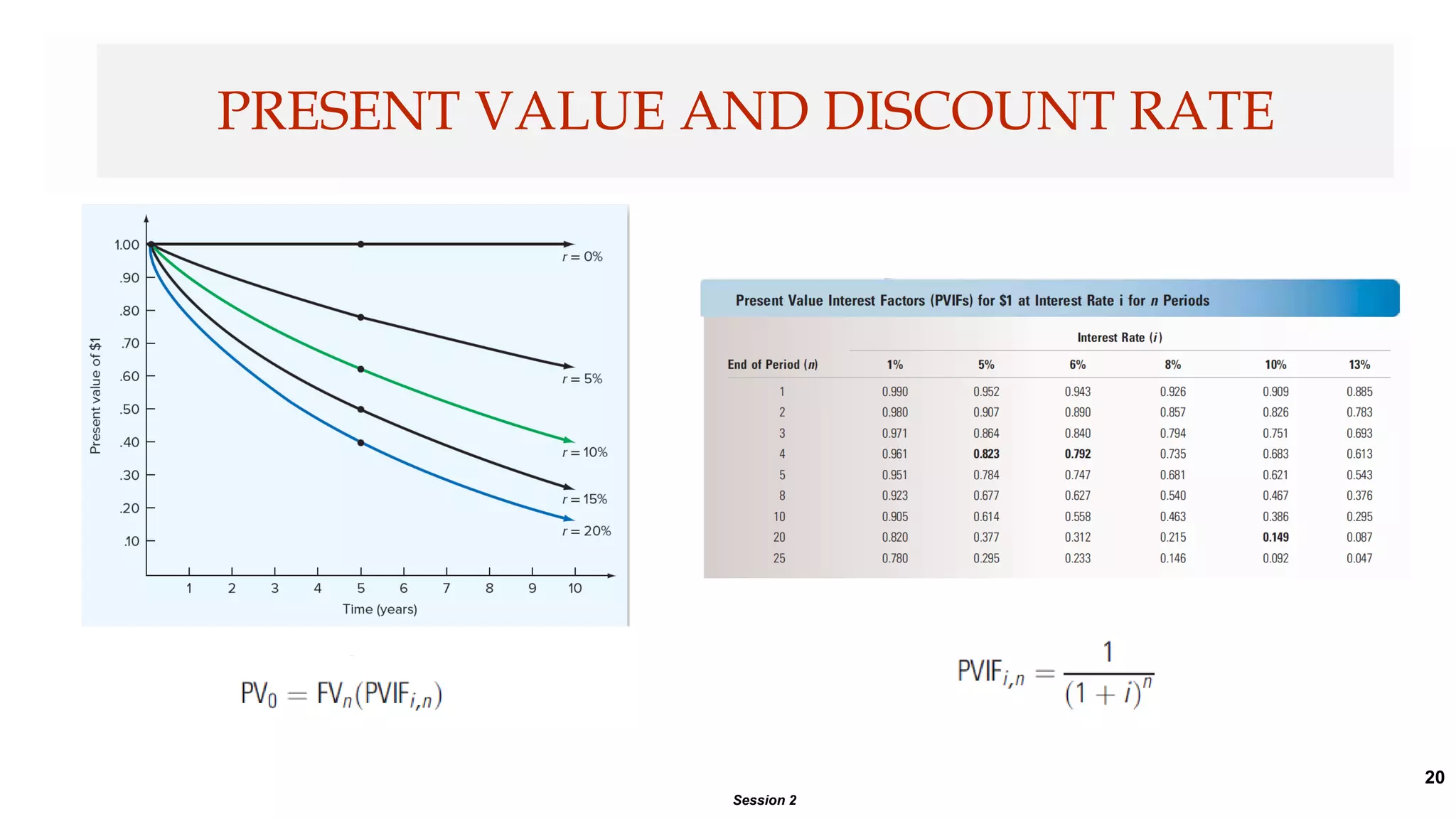

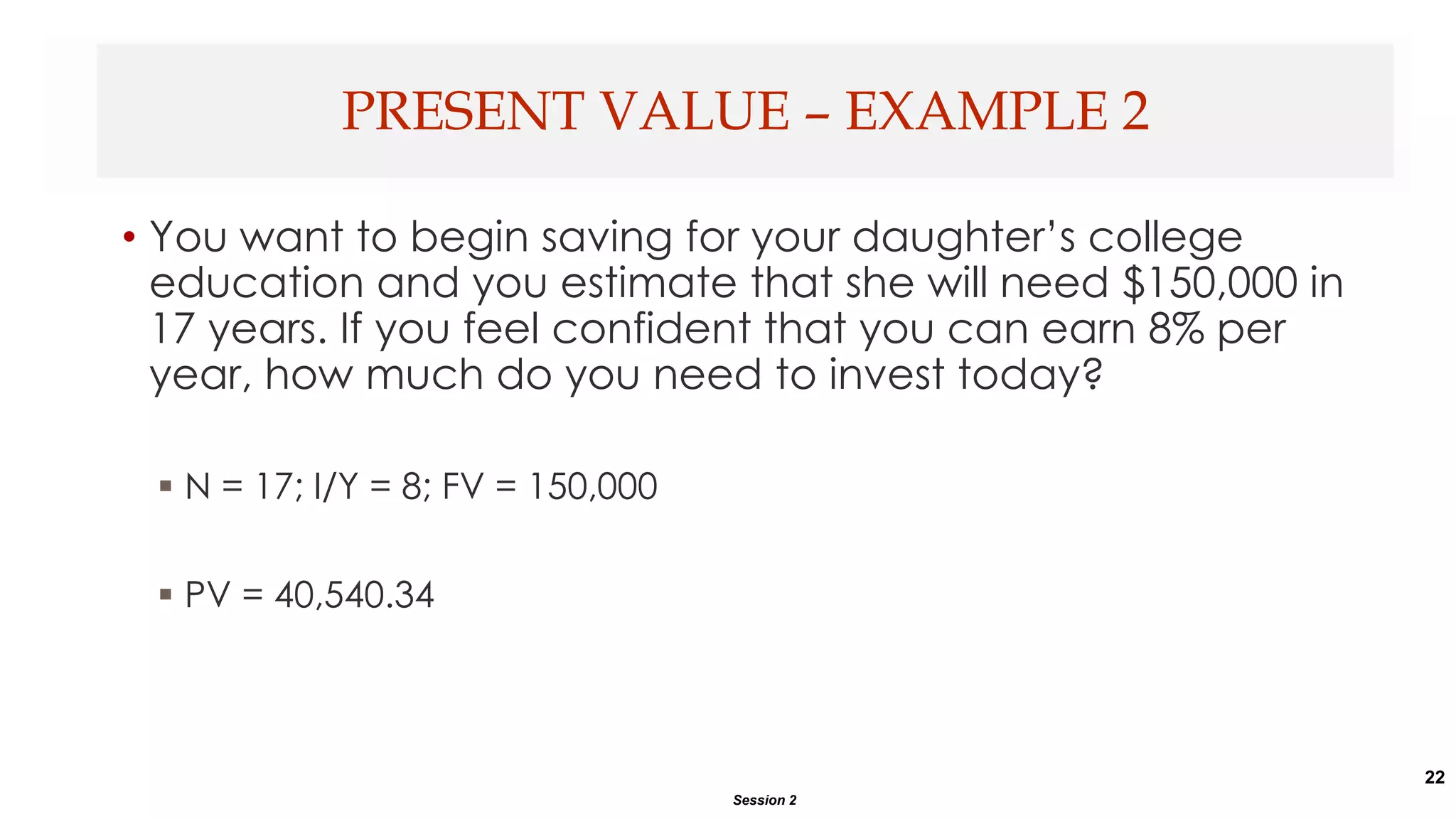

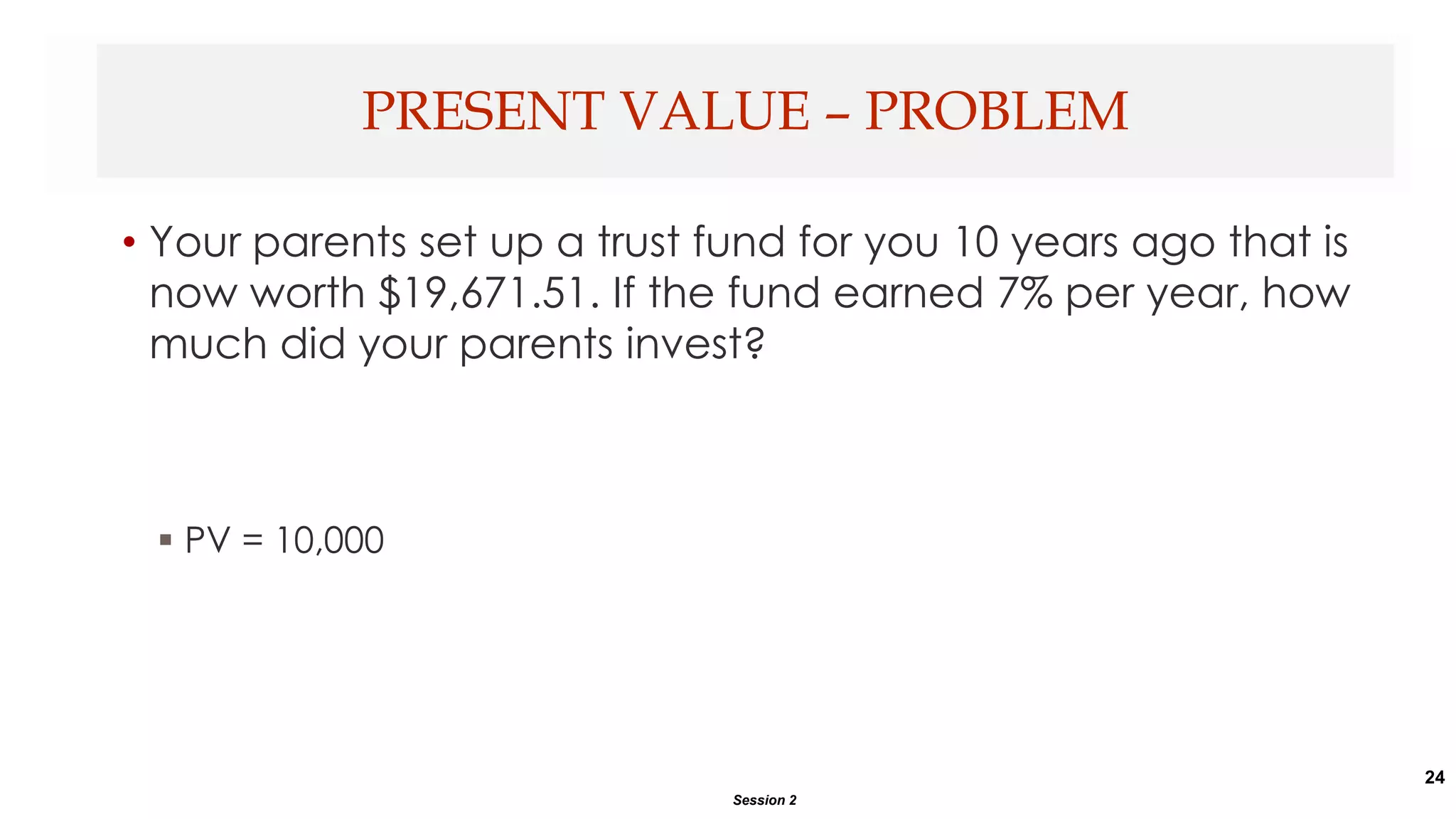

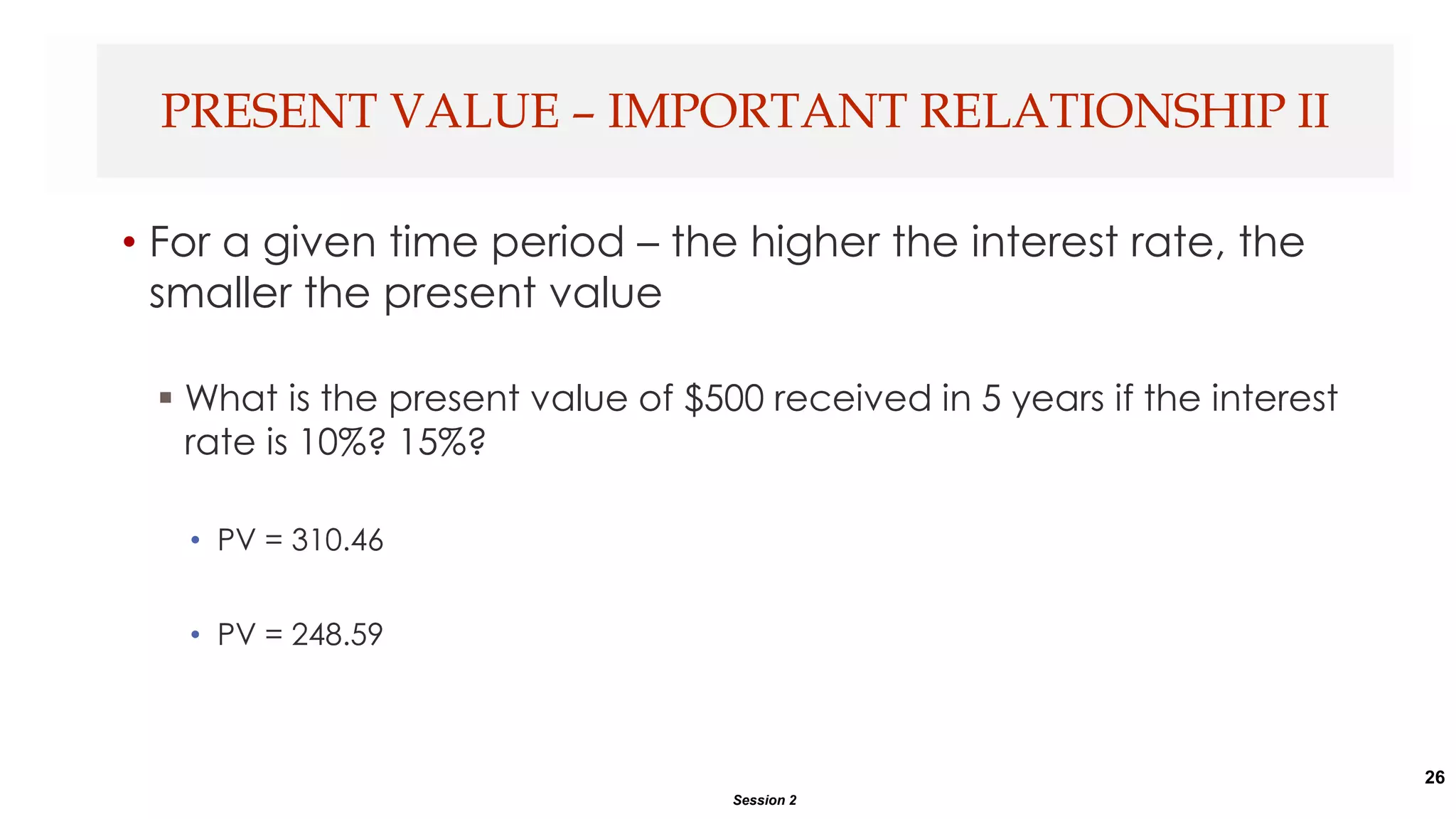

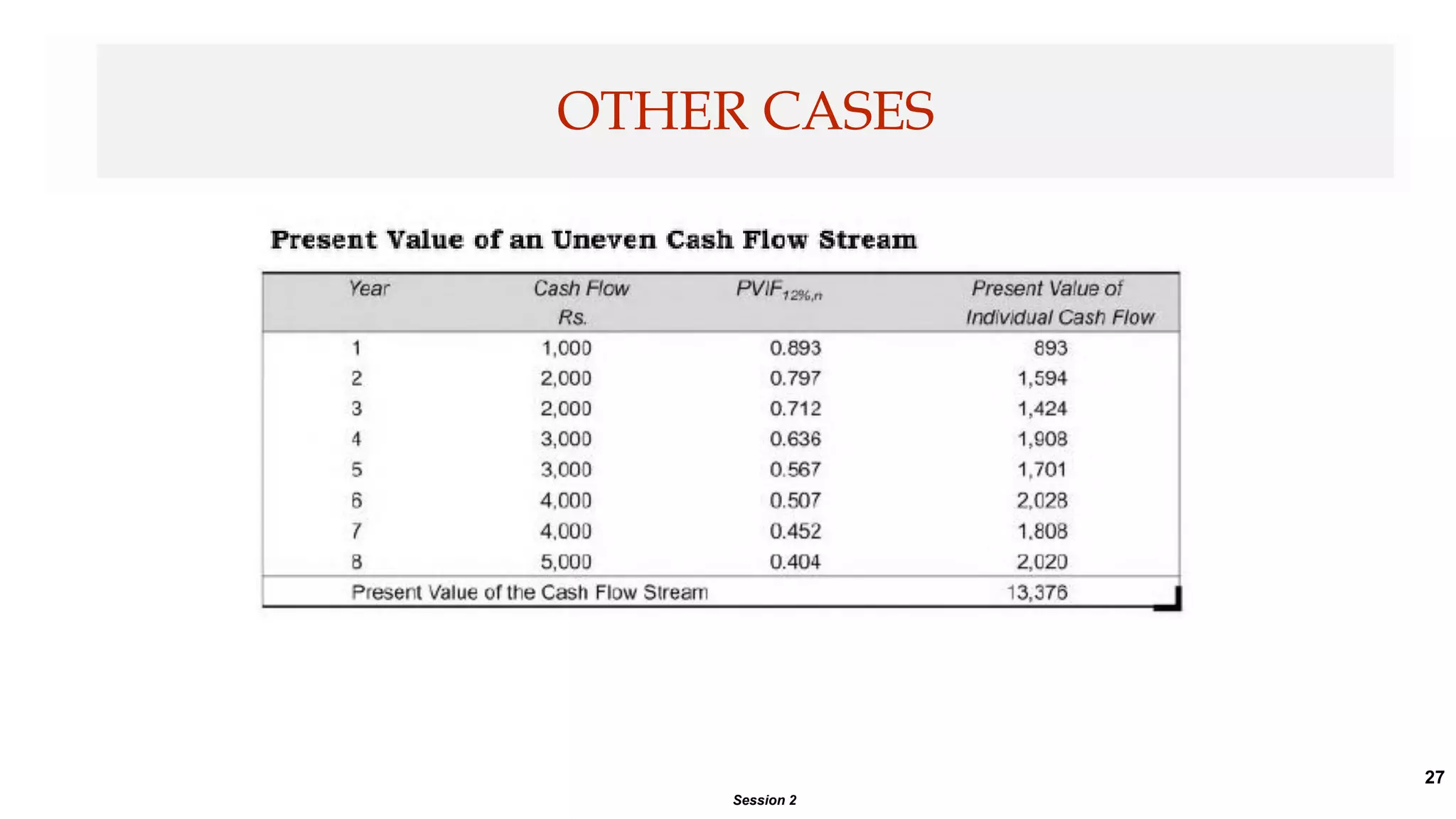

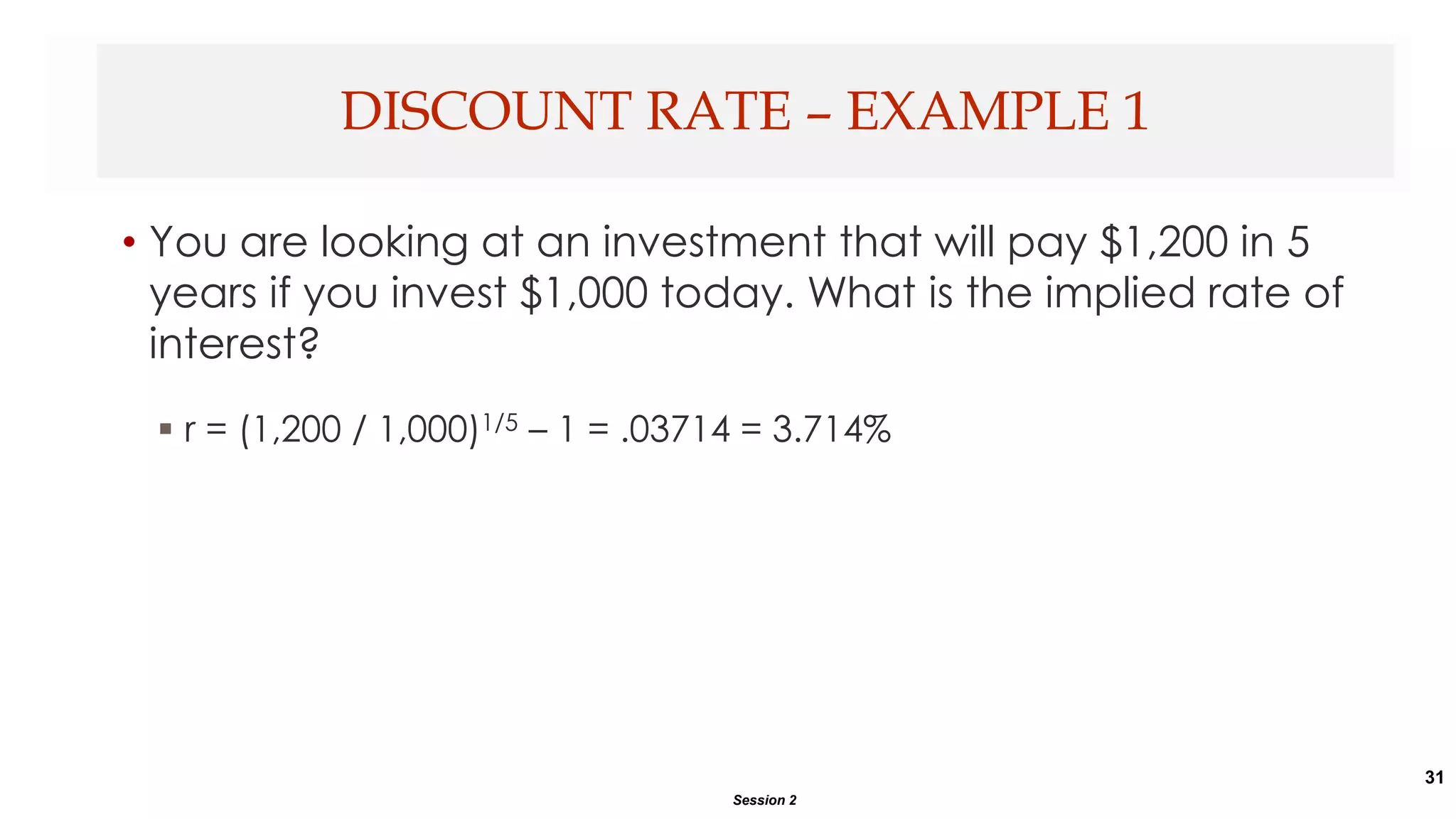

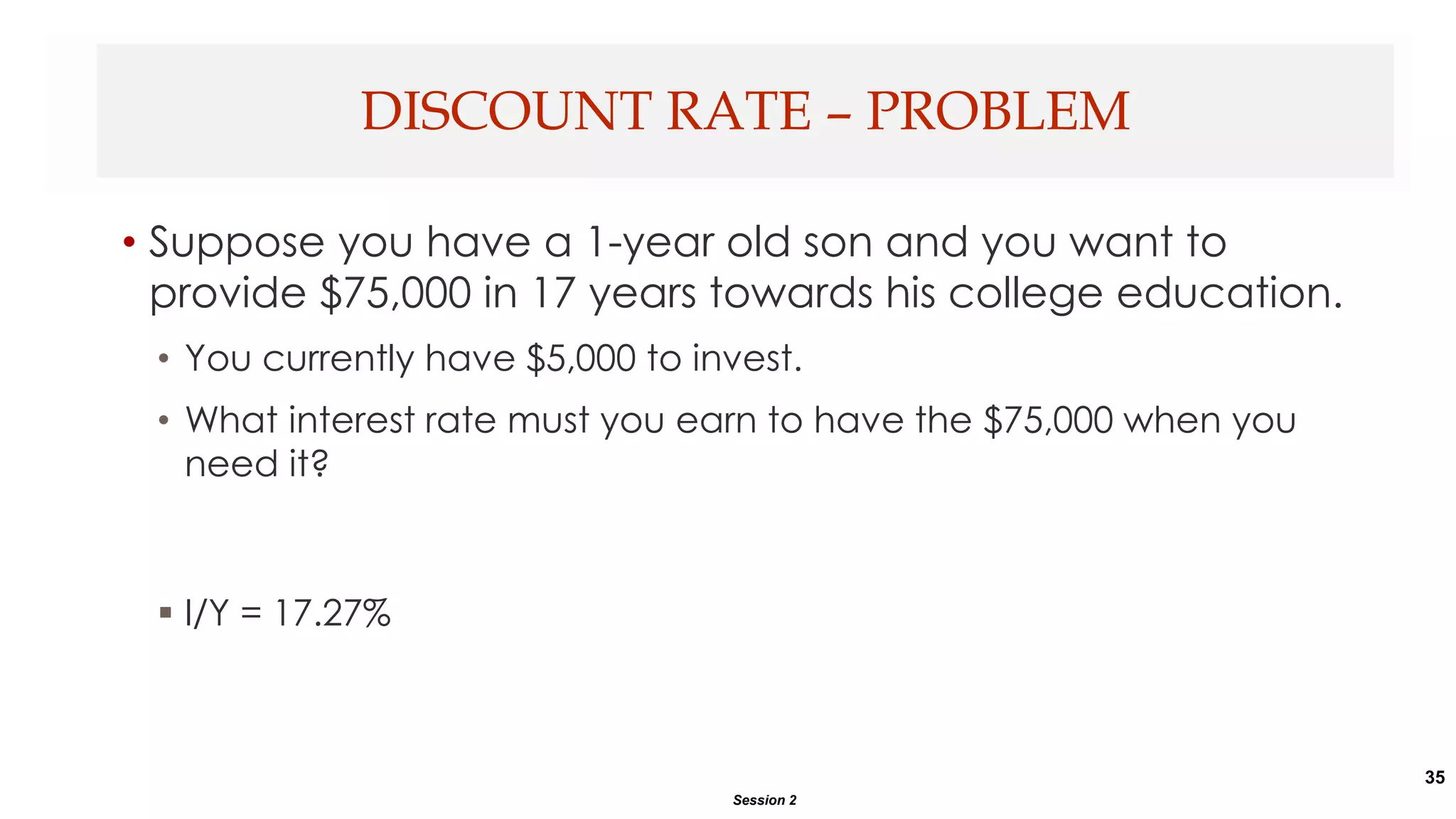

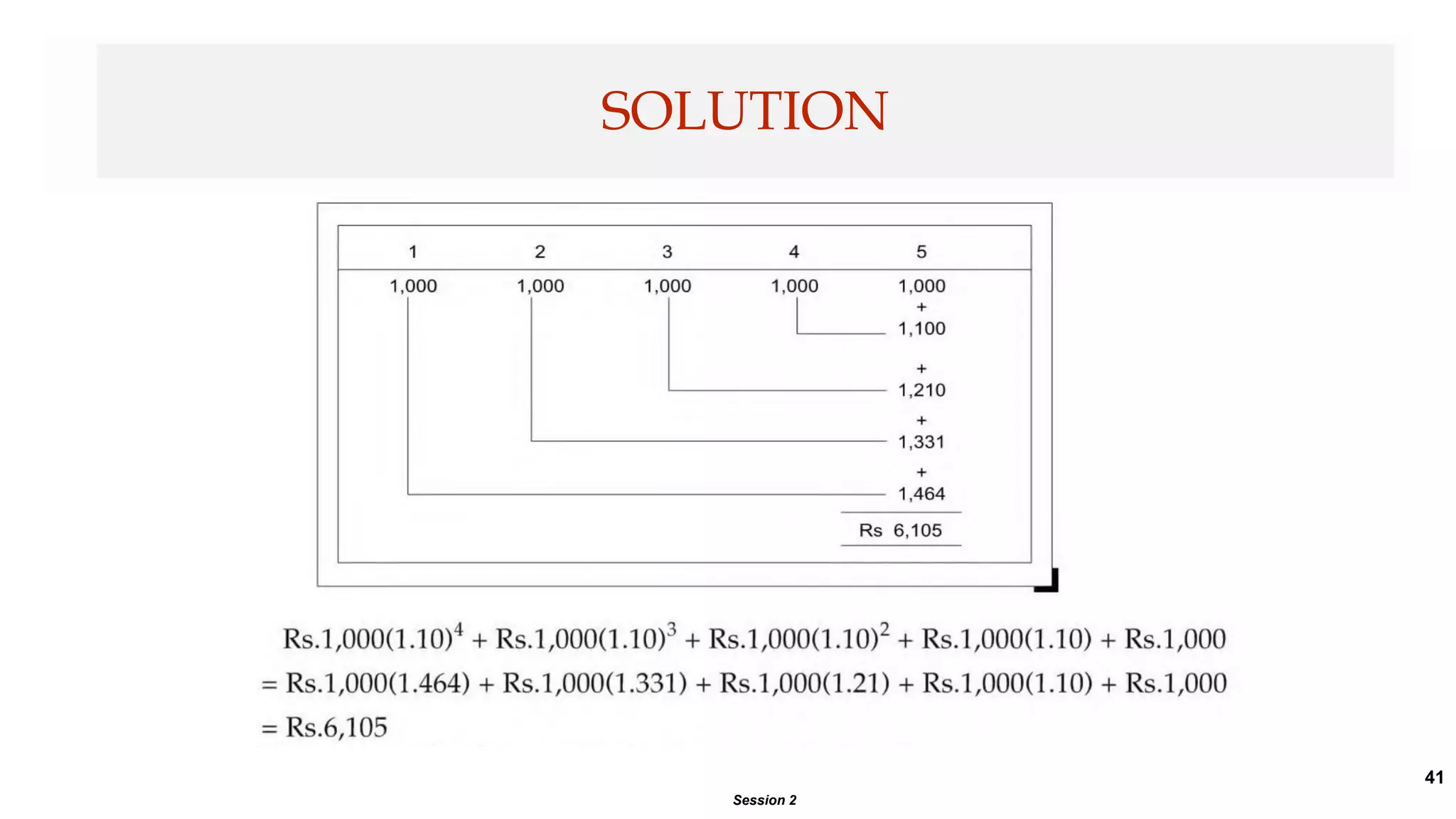

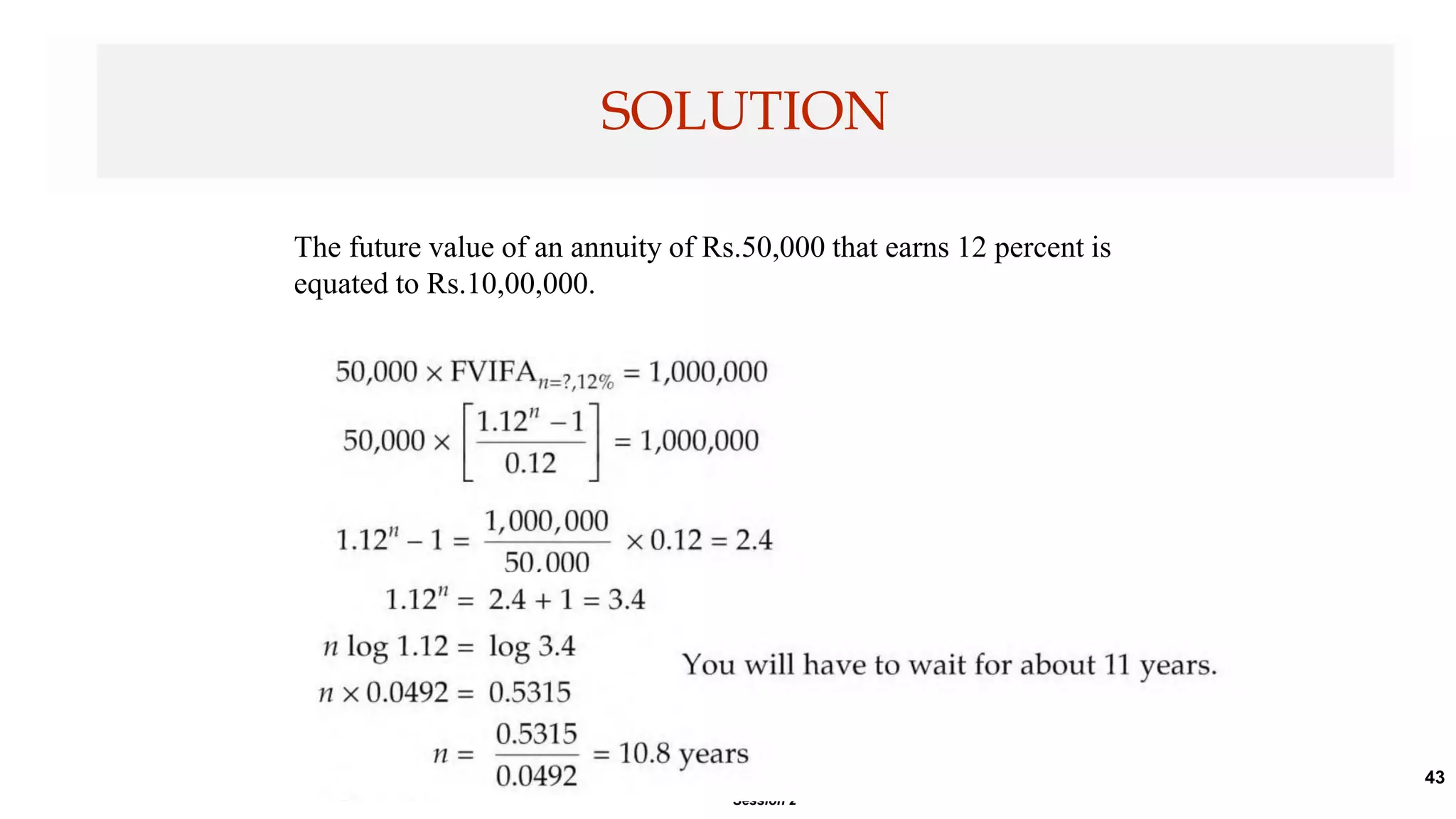

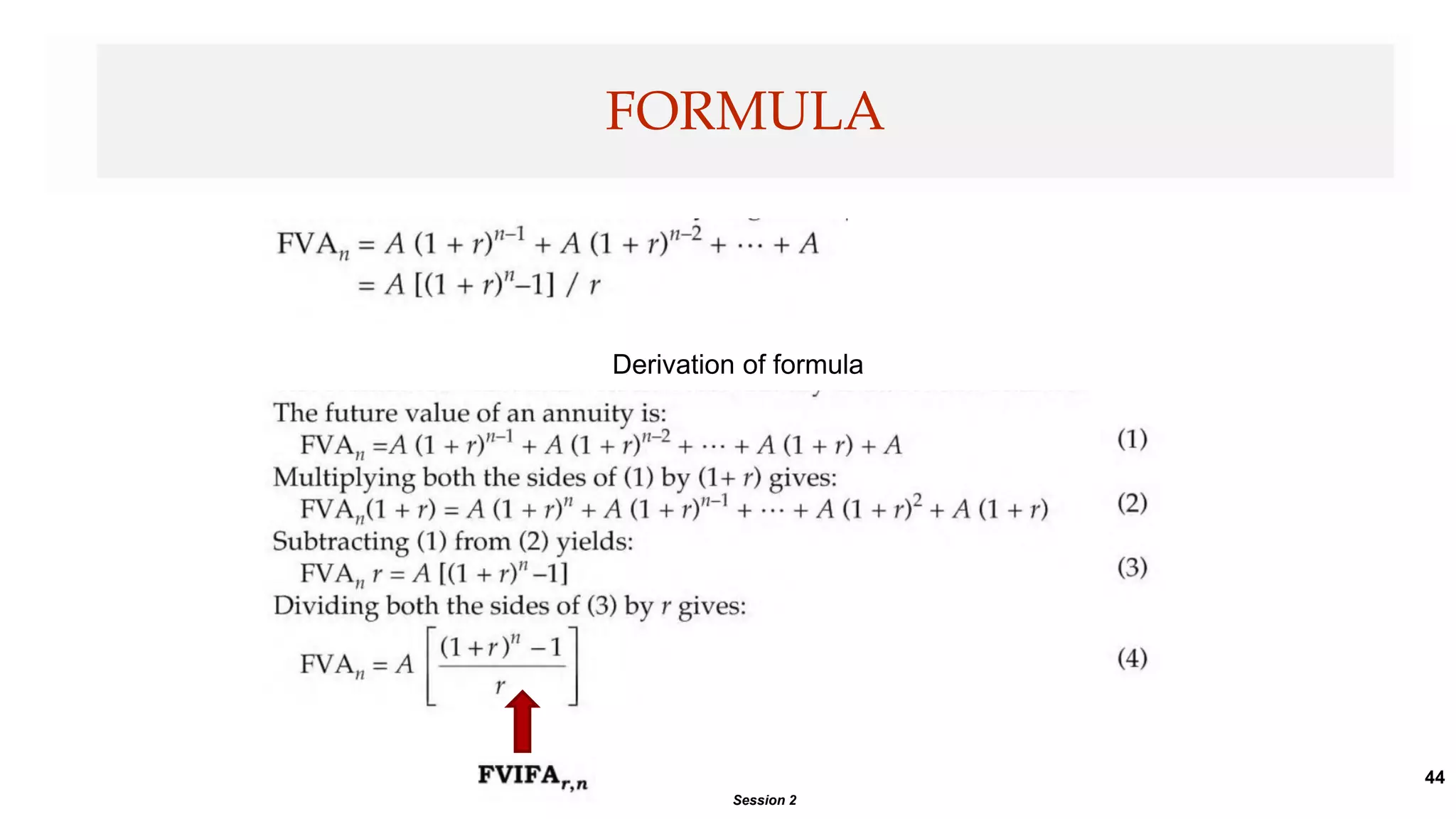

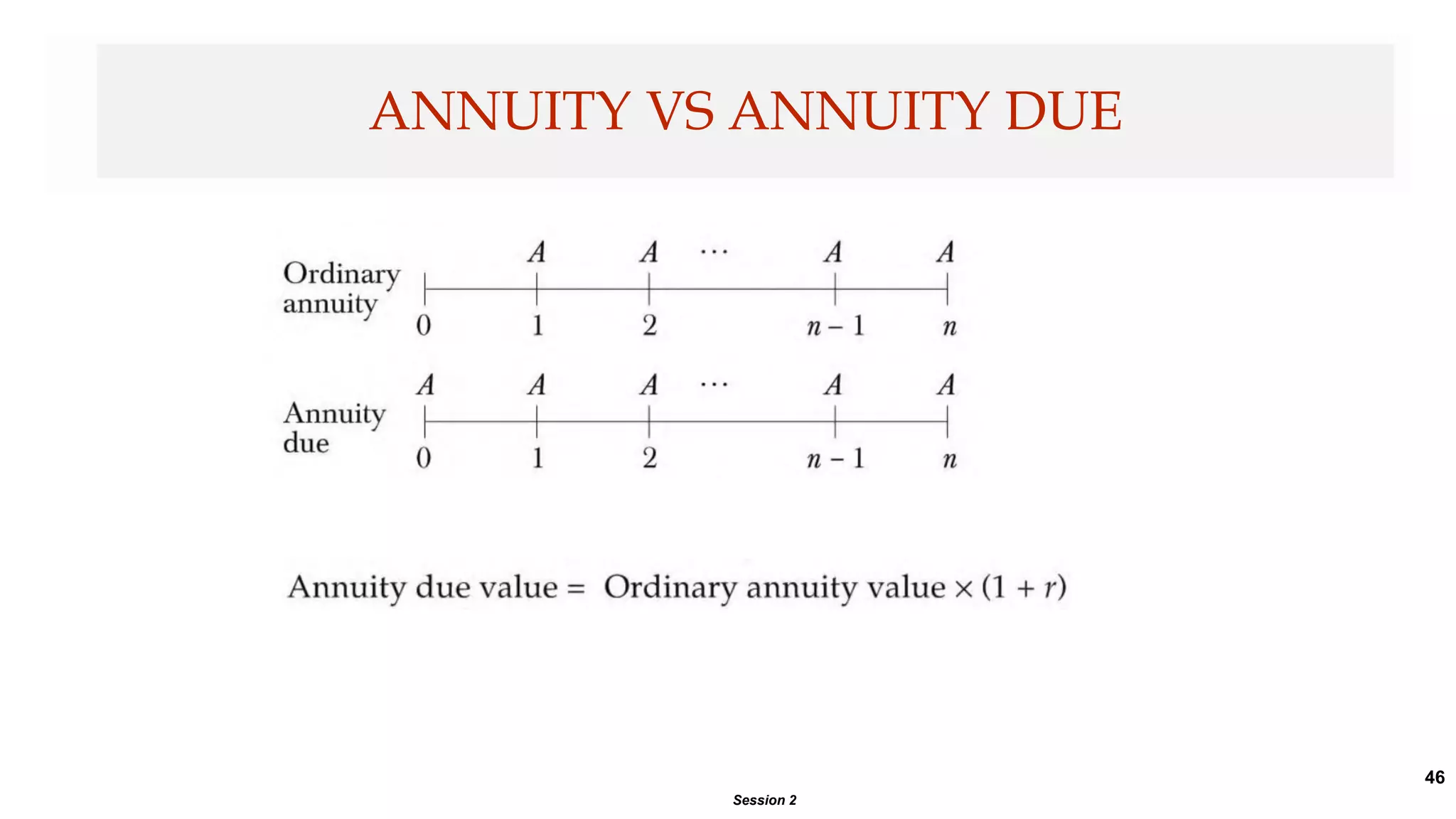

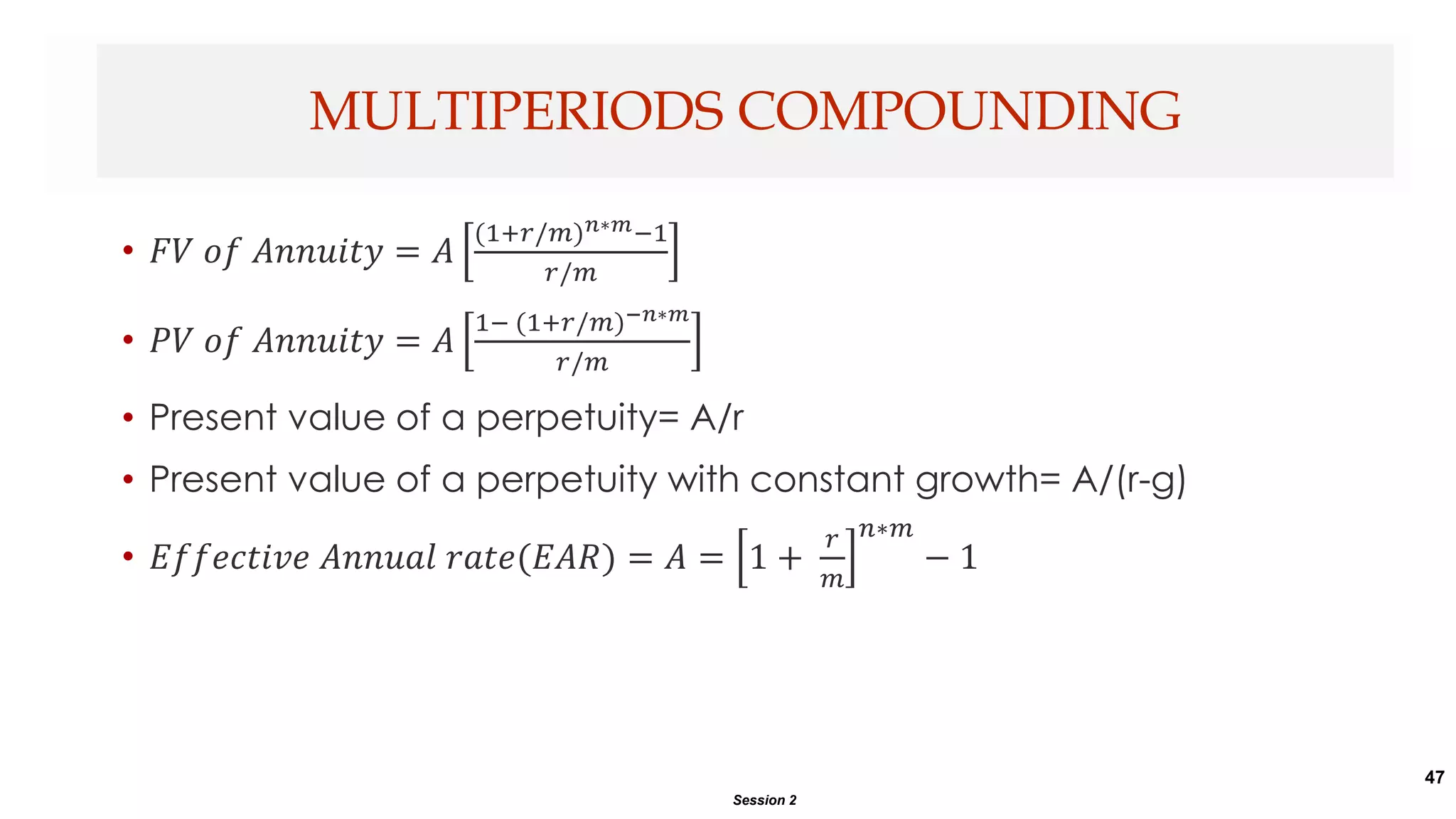

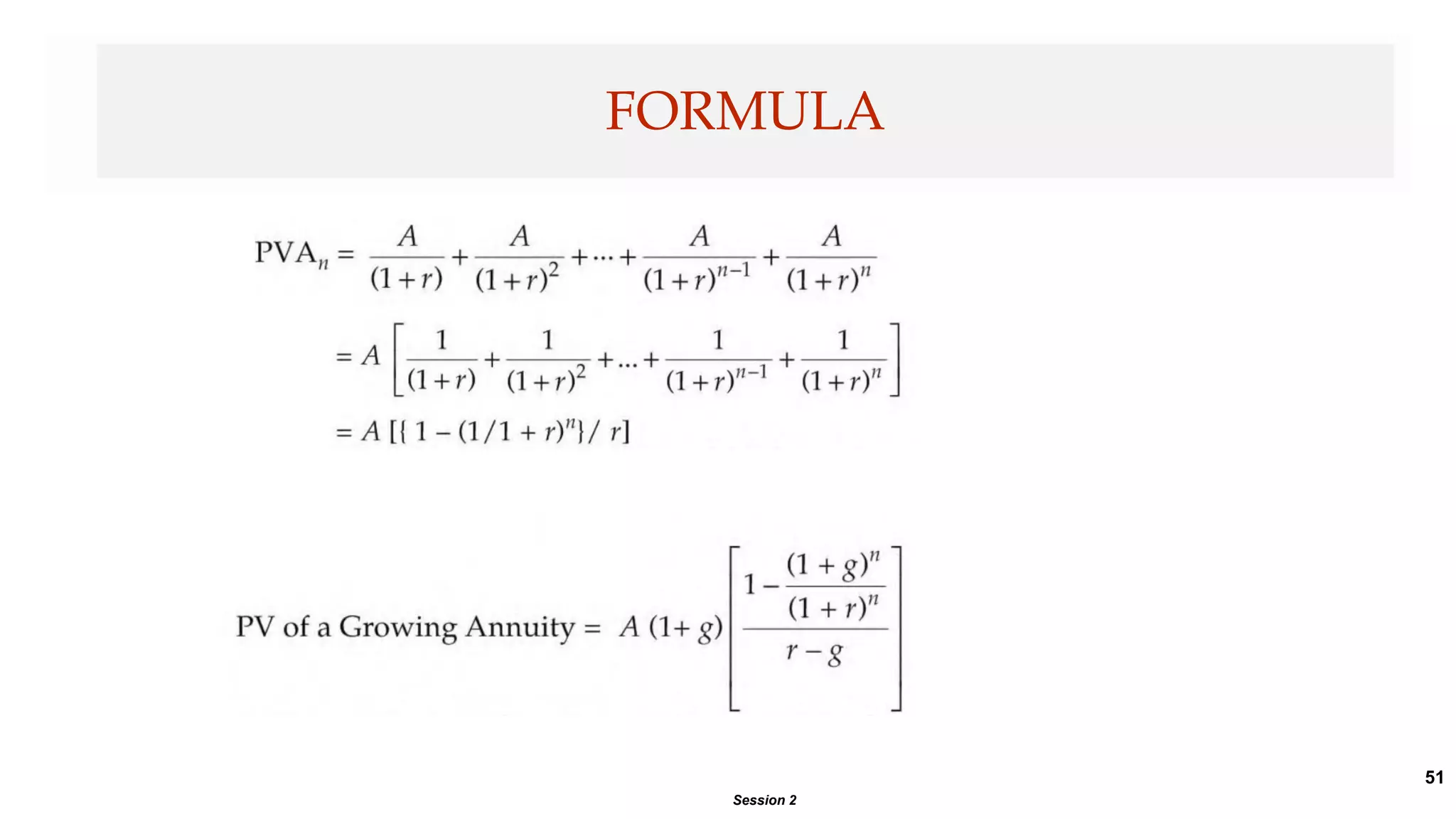

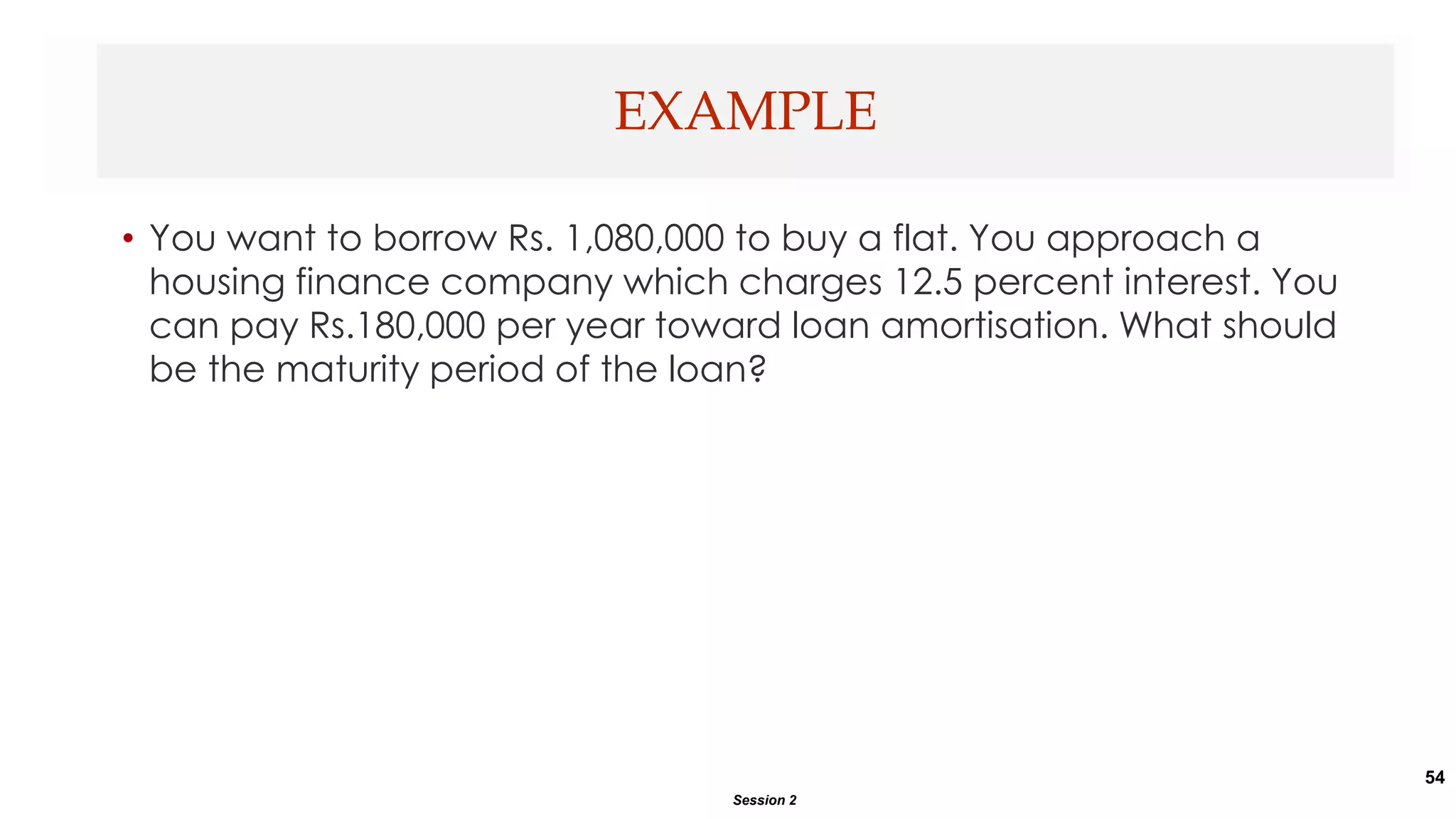

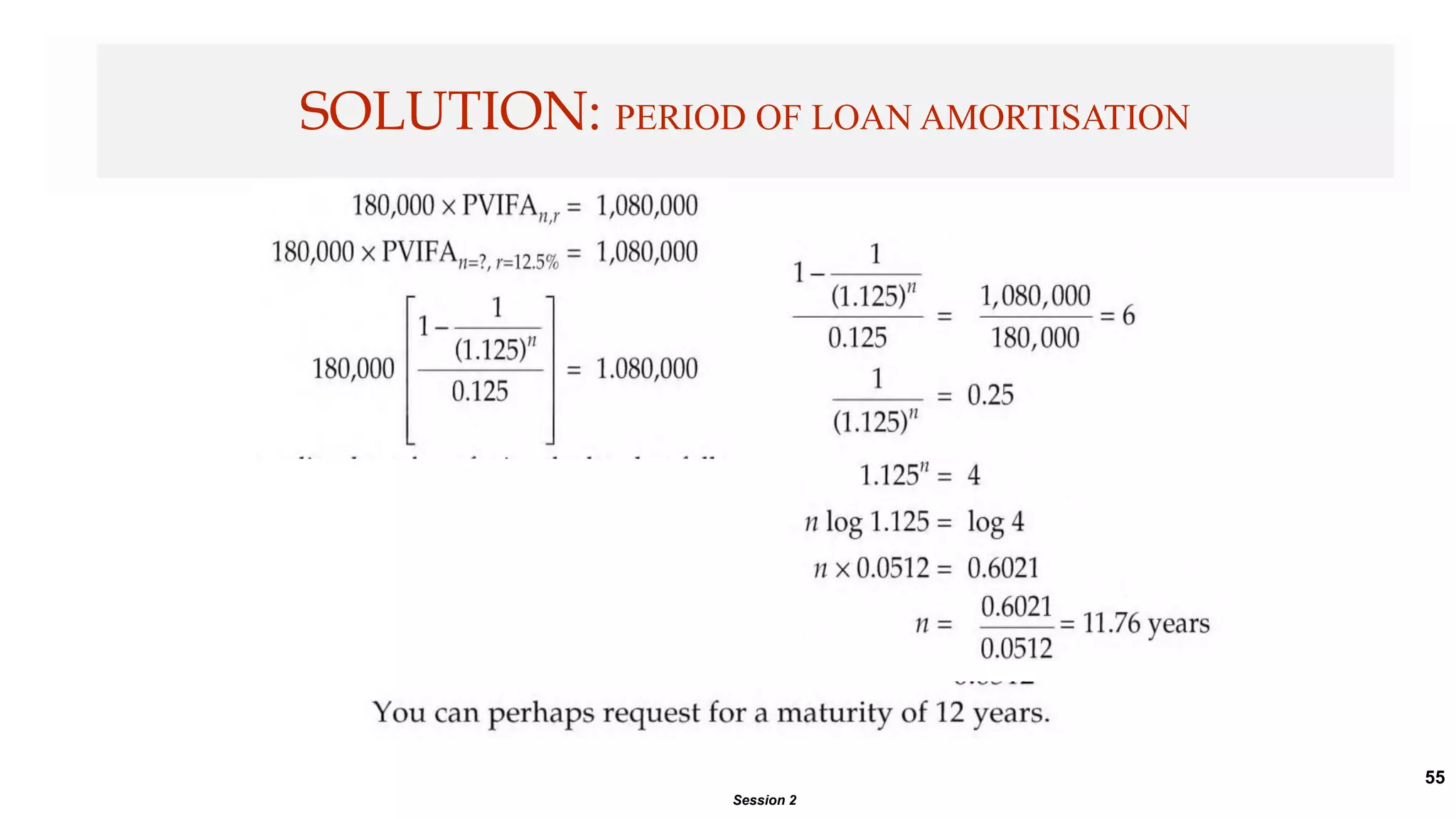

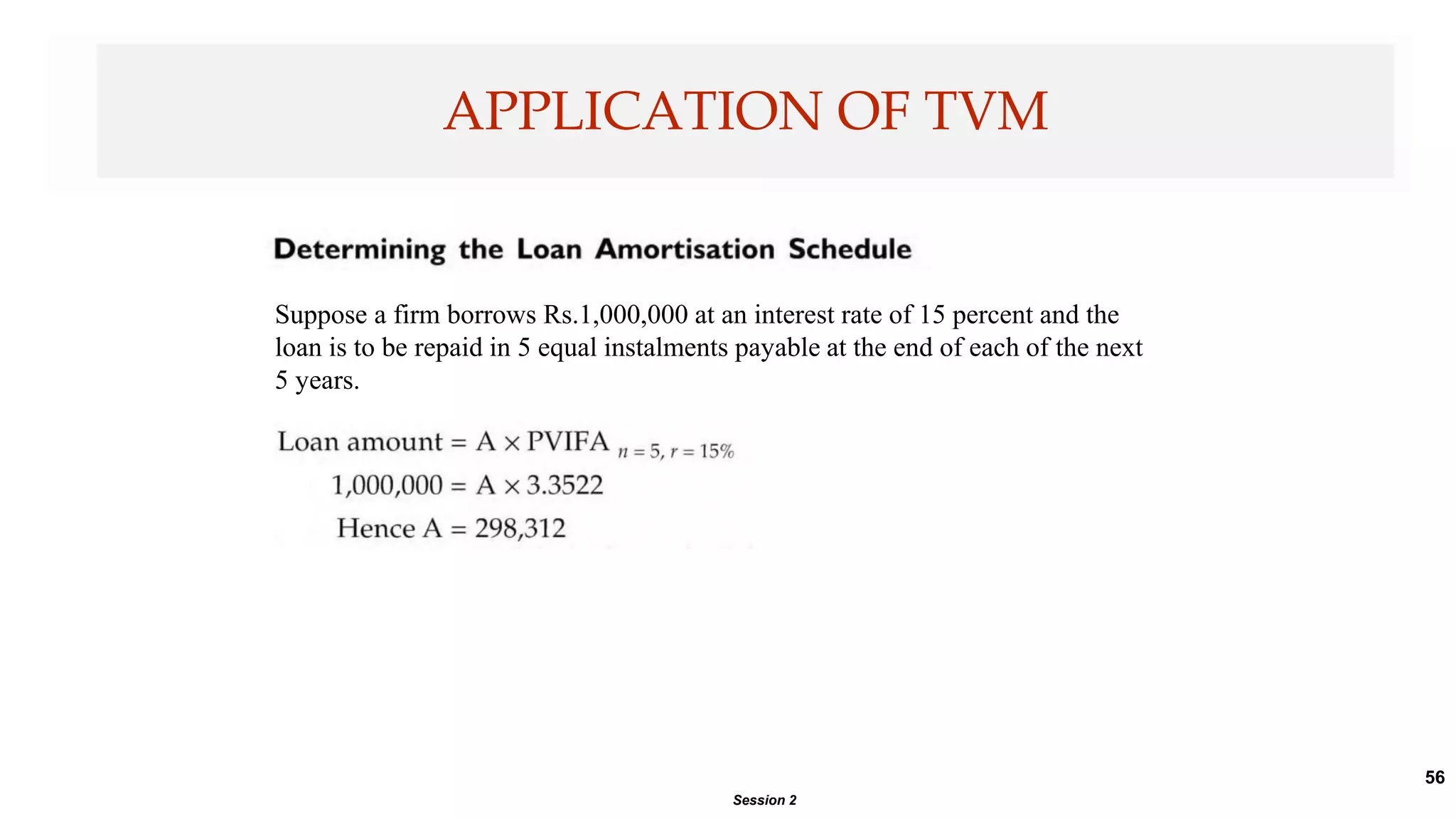

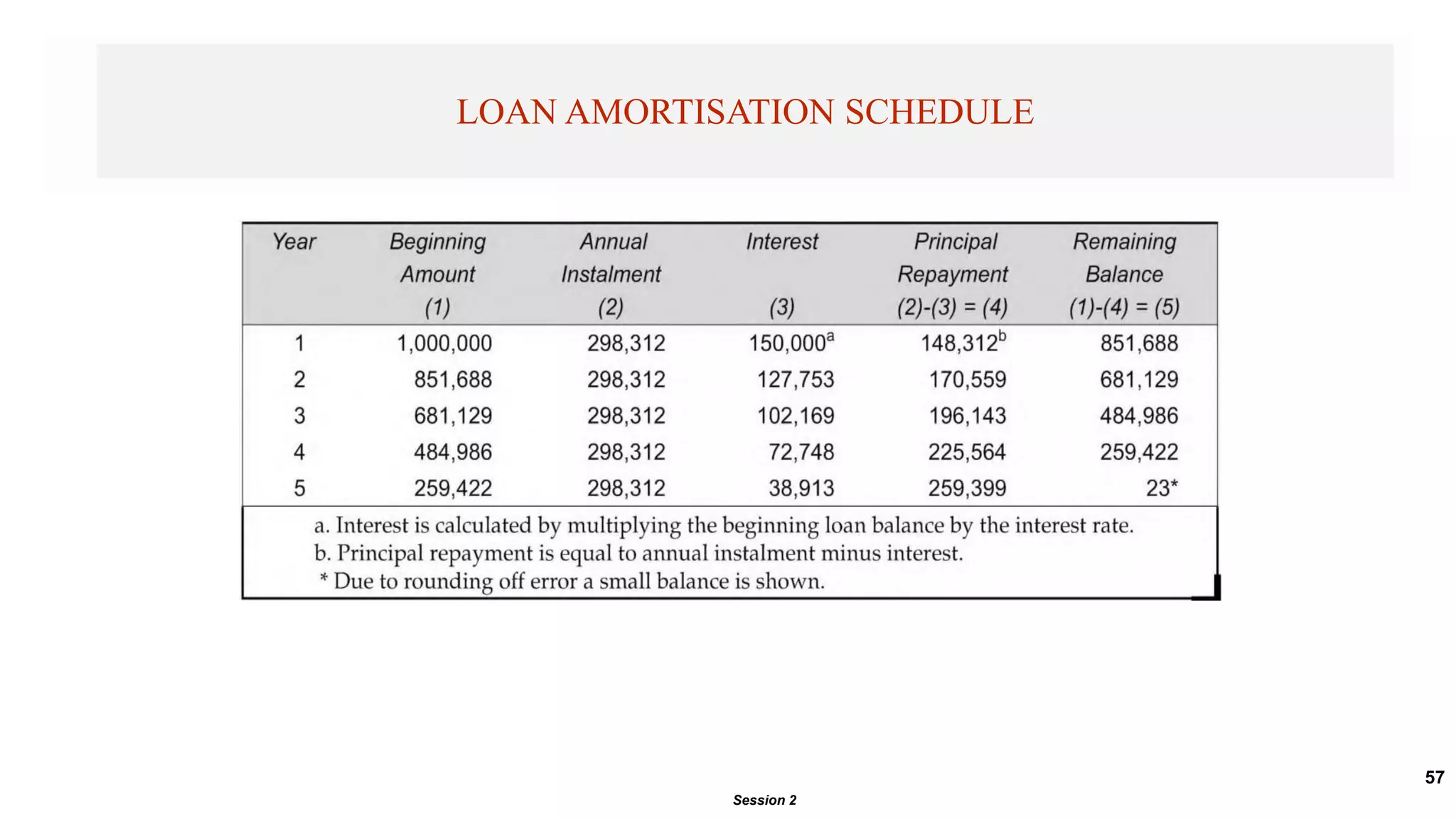

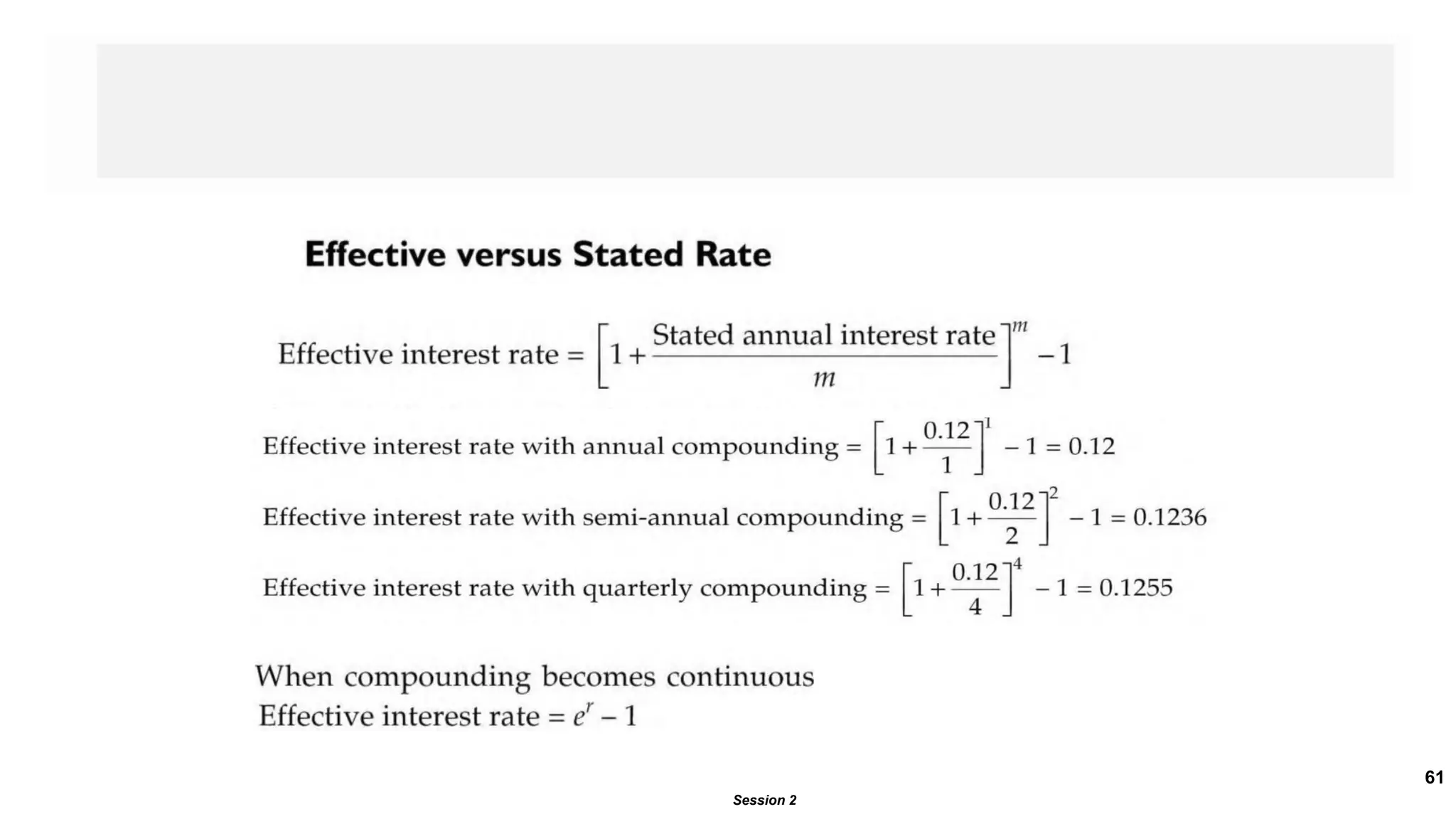

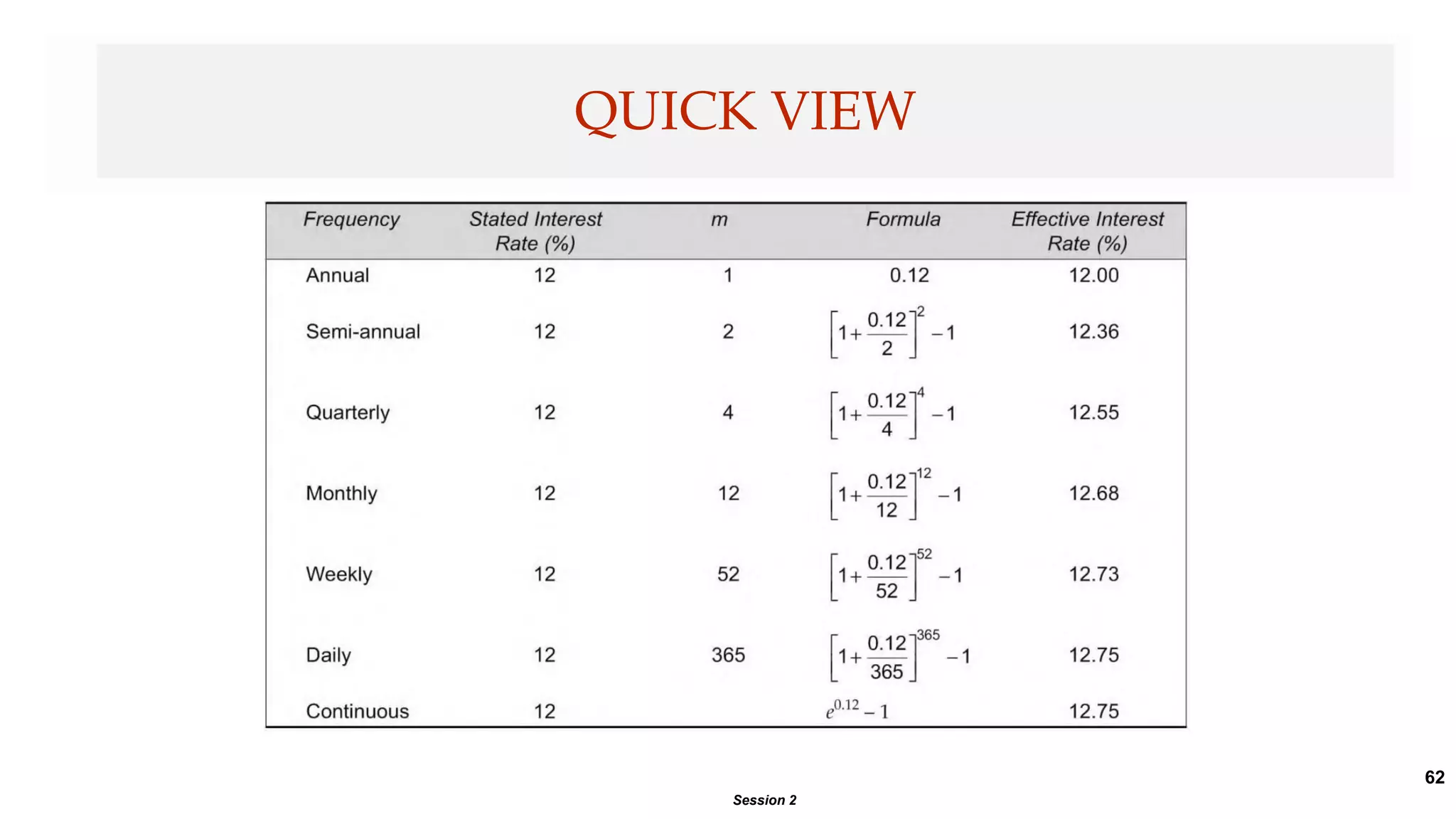

This document provides an introduction to time value of money concepts. It discusses key terms like future value, present value, compounding, discounting, and interest rates. Examples are provided to illustrate how to calculate future and present values using time value of money formulas. The document also covers topics like annuities, loan amortization, and using time value of money concepts to evaluate investment projects.