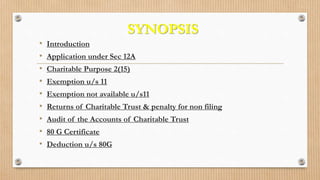

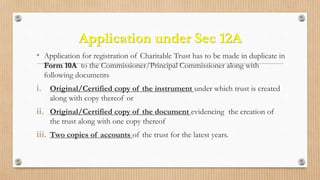

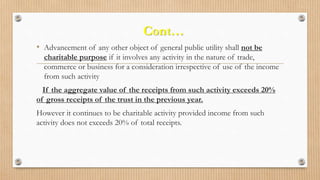

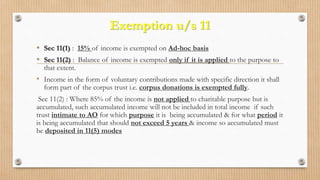

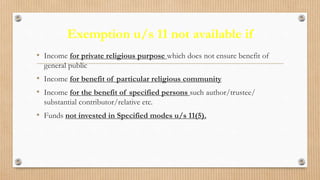

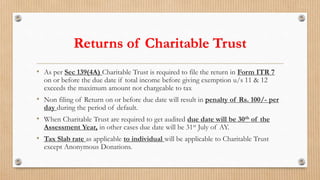

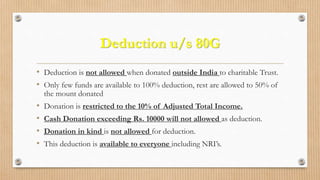

The document discusses taxation rules for charitable trusts in India. It explains that charitable trusts must be registered under section 12A of the Income Tax Act to receive tax exemptions under sections 11 and 12. It outlines the application process and defines charitable purposes. It also discusses exemption eligibility, filing requirements, audit rules, and sections 80G and 80G that allow donors to receive deductions for donations to registered trusts.