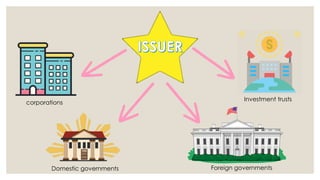

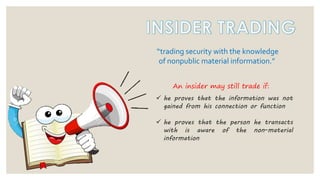

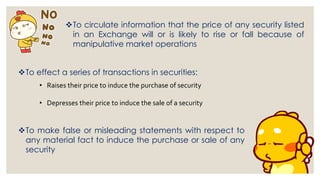

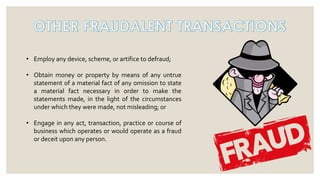

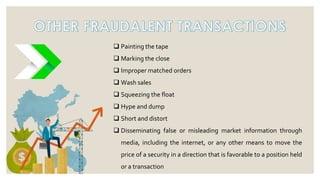

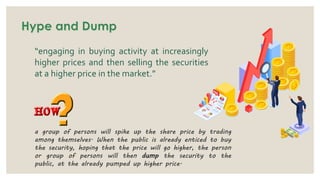

The Securities Regulation Code establishes rules for regulating securities transactions in the Philippines. It was enacted in 2000 and divides regulations into 13 chapters covering topics like insider trading, market manipulation, and disclosure requirements. The code aims to protect investors, encourage stock ownership, and promote fair securities markets. Key provisions address registration of securities offerings, prohibitions on fraudulent or manipulative practices, and restrictions on trading by corporate insiders using non-public information. Violations can lead to civil and criminal penalties including large fines and imprisonment.