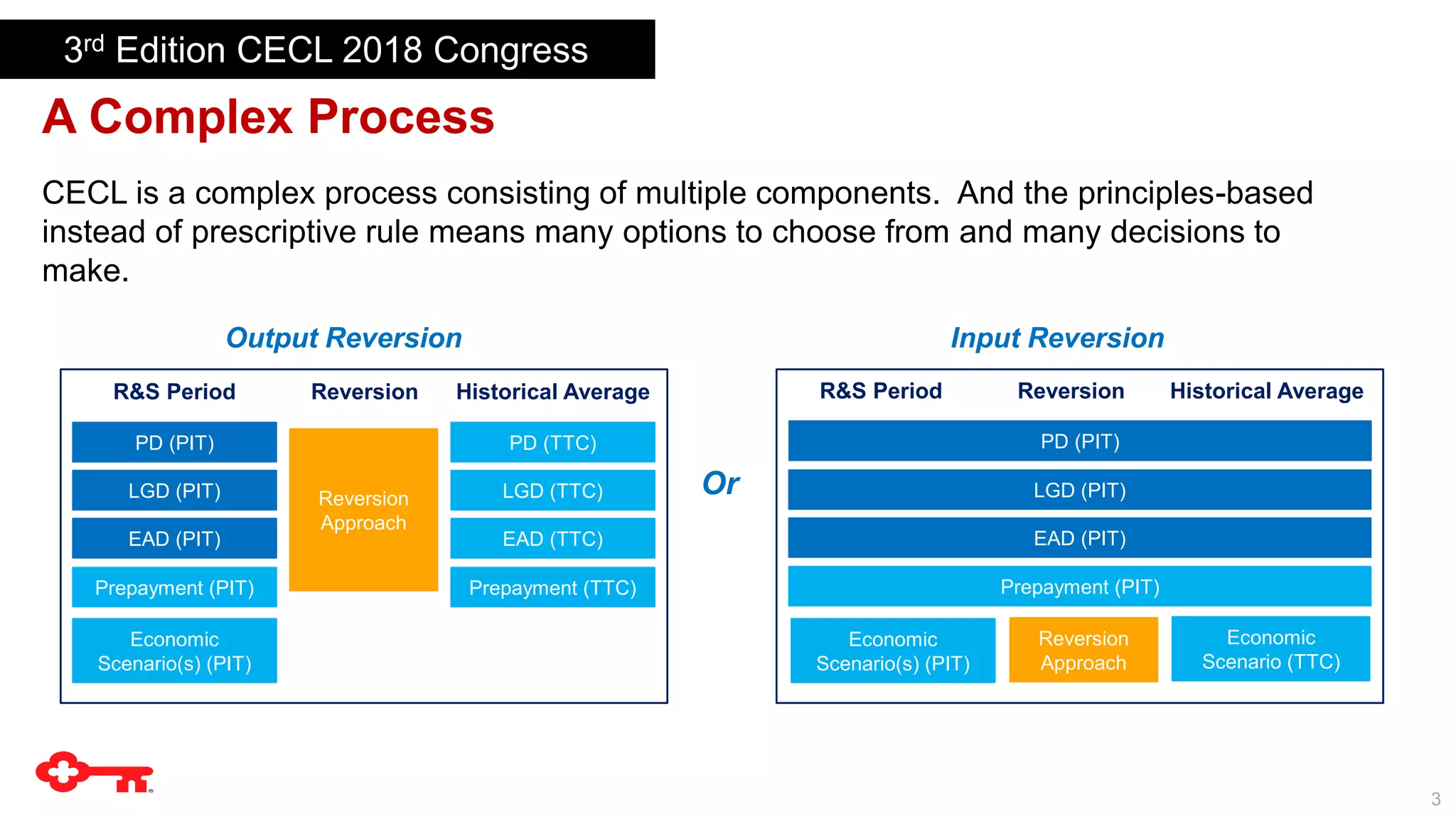

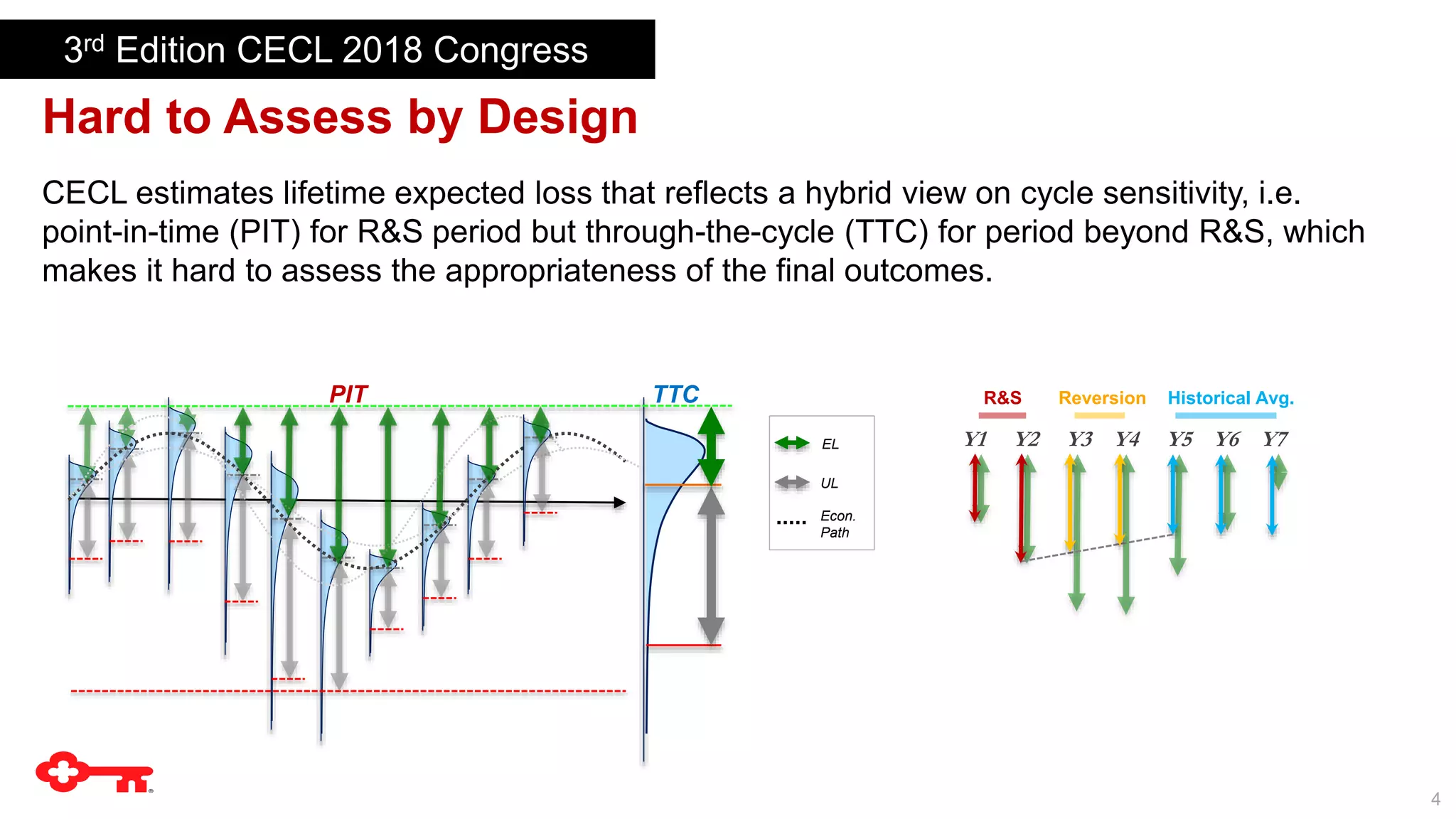

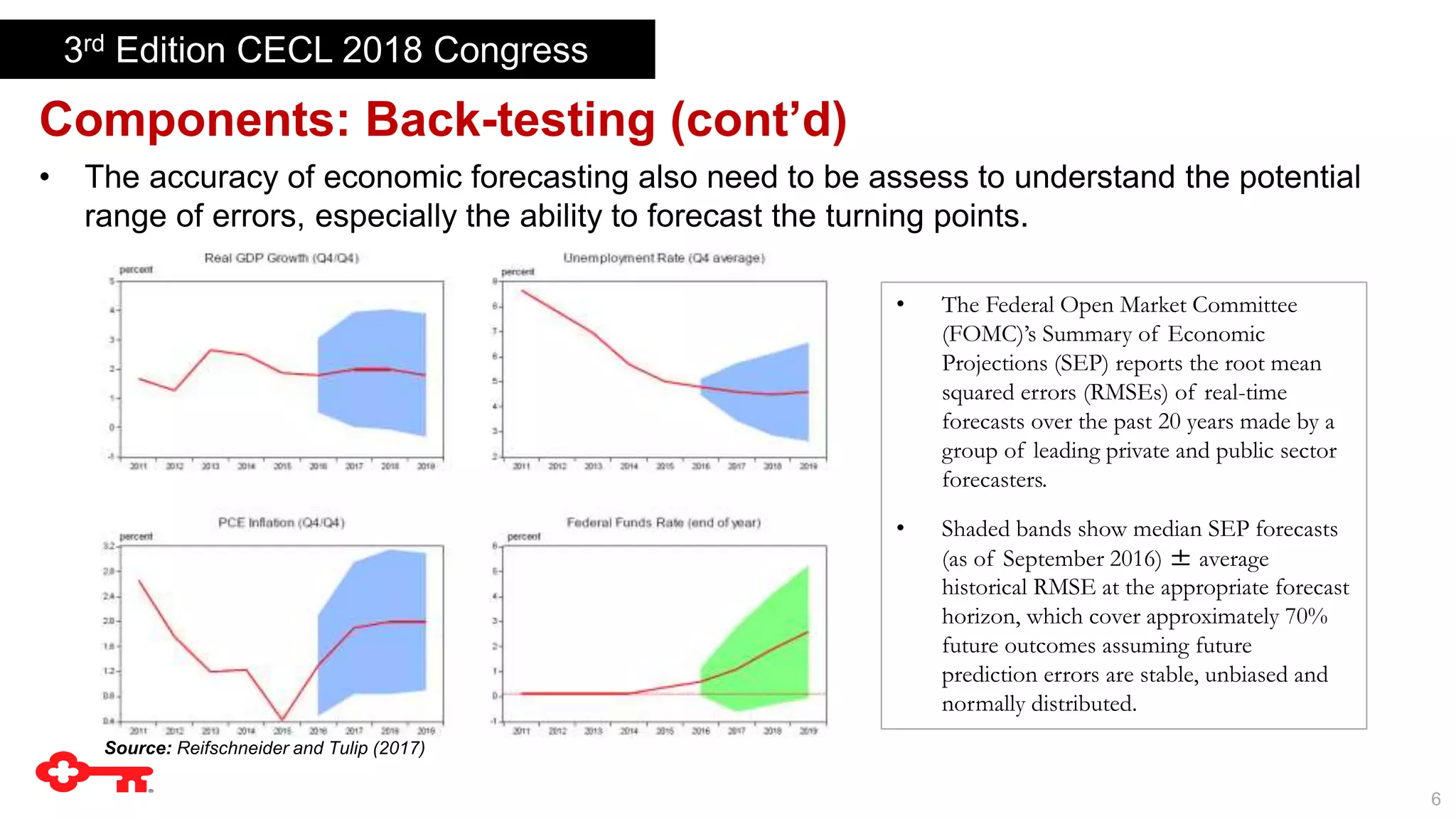

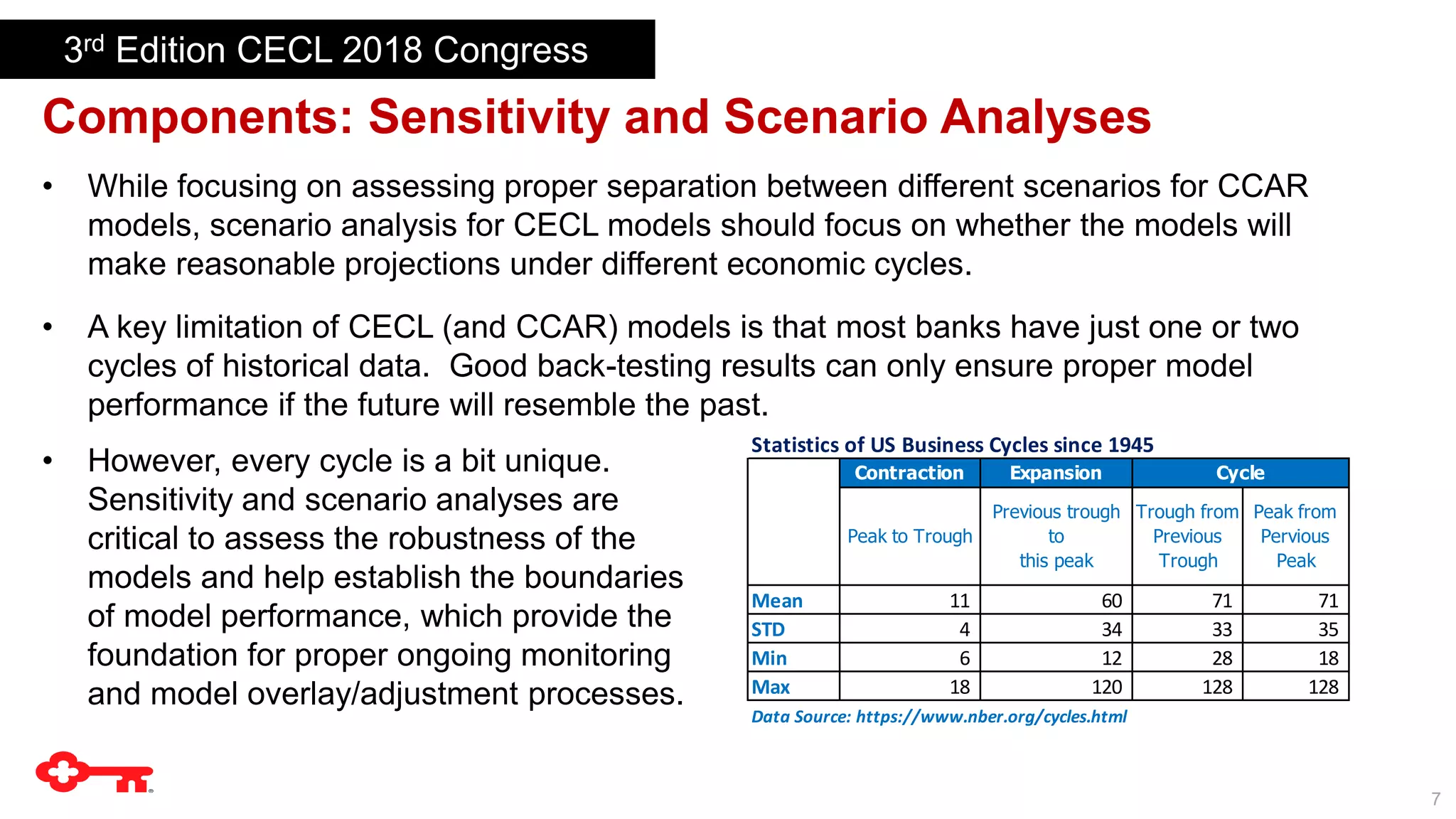

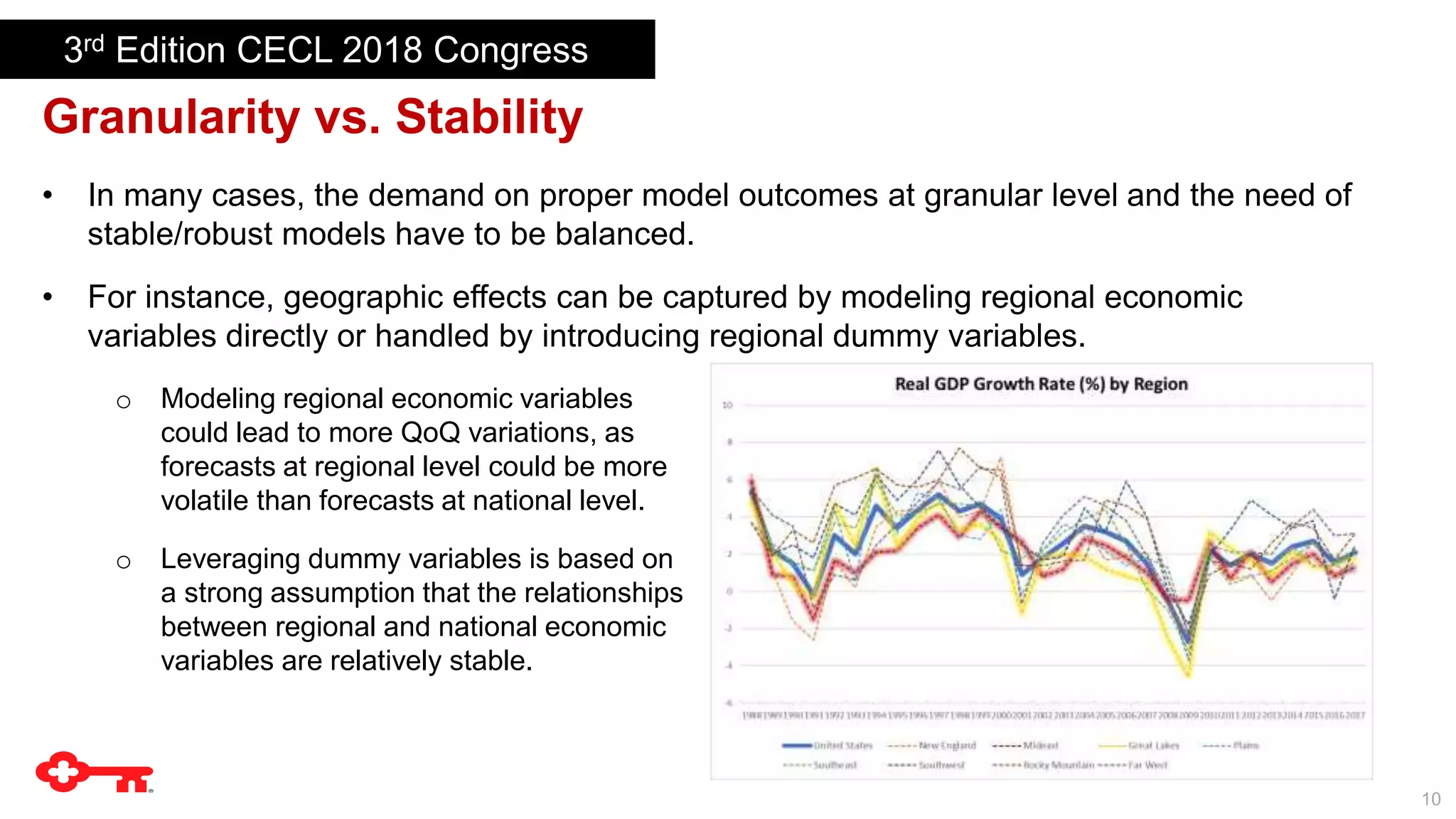

This document summarizes a presentation about assessing CECL models. It discusses that CECL requires estimating lifetime expected credit losses using multiple components and economic scenarios, which makes the models complex and outcomes difficult to assess. It emphasizes that back-testing, sensitivity analysis, and scenario analysis are important to evaluate whether the models perform reasonably under different economic conditions and assess the impact of assumptions. It also stresses the need to review outcomes and test assumptions at granular levels by risk drivers and perform qualitative adjustments through model risk management.