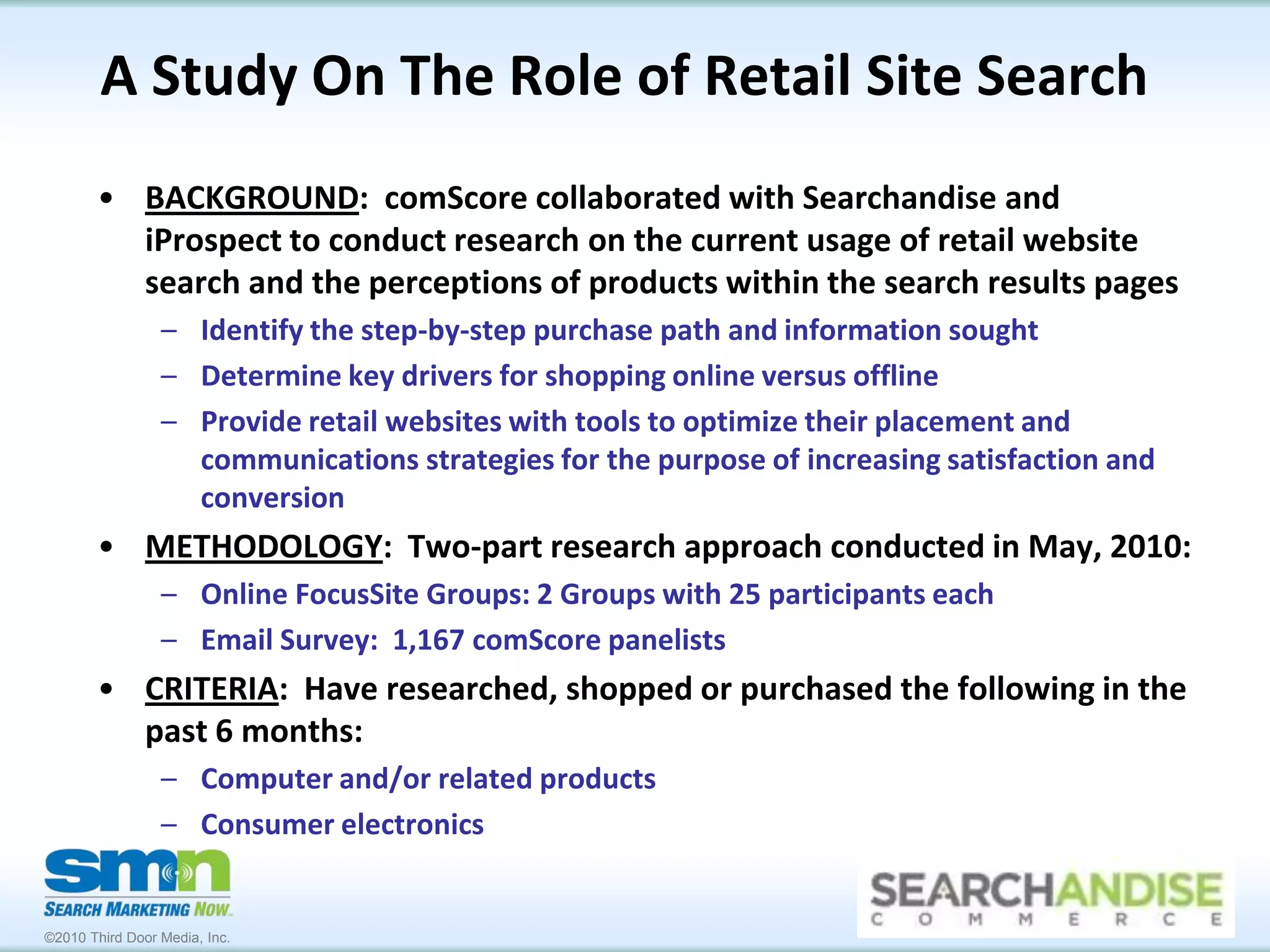

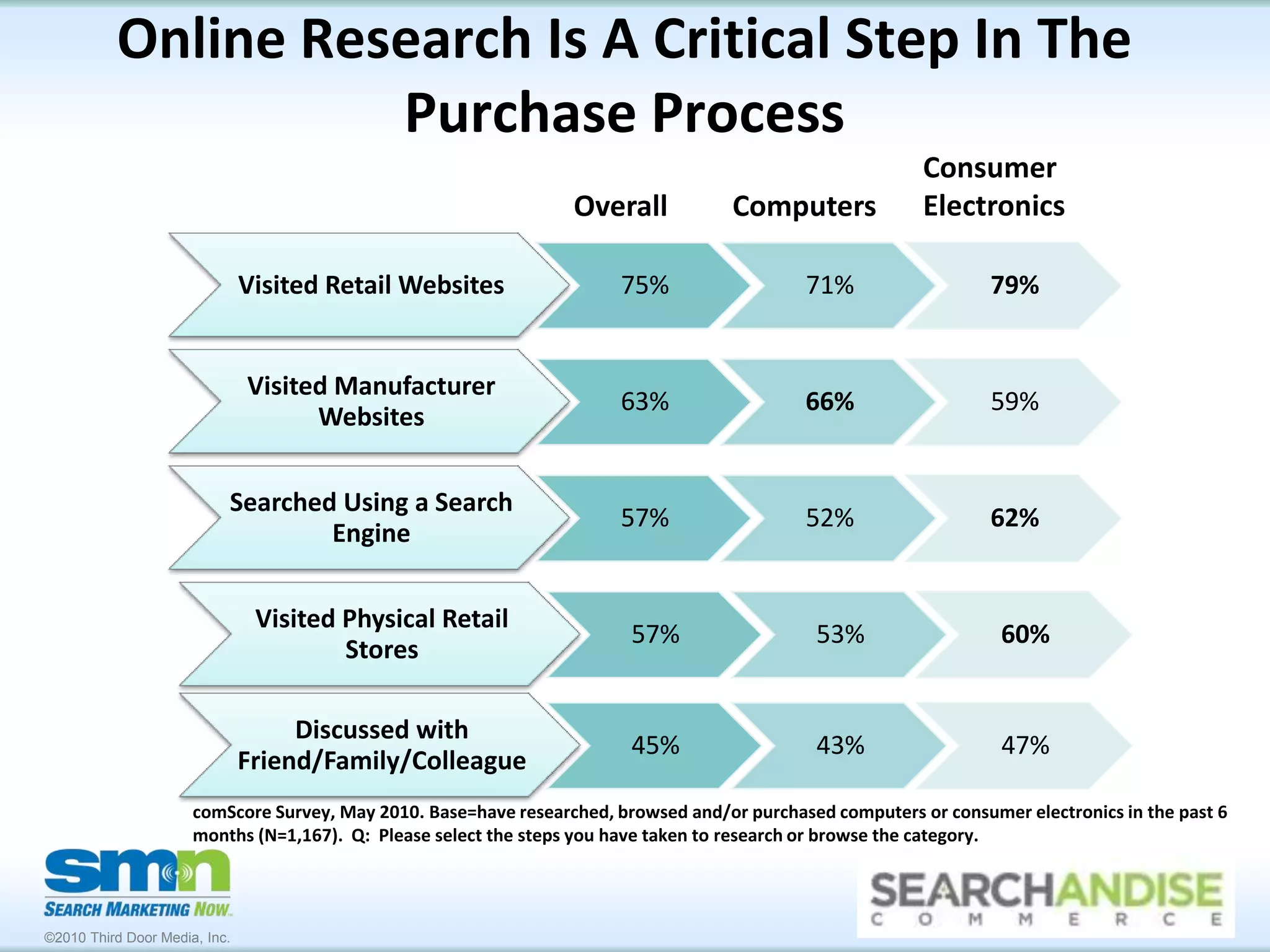

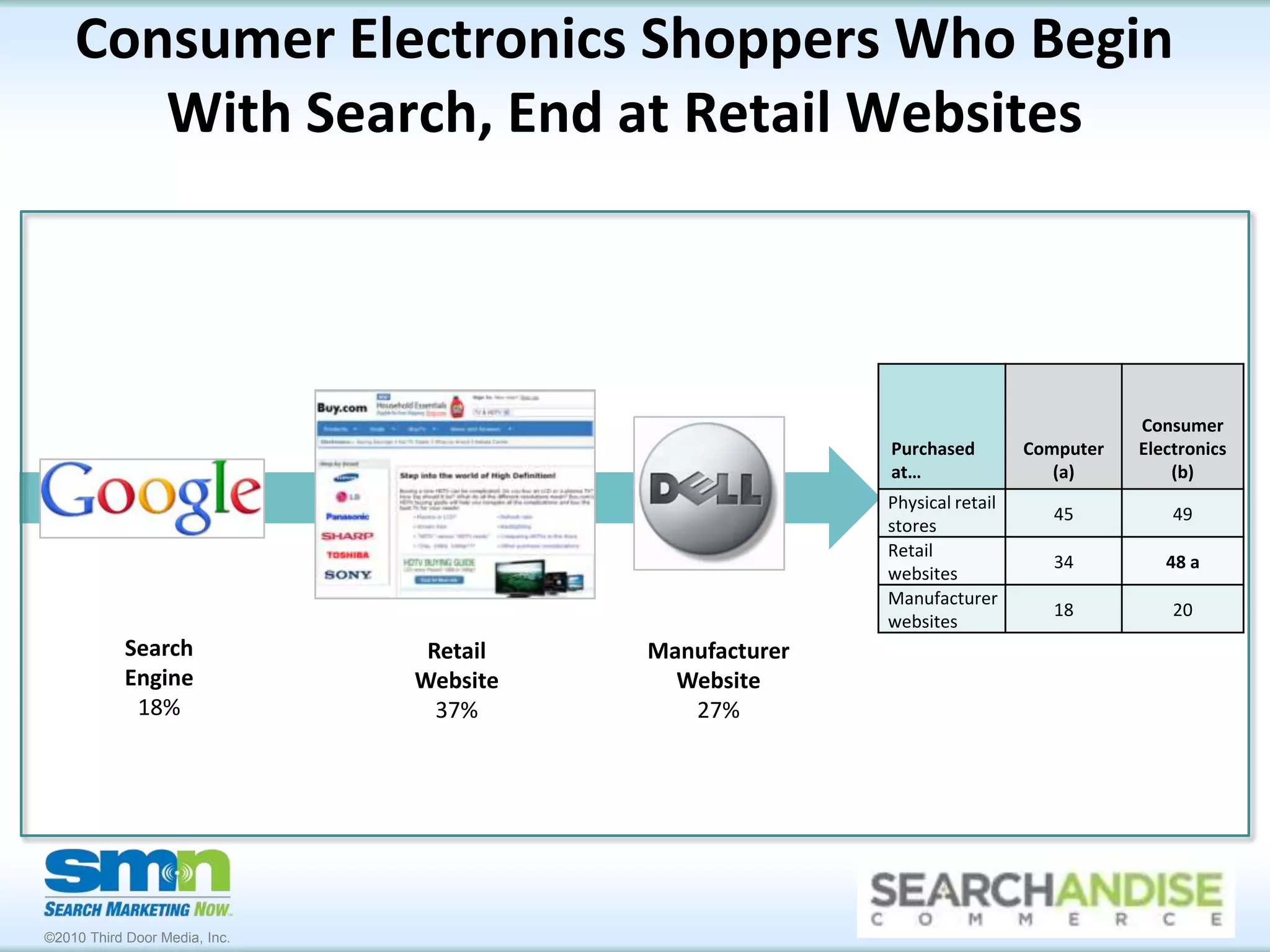

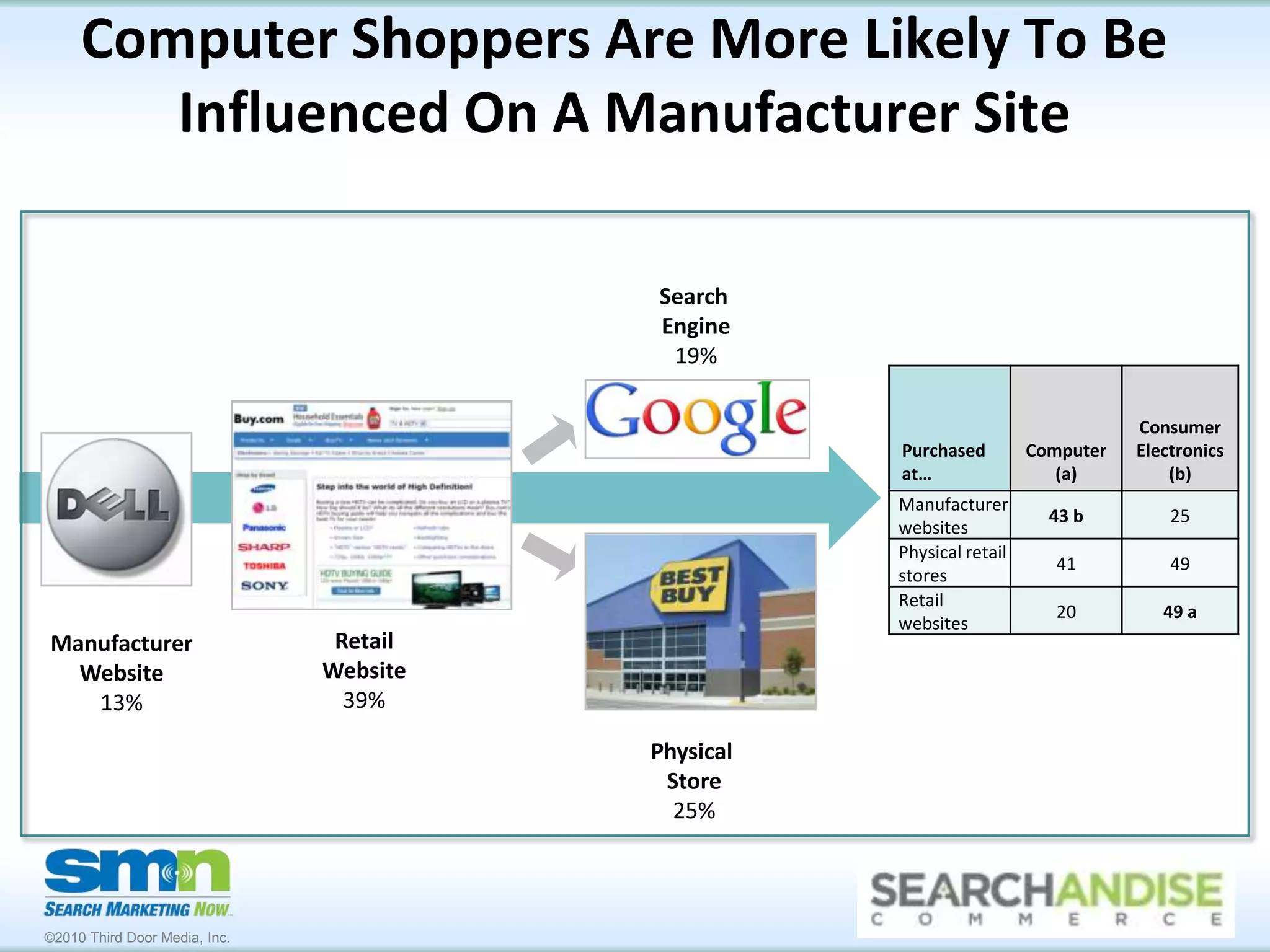

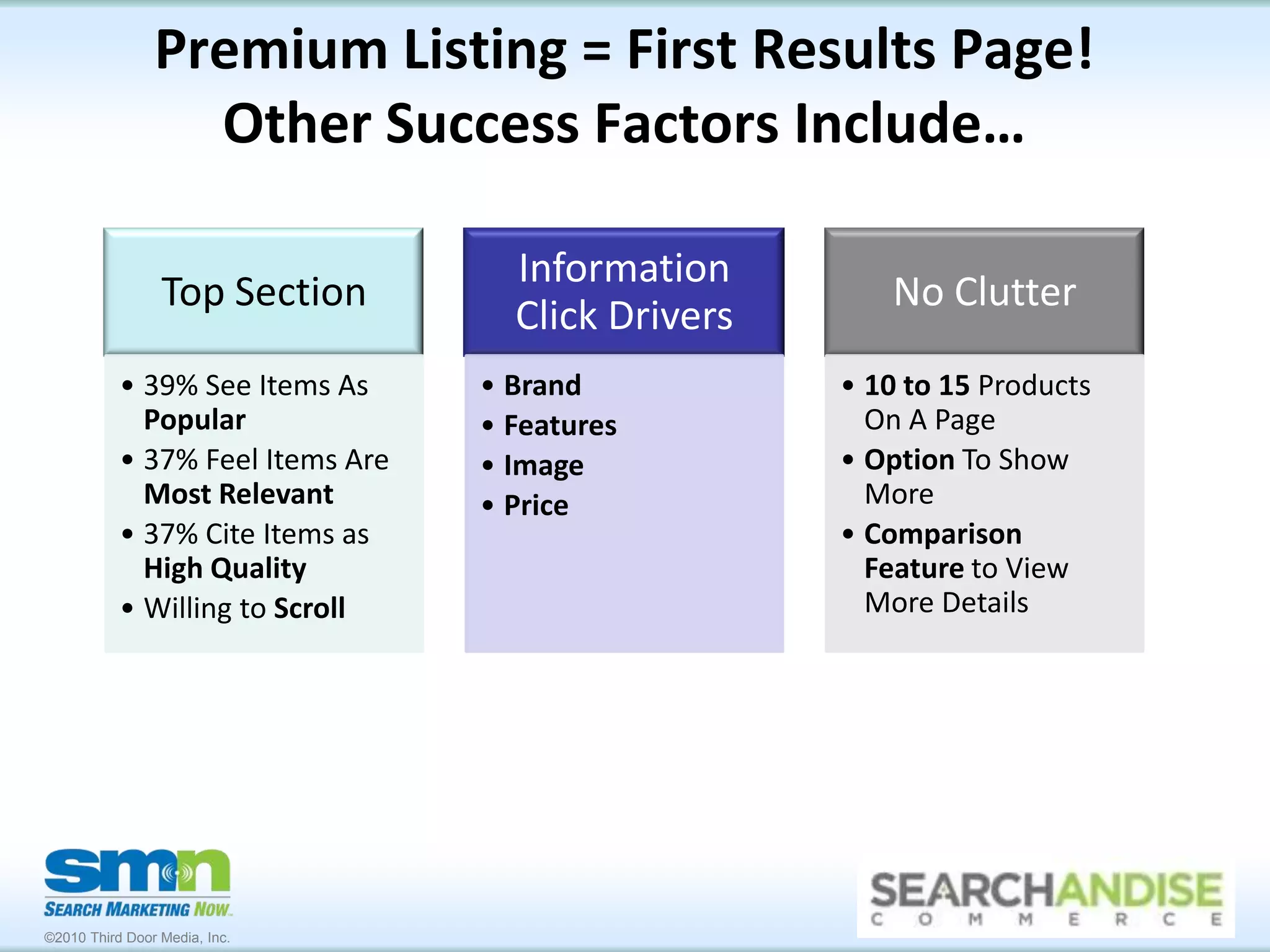

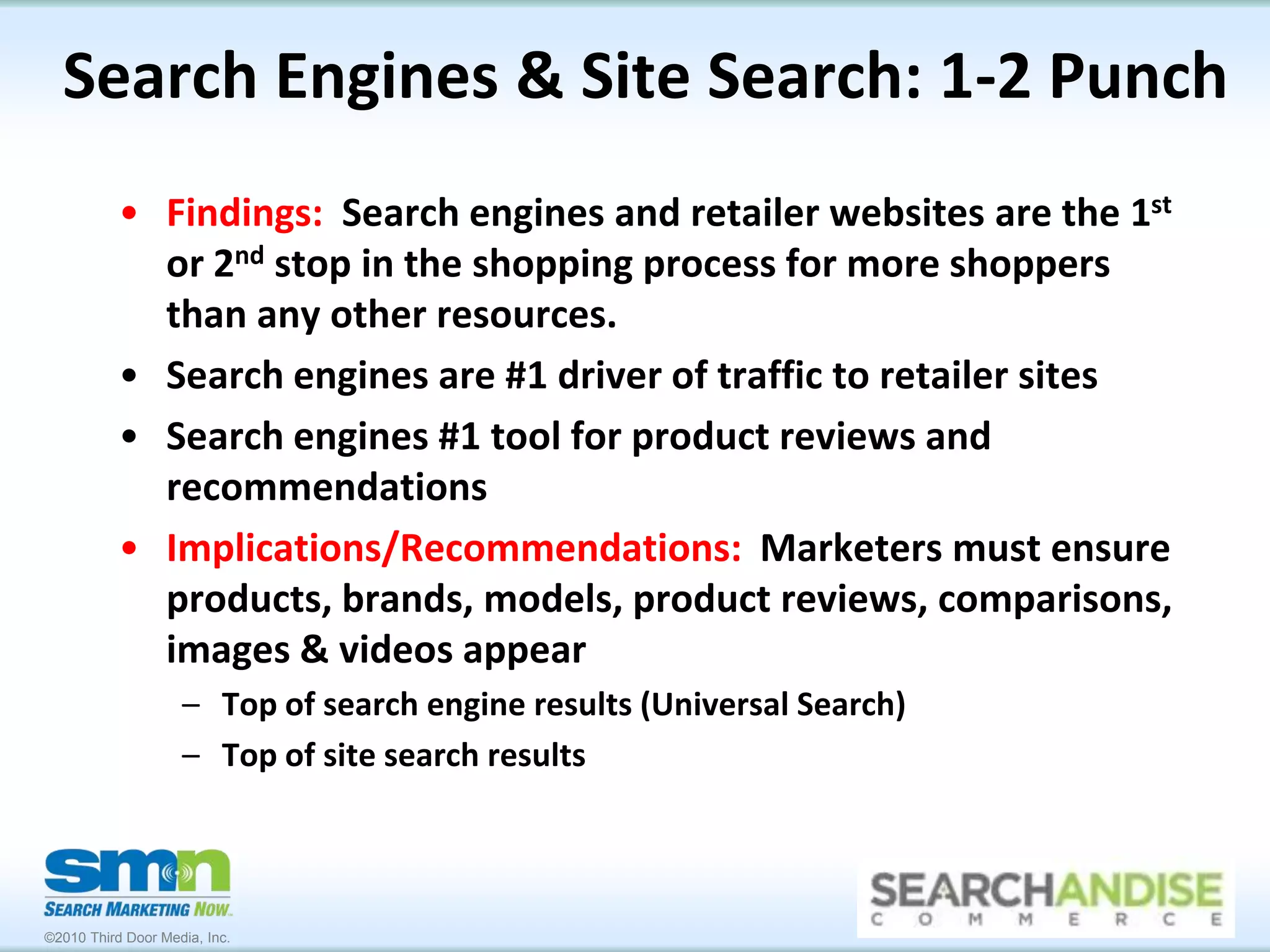

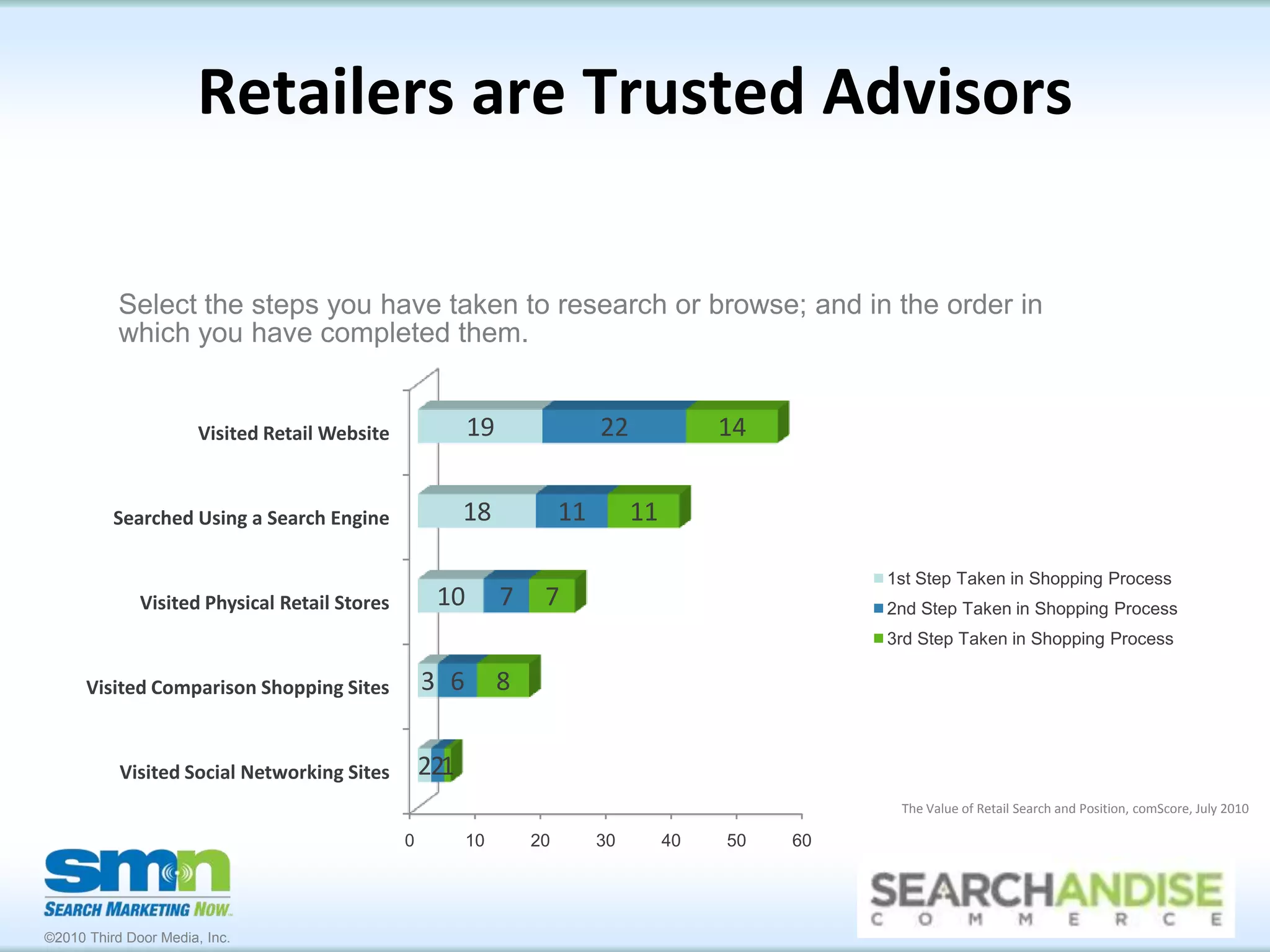

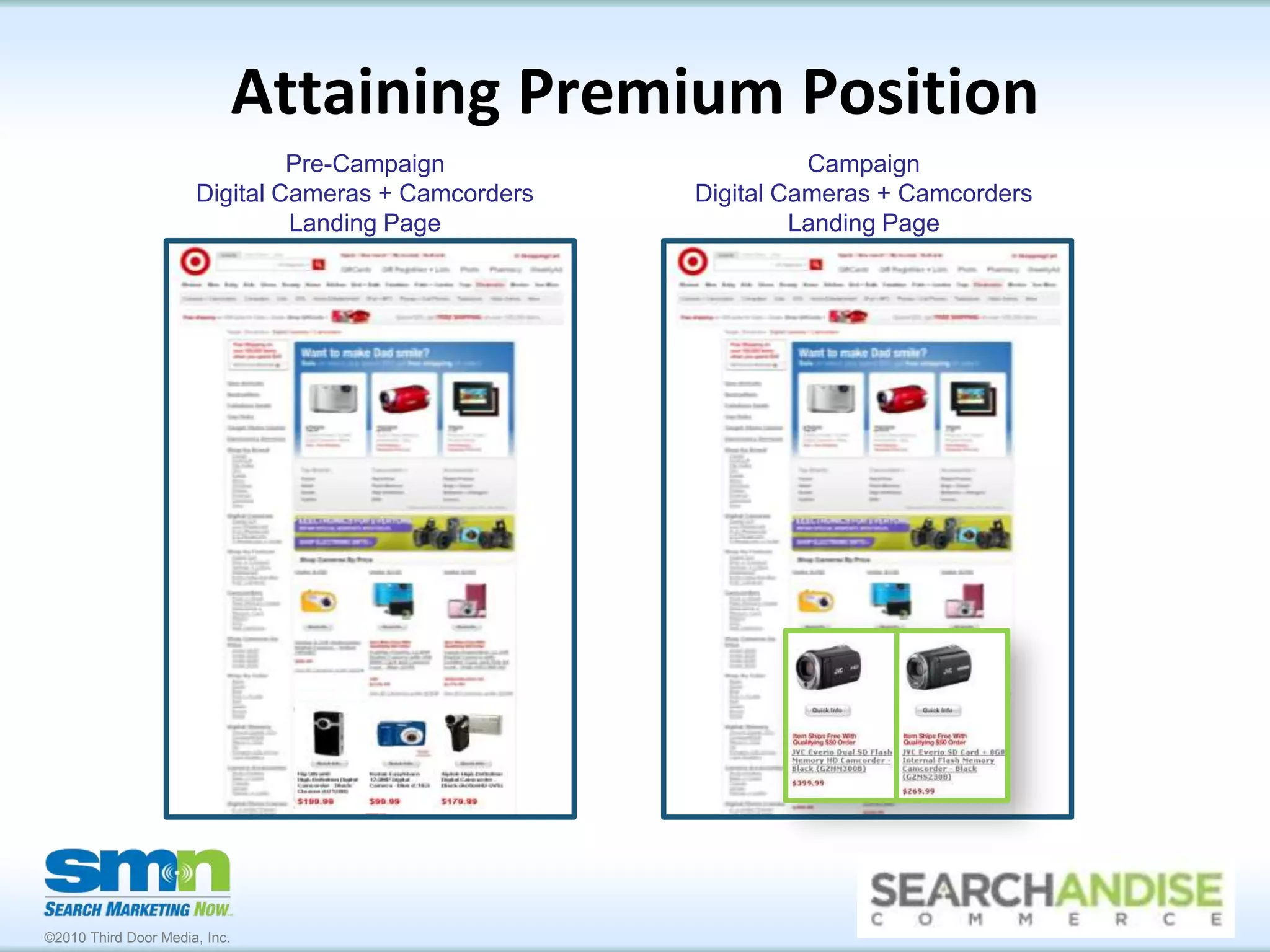

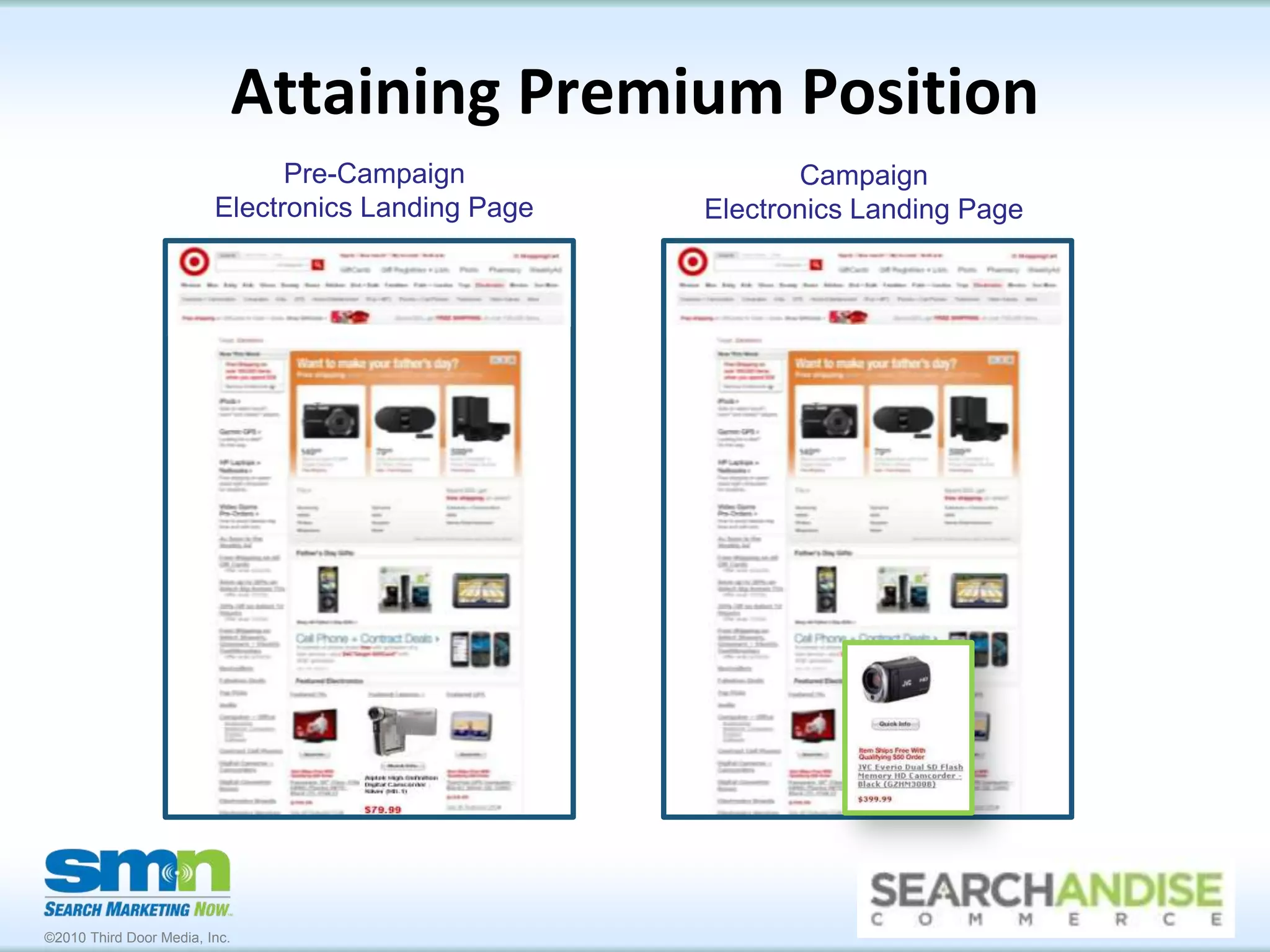

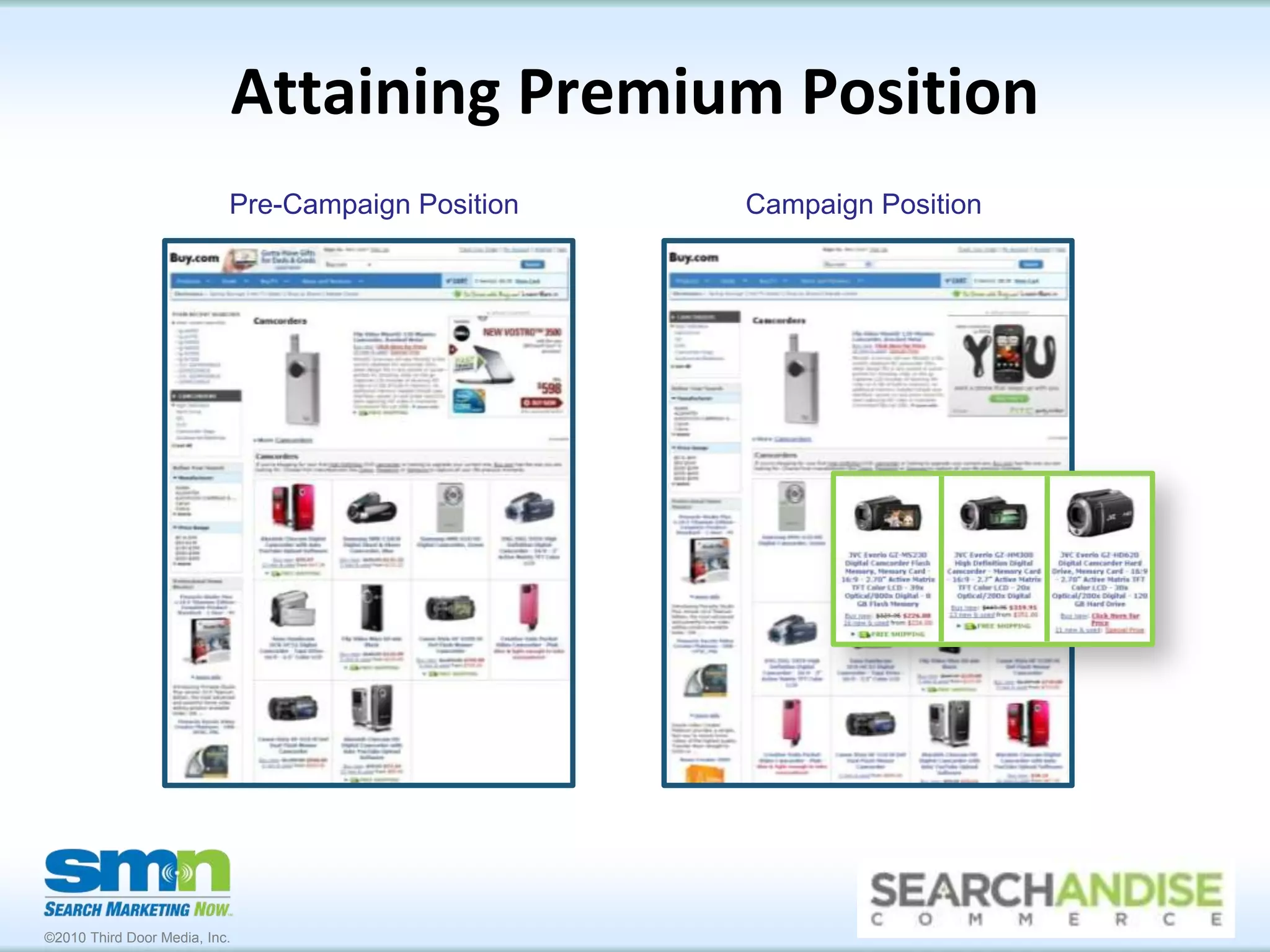

The document summarizes key findings from a research study on how online consumers search for and purchase products from retail websites. It finds that (1) retail website search and search engines are the top ways consumers begin their product research, (2) search results positioning strongly influences what products consumers perceive as most relevant and of higher quality, and (3) marketers should work to attain premium positioning on retail search results pages to boost visibility and increase sales. The document also provides recommendations on how retailers and product marketers can better meet consumer preferences for information and optimize their search marketing strategies.