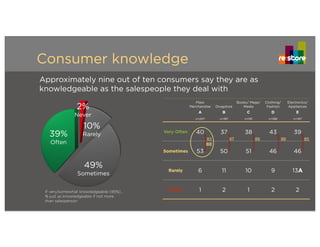

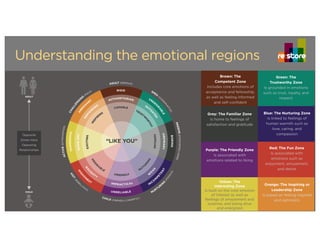

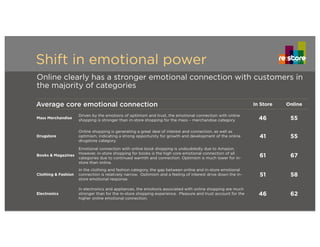

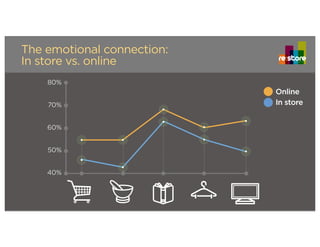

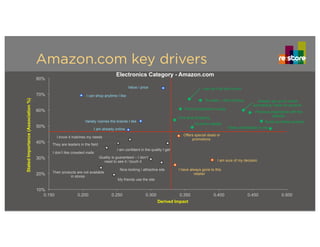

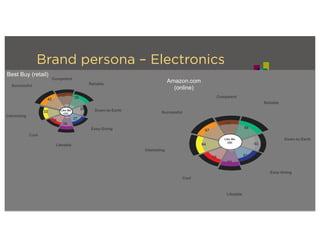

The document discusses the evolving landscape of retail, emphasizing the psychological and emotional factors influencing consumer behavior in both online and offline shopping environments. It highlights insights from Hotspex research, showcasing how brands can leverage emotional connections to enhance customer loyalty and create better shopping experiences. Key findings include the increasing trend towards online shopping, particularly among tech-savvy consumers, and the importance of price and selection in driving purchasing decisions.