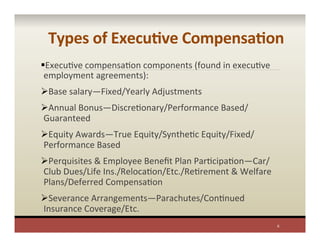

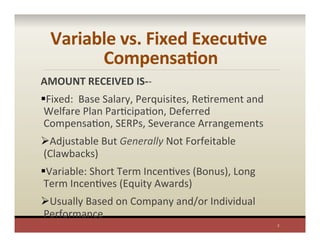

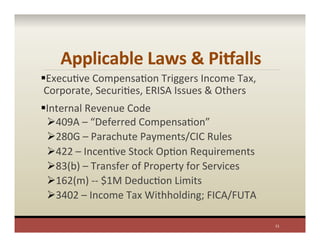

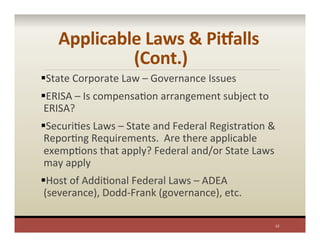

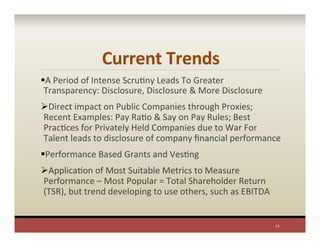

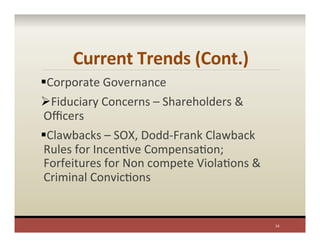

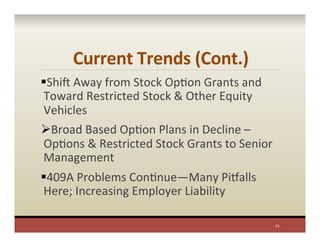

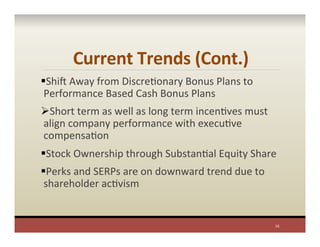

The document discusses executive compensation trends for 2015, emphasizing the importance of effective leadership for company growth and retention of talent in competitive environments. It covers types of compensation, applicable laws, and current trends, notably the shift towards performance-based compensation and increased transparency among public companies. The document also highlights various forms of equity awards and the legal implications surrounding executive compensation practices.